Over the past 24 hours, the cryptocurrency market capitalization has dropped by another 5.6%, dipping below $4 trillion, now standing at $3.91 trillion. The market is down today, with the large majority of the top 100 coins per market capitalization turning red. At the same time, the total crypto trading volume is at $264 billion.

TLDR:

Crypto Winners & Losers

Over the past 24 hours, all top 10 coins per market capitalization have turned red.

Bitcoin (BTC) decreased by only 0.2% in a day, meaning it’s unchanged. The current price is $118,256, holding above the $118,000 level. BTC’s is the lowest fall on this list.

Then, Ethereum (ETH) is down by 2.6% over the same period. It’s now trading at $3,574. This is the second lowest decrease.

Two coins saw double-digit drops. XRP (XRP) fell the most in this category: 12.1% to $3.05.

Also, Dogecoin (DOGE) dropped 10.7%, now trading at $0.2303.

The other coins in this category saw decreases between 3% and 8% each.

In the top 100 coins category, only four coins are green, and only one had an increase above 0.3%. Story (IP) appreciated 3.8% to $5.13.

At the same time, some 25 coins recorded double-digit drops. The highest of these are 16.3% and 15.6% by Aptos (APT) and Flare (FLR), now trading at $4.59 and $0.02205.

Moreover, PUMP, the native token of Pump.Fun, dropped 20% in 24 hours after founder Alon Cohen said there is no immediate token airdrop.

“We want to make sure that it is a meaningful airdrop and it is executed well,” Cohen said. “We’re actually focusing on bringing back a lot of that attention and hype to our ecosystem. That being said, the airdrop is not going to be taking place in the immediate future.”

Meanwhile, bankrupt crypto exchange FTX said it would begin its next round of cash distributions to creditors on or around 30 September. The payments will be processed through FTX’s designated distribution partners, including BitGo, Kraken, and Payoneer.

Industry is Shifting to Bitcoin-Ethereum Interconnection

James Harris, Group CEO of digital asset firm Tesseract, commented that “crypto hitting $4 trillion in total market cap earlier this month was a serious milestone, and while we’ve seen a bit of a pullback in the past couple of days, the rally has been driven by a combination of structural and cyclical forces.”

“It’s a powerful trifecta: regulatory clarity, macro easing, and corporate adoption. Together, they’re pushing crypto from speculative asset to serious portfolio contender. That said, these same forces can reverse — so while the momentum is real, disciplined risk management remains essential.”

Also, Dom Harz, co-founder of hybrid chain BOB, commented that Ethereum ETFs saw the third-largest day of inflows in history this week. They also celebrated their one-year anniversary yesterday, coming far since their launch.

The high inflows may be the result of buy-in from investors who “missed out” on BTC, which hit a new record high of $122,000 the week prior.

“Either way, investor appetite for the two biggest blockchains is undeniable,” Harz says. What’s more, this momentum is not showing signs of slowing down. ETH is “outperforming the original blockchain so far this month. Institutional investors are taking note, and many major players are announcing plans to grow their ETH treasuries.”

Therefore, Harz argues, “the real opportunity lies at the intersection of Bitcoin and Ethereum.”

Fast developments in innovations like BitVM and Bitcoin DeFi are making “the idea that investors must look beyond Bitcoin for DeFi opportunities” outdated.

“The industry is experiencing a shift toward a more interconnected future, where Bitcoin’s robust security and Ethereum’s programmability align to drive broader adoption without compromising decentralization,” Harz concludes.

Levels & Events to Watch Next

At the time of writing, BTC trades at $118,256. Its intraday high was $119,197, after which the price fell to the intraday low of $117,422, before returning to the current level.

The coin still stands above $118,000 and is trying to hold on to it. It has dipped below this level several times over the past 24 hours. Observers are now looking to see if it will manage to keep the level and move upwards again, or if it will drop below it, possibly into the $116,700 zone.

Keep an eye on the $120,094 mark, after which the price could move above $122,000 and towards $128,000.

