Cryptocurrency’s traditional four-year cycle has collapsed, replaced by a new market structure where liquidity concentration and investor positioning now determine price action, according to a comprehensive year-end analysis from leading OTC desk Wintermute.

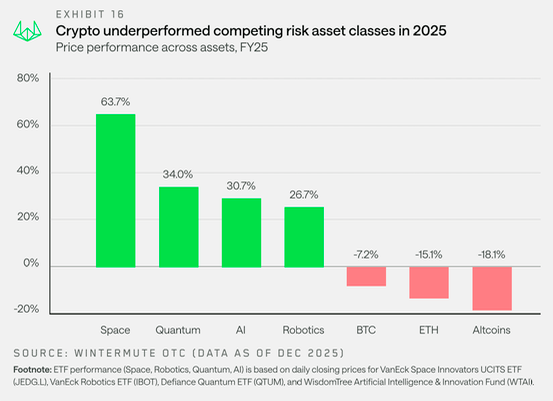

The firm’s proprietary trading data reveals that 2025 marked a fundamental shift in how digital assets trade, with the year’s muted performance indicating crypto’s transition from speculation-driven rallies to a more institutionally anchored asset class.

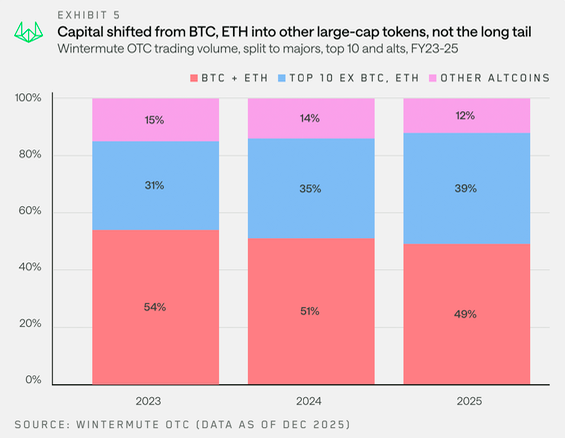

Wintermute’s OTC flow data shows the historic pattern of Bitcoin gains recycling into Ethereum, then blue chips, and finally altcoins has weakened dramatically.

Exchange-traded funds and digital asset treasury companies evolved into what the firm describes as “walled gardens,” providing sustained demand for large-cap assets without naturally rotating capital into the broader market.

With retail interest diverted toward equities, 2025 became a year of extreme concentration where a handful of major tokens absorbed the vast majority of new capital while the rest of the market struggled.

Traditional Seasonality Shattered by Structural Shifts

Trading activity in 2025 followed a distinctly different pattern than previous years, breaking what had felt like seasonal rhythms.

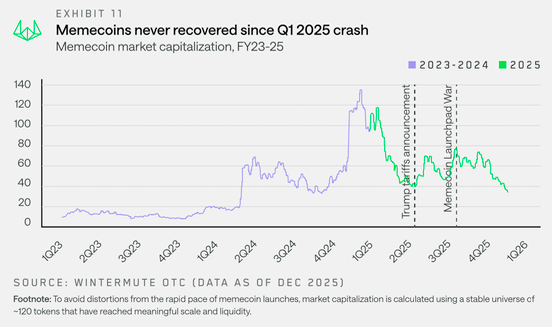

Early-year optimism around the pro-crypto U.S. administration quickly disappointed as risk sentiment deteriorated sharply through the first quarter when memecoin and AI-agent narratives faded.

Trump’s tariff announcement on April 2 further pressured markets, concentrating activity early in the year before broad softening through spring and summer.

The late-year pickup seen in 2023 and 2024 failed to materialize, shattering narratives around “Uptober“ and year-end rallies.

Wintermute’s data reveals these were never true seasonal patterns but rather rallies driven by idiosyncratic catalysts like ETF approvals in 2023 and the new U.S. administration in 2024.

Markets became increasingly choppy as macro forces took control, with flows turning reactive and episodic around headlines without sustained momentum.

