The S&P 500 (SP500) on Friday advanced 0.77% for the week to close at 4,594.63 points, posting gains in three out of five sessions. Its accompanying SPDR S&P 500 Trust ETF (NYSEARCA:SPY) added 0.83% for the week.

During this week, Thursday marked the end of November, a month that turned out to be historic for markets. The benchmark S&P (SP500), along with the Nasdaq Composite (COMP.IND) and the Dow (DJI), notched their best monthly advance this year and one of their best Novembers on record.

That climb has been largely driven by favorable economic data and comments from Federal Reserve speakers that has led to a general consensus that the central bank is done hiking rates and can deliver a soft landing – an event where inflation comes down without compromising employment or growth.

A similar trend contributed to this week’s gains and has led to the S&P 500 (SP500) notching its highest closing level of the year. This leaves the market poised for a strong finish to the year with Friday being the first day of December. Investors will hope that November’s momentum can extend into a “Santa Claus” rally.

The week started off with the retail sector in focus, after Cyber Monday followed last week’s Black Friday in setting new records for spending. Two economic indicators grabbed most of the spotlight on Wednesday and Thursday – first, the second estimate of U.S. Q3 GDP growth was revised higher. Then, Thursday’s personal income and outlays report showed a M/M and Y/Y moderation in the Fed’s preferred inflation gauge – the personal consumption expenditures price index. Both sets of data greatly strengthened soft landing hopes.

Fed chair Jerome Powell garnered attention on Friday with some comments at a fireside chat at Spelman College. Powell in his opening remarks attempted to tamp down the market’s enthusiasm in terms of rate cute expectations, saying that it was still too “premature” to conclude that monetary policy was sufficiently restrictive. However, once the fireside chat started, Powell’s replies to questions were a lot more positive and all but confirmed to traders that the central bank would not hike rates anymore.

In the lead-up to Powell, there was notable positive commentary from Fed Governor Christopher Waller on Tuesday and Chicago Fed President Austan Goolsbee earlier today.

The continued favorable economic data also led to investors snapping up bonds this week, driving Treasury yields lower and helping equities. The longer-end 10-year yield (US10Y) has slipped 26 basis points while the shorter-end more rate-sensitive 2-year yield (US2Y) has slid 40 basis points. The demand for bonds also got a close examination in the form of Treasury note auctions this week – a $54B 2-year auction on Monday tailed while a $55B 5-year auction traded through. Tuesday’s $39B 7-year auction tailed by a significant margin.

See how Treasury yields have done across the curve at the Seeking Alpha bond page.

Turning to the weekly performance of the S&P 500 (SP500) sectors, nine of the 11 ended in the green, led by an outsized jump of about 5% in Real Estate. Communication Services and Energy were the top losers. See below a breakdown of the performance of the sectors as well as their accompanying SPDR Select Sector ETFs from November 24 close to December 1 close:

#1: Real Estate +4.99%, and the Real Estate Select Sector SPDR ETF (XLRE) +4.65%.

#2: Materials +2.57%, and the Materials Select Sector SPDR ETF (XLB) +2.75%.

#3: Industrials +2.14%, and the Industrial Select Sector SPDR ETF (XLI) +2.26%.

#4: Financials +2.09%, and the Financial Select Sector SPDR ETF (XLF) +2.23%.

#5: Consumer Discretionary +1.48%, and the Consumer Discretionary Select Sector SPDR ETF (XLY) +1.69%.

#6: Utilities +1.27%, and the Utilities Select Sector SPDR ETF (XLU) +1.34%.

#7: Consumer Staples +0.55%, and the Consumer Staples Select Sector SPDR ETF (XLP) +0.77%.

#8: Health Care +0.48%, and the Health Care Select Sector SPDR ETF (XLV) +0.53%.

#9: Information Technology +0.34%, and the Technology Select Sector SPDR ETF (XLK) +0.63%.

#10: Energy -0.11%, and the Energy Select Sector SPDR ETF (XLE) +0.11%.

#11: Communication Services -2.49%, and the Communication Services Select Sector SPDR Fund (XLC) -1.48%.

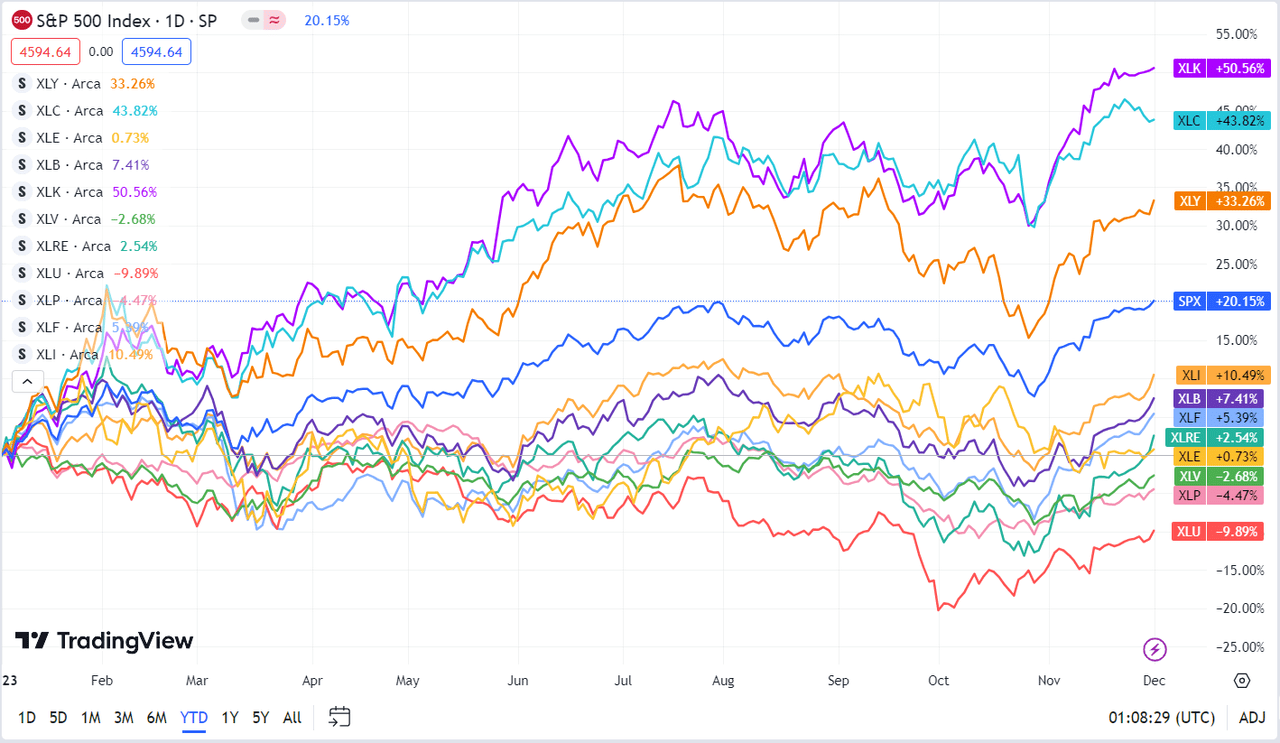

Below is a chart of the 11 sectors’ YTD performance and how they fared against the S&P 500 (SP500). For investors looking into the future of what’s happening, take a look at the Seeking Alpha Catalyst Watch to see next week’s breakdown of actionable events that stand out.