After a single day of brief increases, the crypto market is down today. It fell 2.3% over the past 24 hours to $2.66 trillion. Moreover, 64 of the top 100 coins saw their prices decrease in this timeframe. Also, the total crypto trading volume stands at $160 billion.

TLDR:

Crypto Winners & Losers

On Wednesday morning (UTC), 7 of the top 10 coins per market capitalisation have seen their prices drop.

Bitcoin (BTC) dropped by 2.9%, now changing hands at $76,415. This is the second-highest decrease in the category.

Ethereum (ETH) is up 4.3%, now trading hands at $2,318. This is the second-highest rise in the category.

The biggest drop on this list is 6.5% by Solana (SOL), standing at $97.8.

At the same time, three coins posted increases and only one of these above 0.5%. Tron (TRX) is up 1.1%, changing hands at $0.2865.

Dogecoin (DOGE) and Figure Heloc (FIGR_HELOC) appreciated 0.3% and 0.2% to $0.1083 and $1.04, respectively.

Furthermore, of the top 100 coins per market cap, 64 have posted price drops today.

One of these saw a double-digit fall: Hyperliquid (HYPE) is down 10.5% to $33.33.

Provenance Blockchain (HASH) follows with a 9.7% drop to the price of $0.01941.

At the same time, Cosmos Hub (ATOM) and PAX Gold (PAXG) are the best performers among the green coins. They’re up 4.4% and 3.5% to $2.09 and $5,106, respectively.

Meanwhile, Michael Burry, the investor behind ‘The Big Short’, argued that Bitcoin’s ongoing falls could trigger a $1 billion sell-off in gold and silver.

“It looks like up to $1 billion in precious metals were liquidated at month’s very end as a result of falling crypto prices,” Burry said. The crypto-precious metals correlation has created “sickening scenarios,” he added.

‘Time Compressed Rather Than Trend Resolved’

Tony Severino, market analyst at YouHodler, commented that “across markets, the common theme this week is not direction, but compression,” Severino concludes.

“Currency volatility is rising even as the dollar softens, metals are holding extreme levels without breaking, and Bitcoin remains locked in one of the tightest volatility regimes in its history,” he writes. “These conditions tend to frustrate short-term participants, but they also signal that markets are working off time rather than trend.”

“For crypto investors, this is a phase that rewards discipline over prediction. Macro forces are shifting beneath the surface, and technical structures across assets suggest that resolution is approaching – even if timing remains uncertain. When volatility expands from these conditions, history suggests the move is unlikely to be subtle. Until then, patience, positioning, and risk management remain the real edge.”

Severino explains that BTC remains locked in a tightening range. However, there is a “more important signal” emerging on the monthly timeframe.

“Bollinger Bands on the monthly chart are the tightest they have ever been, reflecting an extreme level of volatility compression,” Severino says. Also, BTC still trades below the monthly basis line.

Per the analyst, sustained closes below the monthly Bollinger basis often precede “capitulation-style moves in the months that follow.”

“This does not guarantee immediate downside, but it reinforces the idea that time is being compressed rather than trend resolved. When volatility finally expands from these conditions, the resulting move has tended to be decisive – and markets rarely give ample warning once that expansion begins.”

After GameStop moved its entire 4,710 BTC treasury to an exchange this week, showcasing unrealised losses. A liquidation hasn’t been confirmed, Severino says, but “the move alone was enough to spark market speculation, underscoring how sensitive sentiment remains around corporate-held Bitcoin.”

Meanwhile, altcoins lag Bitcoin, with total market cap measures struggling to reclaim former support levels. “Technically, this reflects caution rather than capitulation, as many altcoins remain range-bound with declining volatility.”

That said, early rotation is beginning to appear, he adds. Higher-quality Layer 1s, Layer 2s, and infrastructure-focused tokens display improving relative strength against the broader altcoin complex.

Levels & Events to Watch Next

At the time of writing on Wednesday morning, BTC was trading at $76,415. It started the day with its intraday high of $78,902. It then briefly dipped to the daily low of $73,111 before recovering to the current level.

Over the past week, the coin’s price decreased by 14.2%. It moved between $73,111 and $90,117.

An inability to hold the current level would lead to a drop towards $73,000. After this, it could revisit the $71,200 and $70,050 zones, potentially dipping into the $69,000 territory.