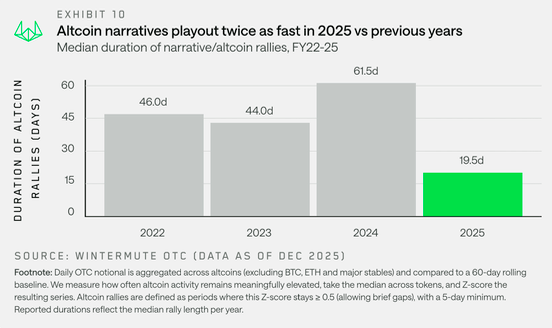

Altcoin rallies shortened dramatically, averaging roughly 19 days in 2025, down from 61 days the prior year.

Themes including memecoin launchpads, perpetual DEXs, and the x402 meta sparked brief activity bursts but failed to develop into durable market-wide rallies, largely due to choppy macro conditions and market fatigue after 2024’s excesses.

Institutional Engagement Deepens Despite Muted Returns

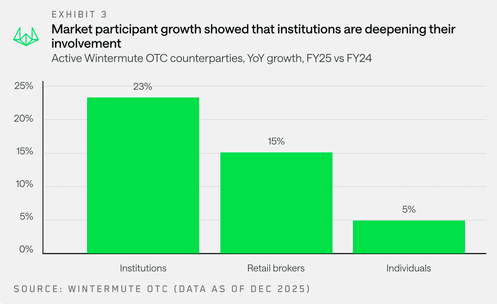

Despite modest price activity, institutional counterparties showed staying power through 2025.

Wintermute saw 23% year-over-year growth among institutional participants, including crypto-native funds, asset managers, and traditional financial institutions.

Engagement deepened materially, with activity becoming more sustained and focused on deliberate execution rather than exploratory positioning.

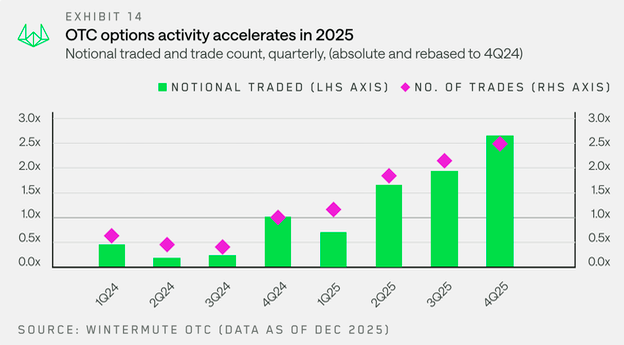

The firm’s derivatives data also reveals options activity more than doubled year-over-year, with systematic yield and risk management strategies dominating flow for the first time rather than one-off directional bets.

By the fourth quarter, options notional reached 3.8 times first-quarter levels, while trade counts doubled, indicating sustained growth across both ticket size and frequency.

Both institutional and retail investors rotated back into majors by year-end following the October 10 deleveraging event that triggered roughly $19 billion in liquidations over 24 hours.

Altcoin open interest also collapsed by 55%, from around $70 billion to $30 billion by mid-December, as forced unwinding flushed out excess leverage concentrated outside Bitcoin and Ethereum.

Three Catalysts Could Broaden 2026 Recovery

Wintermute identifies three scenarios that would need to materialize for market breadth to recover beyond large-cap concentration.

First, ETFs and DATs must broaden their mandates, with early signs emerging in the Solana and XRP ETF filings.

Second, strong rallies in Bitcoin or Ethereum could generate wealth effects that spill over into the broader market, similar to 2024’s pattern, though capital recycling remains uncertain.

Third and least likely, retail investor mindshare could rotate back from equities and AI themes toward crypto, bringing fresh capital inflows and stablecoin minting.

“2025 fell short of the expected rally, but it may mark the beginning of crypto’s transition from speculative to an established asset class,” Wintermute’s analysis concludes.

Independent analysis from Adler Asset Management reinforces the ongoing deleveraging theme, extending into 2026.

Adler pointed out that the Bitcoin Advanced Sentiment Index collapsed from the High Bull zone around 80% to 44.9%, breaking below neutral 50% and signaling a market regime shift.

The largest long liquidation cascade over their entire observation period occurred on January 19, with over $205 million liquidated in a single hour as the price dropped from $95,400 to $92,600 within 24 hours.

Whether concentration persists or liquidity broadens beyond a handful of large-cap assets will determine 2026 outcomes, with understanding where capital can flow and what structural changes are needed proving critical for navigating the post-cycle crypto market.