DeFi Development Corp., the first public company to build its treasury strategy around Solana, announced it now holds 999,999 SOL and SOL equivalents on its balance sheet.

The milestone follows the purchase of 141,383 SOL between July 14 and July 20 at an average price of $133.53, amounting to roughly $19 million in new holdings.

“Just one SOL to go,” the company noted in a statement, referring to the symbolic target of holding 1 million SOL

DeFi Development Hits $181M in Solana Holdings, Eyes 1M SOL Milestone

While MicroStrategy became synonymous with institutional Bitcoin accumulation, DeFi Development is carving out a similar path for Solana.

The company’s Solana holdings have grown sharply since April, when it began building its treasury.

The Florida-based company now holds approximately $181 million worth of SOL, including both spot purchases and discounted locked tokens. The new accumulation also includes 867 SOL earned organically through staking, validator operations, and other on-chain activity.

With 19,445,837 shares outstanding as of July 18, the firm’s SOL-per-share (SPS) reached 0.0514, a 13% increase from the previous week. The company now sets its sights on reaching 1 SPS by December 2028. Its midterm goal is 0.1650 SPS by June 2026.

To support its accumulation strategy, DeFi Development is tapping into a $5 billion equity line of credit. As of this month, only 0.4% of the available capacity has been drawn. Roughly $19.2 million has been raised so far, with $5 million in proceeds remaining for future purchases.

Beyond its growing token reserves, DeFi Development recently launched the DFDV Treasury Accelerator, an international expansion effort modeled on a franchise system.

The program aims to help partners around the world establish their own Solana treasuries. In return, DeFi Development will retain equity stakes in the regional vehicles.

DeFi Development’s long-term plan is to maintain and compound its SOL position through validator revenue and staking rewards.

“Substantially all” unlocked SOL is currently staked, the company said, with additional revenue coming from third-party delegators using its validators.

Shares of DFDV dipped 8.7% in Friday’s regular trading but rebounded 10.2% in pre-market activity to $26.90.

Solana Reclaims $100B Market Cap as Institutional Demand and On-Chain Activity Climb

The rapid rise of DFDV’s treasury comes as Solana’s market capitalization has surged past $100 billion once again, marking the first time since January 2025 that the token has crossed this threshold.

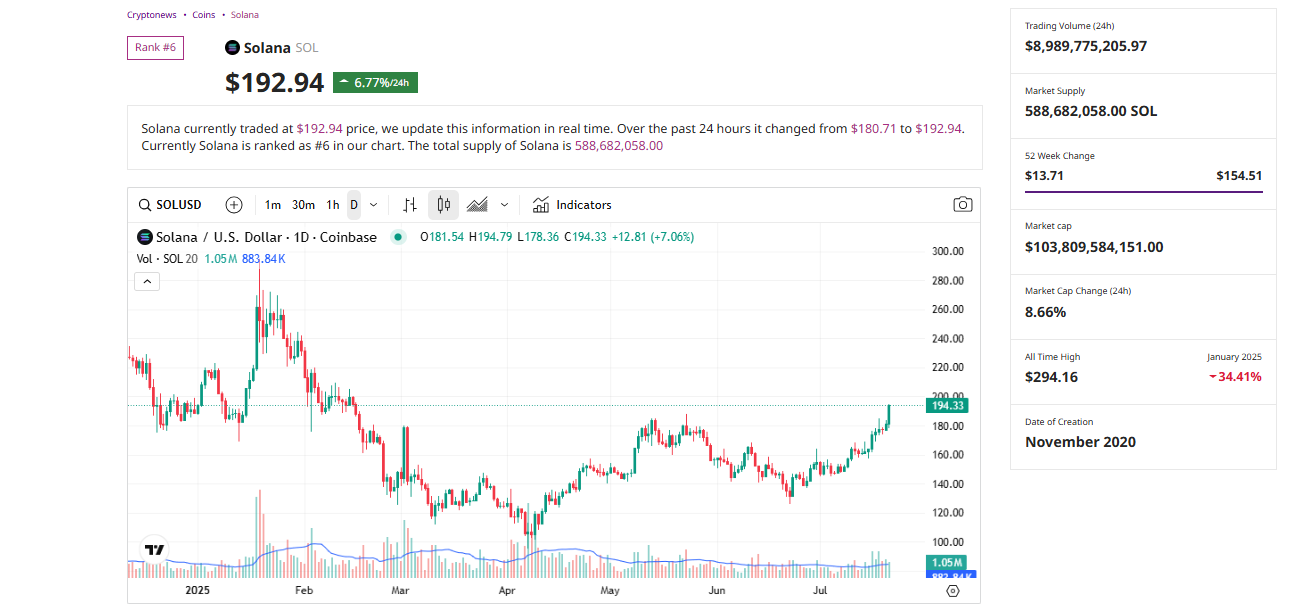

As of July 21, SOL’s market cap stood at $102.6 billion, following a 6.7% jump in the last 24 hours that brought the token’s price to around $192.94.

The current rally places Solana as the sixth-largest crypto asset by market cap, just $9 billion shy of Binance Coin (BNB), while maintaining a significant lead over USD Coin (USDC). This milestone comes after weeks of steady gains, with SOL up over 34% in the last month.

Recent developments have helped fuel the token’s momentum. The launch of the REX-Osprey SOL + Staking ETF has drawn attention, with the fund nearing $100 million in assets under management and offering staking rewards.

Institutional interest has grown accordingly, with several companies, such as DeFi Development Corp. and SOL Strategies, accumulating SOL for treasury use. Solana’s decentralized exchange (DEX) volume has also contributed to market optimism.

According to Syndica, Solana DEXes processed over $1 trillion in cumulative volume during the first half of 2025, more than the previous two half-years combined. Public companies now collectively hold 1.85 million SOL, or about 0.35% of the total supply.

BIT Mining recently disclosed plans to raise up to $300 million to build a SOL treasury, while SOL Strategies, already listed on the Canadian Securities Exchange, holds over 420,000 SOL and is seeking a Nasdaq listing under the ticker “STKE.”

Price action has drawn attention from analysts as SOL pushes through a key resistance zone around $190. On-chain data from Glassnode shows heavy accumulation at this level, with more than 8 million SOL purchased, suggesting $200 could be the next target if momentum holds.

Liquidations have added to the volatility. In the past 24 hours, over $16 million was wiped out, with short positions accounting for $12 million, highlighting strong bullish pressure on Solana-based perpetual platforms.

With sentiment shifting, analysts noted that SOL’s ability to sustain gains above $190 could determine whether it enters a new leg upward in the second half of the year.

The post Solana Treasury Giant Records 999,999 SOL as Market Cap Surges Past $100B appeared first on Cryptonews.

Canadian digital asset firm

Canadian digital asset firm