A new proposal to boost Solana’s block capacity by 66% could be a game-changer, setting the stage for institutional-scale adoption and reinforcing a bullish long-term Solana price outlook.

While altseason sentiment is driving capital into riskier assets, Solana’s current momentum stands out as it continues to surge on the back of strong retail demand.

That could change with the October 10 deadline for a potential spot SOL ETF, which could open the gates to greater TradFi demand on top of the recently launched REX-Osprey’s Solana staking ETF.

This goes hand in hand with the CLARITY ACT, also expected around October, which stands to unlock sidelined demand from institutions waiting on regulatory clarity.

Proposal Could See Block Limit Raised to 100 million

The SIMD-0286 proposal plans to increase Solana’s per-block compute limit from 60 million to 100 million compute units, according to a document posted on GitHub this week.

The goal is to let Solana process more transactions and support heavier apps like DEXs, MEV systems, and restaking protocols without hitting compute ceilings.

This also better equips the network to meet the throughput requirements of institution-driven demand, particularly as it emerges as the go-to network for tokenized equities with xStocks.

The last increase, SIMD-0256, raised the block limit to 60 million compute units and helped the network sustain around 1,700 TPS during peak hours.

While TradFi centralised exchanges like the NASDAQ see regular daytime loads of 10,000-20,000 TPS, a block limit increase to 100 million could narrow the gap and boost Solana’s institutional readiness.

Solana Price Prediction: Is Solana Ready to Surge?

While the proposal could boost Solana’s appeal for institutional applications, demand likely won’t be felt until the CLARITY Act resolves lingering regulatory ambiguity.

In the meantime, Solana continues to trade within an ascending channel, with selling pressure showing signs of exhaustion as increased volatility leads to sharper price swings.

The 15% decline since the week began appears to have eased with support found at the 0.618 Fibonacci retracement at $176, an accumulation zone for shallow reversals.

Momentum indicators back the case for a potential turnaround. The RSI is recovering at 41 after dipping into oversold territory near 30 due to profit-taking.

Similarly, the MACD histogram is beginning to flatten below the signal line, often an early sign of a reversal on the 4-hour time frame, indicating the recent downtrend may be losing steam.

If buying strength returns, the Solana price could advance to retest the channel’s upper resistance, setting the stage for a 64% breakout to $300 if successful.

If $176 is lost, immediate support lies at the 0.5 Fibonacci retracement at $166.50, a more common accumulation zone and bottom marker for reversals.

Solana is Stalling, But Its Ecosystem Still Holds Opportunity

Big gains are harder to come by with major tokens like SOL. Breakout moves take months to build and often play out in days.

For most holders, it’s a waiting game.

But under the surface, low-cap cryptos within the Solana ecosystem are exploding, with some already delivering 10x to 100x returns as retail money pours in.

That’s where Snorter ($SNORT) steps in. Its purpose-built trading bot is engineered to spot early momentum, helping investors get in before the crowd, where the real gains are made.

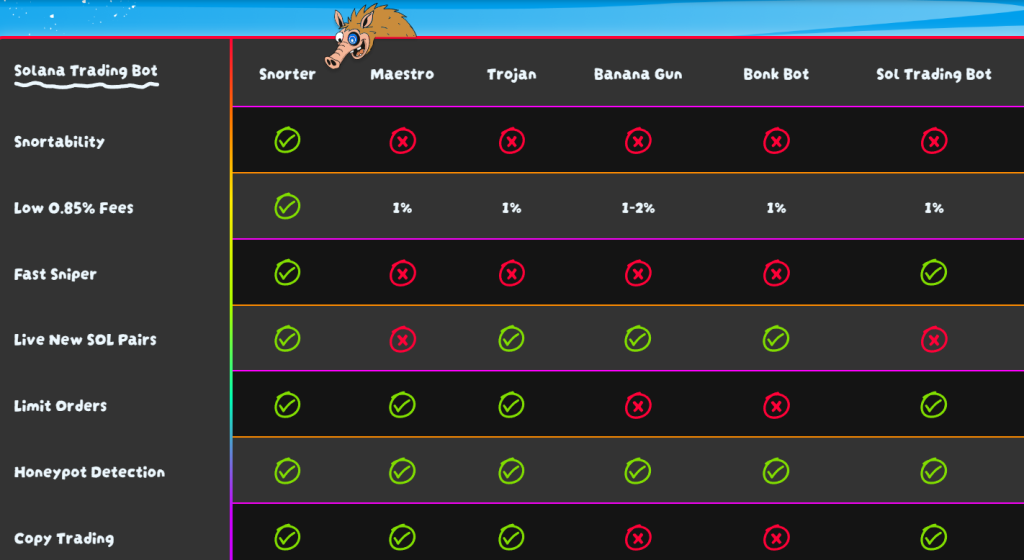

While trading bots are not a new concept, Snorter has been designed specifically for sniping with limit orders, MEV-resistant token swaps, copy trading, and even rug-pull protection.

It’s one thing to get in first, it’s another thing to know when to sell—Snorter Bot can help.

The project is off to a strong start—$SNORT has already raised almost $2.4 million in its initial presale weeks, likely driven by its high 173% APY on staking to rewards early investors.

You can keep up with Snorter on X, Instagram, or join the presale on the Snorter website.

The post Solana Price Prediction: Developers Propose 66% Block Expansion – Is SOL Gearing Up for Institutional-Scale Adoption? appeared first on Cryptonews.

BLOOMBERG’S ETF ANALYSTS RAISE APPROVAL ODDS FOR MOST SPOT CRYPTO ETFS TO 90%+

BLOOMBERG’S ETF ANALYSTS RAISE APPROVAL ODDS FOR MOST SPOT CRYPTO ETFS TO 90%+