At the same time, Ethereum was changing hands at $2,281. Similarly to BTC, ETH saw higher prices earlier in the day, posting the day’s high of $2,326. It then plunged to the intraday low of $2,117 before jumping to $2,324 and correcting downwards.

Additionally, ETH fell 24.2% in the past seven days. It traded in the $2,120–$3,034 range.

If the pullback continues, ETH will revisit the $2,100 level, followed by $2,030, and $1,950.

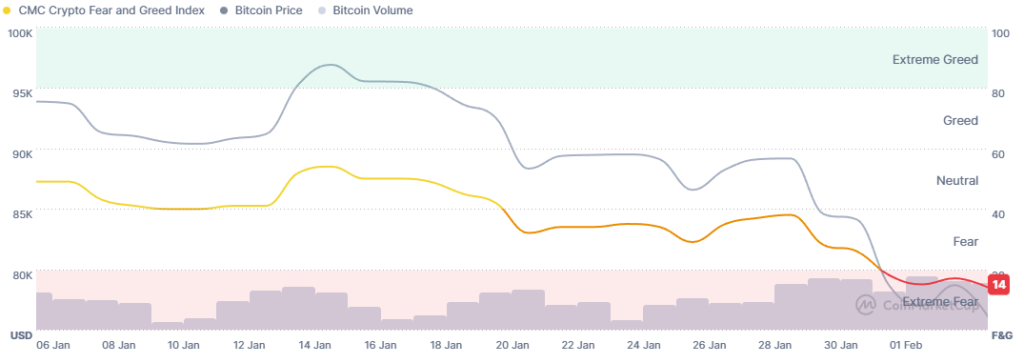

Moreover, the crypto market sentiment pushed even further into the extreme fear zone with the latest fall.

The crypto fear and greed index stands at 14 today, compared to 17 we saw at the same time yesterday. This is the lowest level since late November 2025.

Sentiment reflects the market instability and volatility, as well as increasing general uncertainty. Yesterday’s minor increase in prices did nothing to abate fear among market participants.

ETFs Post Mixed Picture

While it started the week with positive flows, the US BTC spot exchange-traded funds (ETFs) shifted back into the red on Tuesday, posting $272.02 million in outflows. The total net inflow pulled back to $55.3 billion.

Of the twelve ETFs, one posted positive flows, and seven saw outflows. BlackRock took in $60.03 million on 3 February.

On the other hand, Fidelity posted the highest amount of negative flows with in $148.7 million. It’s followed by Ark & 21Share’s $62.5 million.

However, the US ETH ETFs broke the brief red streak with minor inflows of $14.06 million on Tuesday. The total net inflow climbed slightly to $11.99 billion.

Of the nine ETH ETFs, four posted inflows and two recorded outflows. BlackRock is at the top of the green list with $42.85 million in positive flows. Grayscale Mini Trust follows with $19.12 million.

At the same time, Fidelity let go of $54.84 million, followed by VanEck’s $2.47 million in negative flows.

Meanwhile, Cathie Wood’s Ark Invest kept buying during the market downturn. Its ETFs bought some $3.25 million of Bitmine Immersion Technologies, as well as $2.4 million of Circle Internet Group, according to a filing. Moreover, Ark bought about $3.5 million of Bullish and $630,606 of Coinbase.

Speaking of which, Bitmine chairman Tom Lee pushed back on criticism of the company’s Ethereum treasury strategy. Comments accused the company of sitting on unrealised losses and forming future selling pressure.

Lee, however, responded that paper losses are typical when a public vehicle is built to mirror the ETH price through a full market cycle. The company’s aim is to outperform over time and not try to smooth out drawdowns.

Quick FAQ

- Did crypto move with stocks today?

The crypto market recorded a pullback over the past 24 hours. Also, following a sharp increase, the US stock market closed the Tuesday session with a drop. By the end of trading on 3 February, the S&P 500 was down 0.84%, the Nasdaq-100 decreased by 1.55%, and the Dow Jones Industrial Average fell by 0.34%.

- Is this drop sustainable?

In the absence of a firm foothold that would allow the market to recover, the prices are likely to trend downwards. Based on current signals, the price decreases will continue, at least in the short term.