Moreover, Ethereum is currently trading at $3,574. The coin began the day at $3,689, dropping to $3,544, then surging back to $3,662, falling to $3,530, and recovering to the current level.

The coin is working to move above $3,660, but it’s also being pulled below $3,530. Investors are waiting to see which side will prevail.

Ethereum has been performing very well over the past few weeks, so many argue that the price will continue rising towards $4,000.

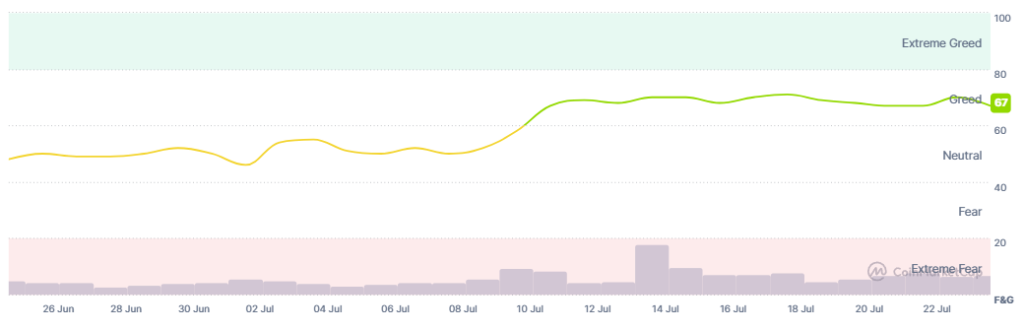

Furthermore, the crypto market sentiment has dropped today, but it still remains in greed territory. It stands at 67 today, compared to 70 yesterday.

The sentiment remains overall positive, but it currently doesn’t indicate a major incoming correction.

Meanwhile, the US BTC spot exchange-traded funds (ETFs) continued the red streak. They recorded another $85.96 million in outflows on 23 July.

BlackRock and Grayscale did see positive flows of $142.56 million and $10.49 million, respectively. But Fidelity, Ark&21Shares, and Bitwise noted outflows.

At the same time, US ETH ETFs continued the green streak with 14 consecutive days of positive flows. It recorded inflows of $332.18 million on Wednesday.

Three funds recorded flows, all positive. These are BlackRock, VanEck, and Fidelity with $324.63 million, $3.95 million, and $3.59 million, respectively.

Recently, analyst Tom Lee, who is also the Chief Investment Officer at Fundstrat Capital and Chairman of Bitmine, said that BTC could hit $1 million in the coming years. “I believe the $200,000 to $250,000 range for Bitcoin remains realistic, as this would only represent approximately 25% of gold’s current market size,” Lee noted.

Meanwhile, Tether is reportedly preparing to attempt an entrance into the US, as a result of a friendlier regulatory scene in that country. “We are well in progress of establishing our US domestic strategy,” CEO Paolo Ardoino said. “It’s going to be focused on the US institutional markets, providing an efficient stablecoin for payments but also for interbank settlements and trading.”

In Brazil, the securitization firm VERT launched a blockchain-powered private credit platform on the XRP Ledger, debuting with a $130 million issuance of an Agribusiness Receivables Certificate (CRA). The integration allows granular, real-time tracking of payments, loan terms, and cash flow events throughout the asset’s lifecycle.

Quick FAQ

- Why did crypto move against stocks today?

The crypto market dropped over the last 24 hours, while the stock market closed higher on Wednesday. The S&P 500 is up by 0.78%, the Nasdaq-100 increased by 0.43%, and the Dow Jones Industrial Average rose by 1.14%. This followed news of a new US-Japan trade deal. Additionally, investors are preparing for the Big Tech quarterly results.

- Is this dip sustainable?

Per analysts, this is a typical and expected dip. Unless a major negative macro factor strikes the markets, the rally is likely to continue.

The post Why Is Crypto Down Today? – July 24, 2025 appeared first on Cryptonews.