Cristi Croitoru

The Industrial Select Sector (XLI) climbed for the second week in a row for the week ending Nov. 10 (+0.94%), and so did the SPDR S&P 500 Trust ETF (SPY) which rose +1.36%.

XLI was among the 6 of the 11 S&P 500 sectors which ended the week in green. Year-to-date, XLI has risen +4.42%, while SPY has soared +15.21%.

The top five gainers in the industrial sector (stocks with a market cap of over $2B) all gained more than +6% each this week. YTD, all these 5 stocks are in the green.

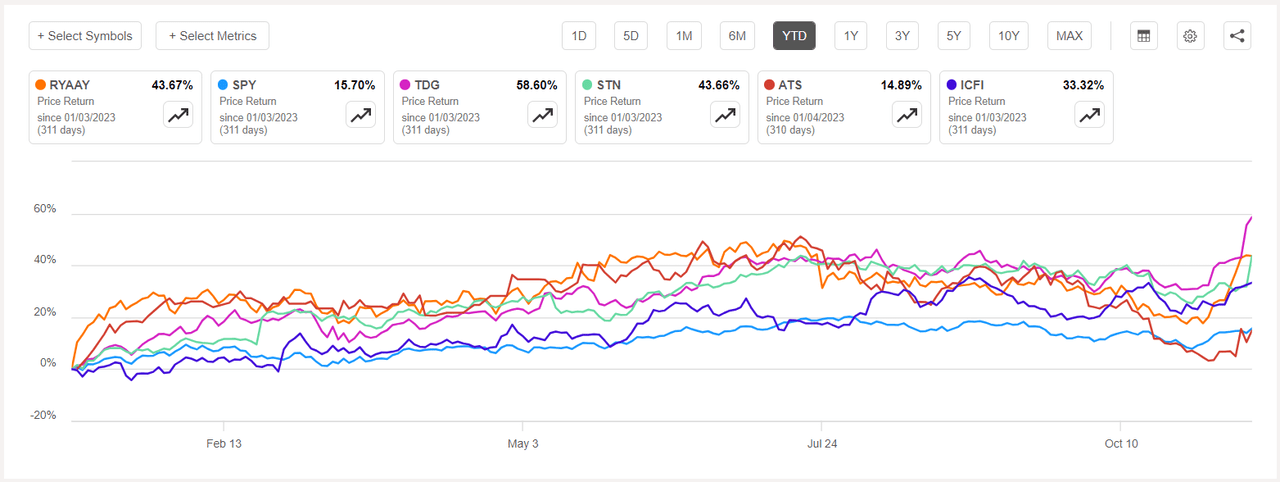

Ryanair (NASDAQ:RYAAY) +13.54%. The Irish airline’s stock rose +4.23% on Monday following the company’s H1 results. The company also expects to post a record annual profit and plans to pay investors a regular dividend for the first time, according to a report from Reuters. YTD, the shares have soared +43.20%.

Ryanair has a SA Quant Rating — which takes into account factors such as Momentum, Profitability, and Valuation among others — of Strong Buy. The stock has a factor grade of A for both Profitability and for Growth. The average Wall Street Analysts’ Rating agrees with a Strong Buy rating of its own, wherein 4 out of 4 analysts tag the stock as Strong Buy.

TransDigm (TDG) +12.52%. The aircraft component maker saw its stock surge +8.70% on Thursday after Q3 results beat estimates. YTD, the shares have surged +57.63%, the most among this week’s top five gainers for this period.

The SA Quant Rating on TDG is Hold with score of A for Momentum and D- for Valuation. The average Wall Street Analysts’ Rating has a more positive view with a Buy rating, wherein 11 out of 21 analysts see the stock as Strong Buy.

The chart below shows YTD price-return performance of the top five gainers and SPY:

Stantec (STN) +7.90%. Shares of the Canadian company, which provides consulting services for infrastructure and facilities, jumped +8.98% on Friday after third-quarter results. YTD, +43.30%.

The SA Quant Rating on STN is Hold with score of B+ for Momentum and B- for Profitability. The rating is in contrast to the average Wall Street Analysts’ Rating of Buy, wherein 8 out of 11 analysts view the stock as such.

ATS (ATS) +7.67%. The Canadian automation solution provider’s Q3 revenue surpassed analysts’ expectations which sent the stock soaring +10.05% on Wednesday. YTD, +19.77%. The SA Quant Rating on ATS is Hold, while the average Wall Street Analysts’ (1 analyst in this case) Rating is Strong Buy.

ICF International (ICFI) +6.70%. The Reston, Va.-based consulting company’s shares climbed throughout the week. YTD, +35.17%. The SA Quant Rating on ICFI is Hold, which differs from the average Wall Street Analysts’ Rating of Buy.

This week’s top five decliners among industrial stocks (market cap of over $2B) all lost more than -12% each. YTD, 2 out of these 5 stocks are in the red.

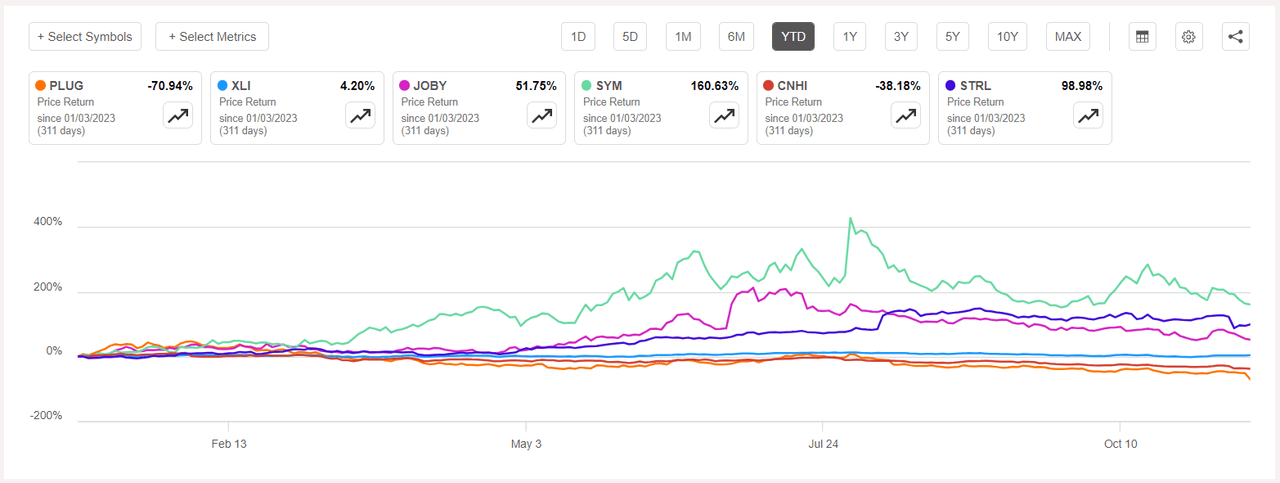

Plug Power (NASDAQ:PLUG) -46.68%. The Latham, N.Y.-based company’s shares slumped -40.47% on Friday following weak Q3 results and flagging going concern warnings, which prompted at least four analyst downgrades on the stock. YTD, the stock has fallen -71.46%, the most among this week’s top five decliners for this period.

The SA Quant Rating on PLUG is Sell with a factor grade of F for Profitability and D- for Momentum. The rating is in stark contrast to the average Wall Street Analysts’ Rating of Buy, wherein 14 out of 31 analysts view the stock as Strong Buy.

Joby Aviation (JOBY) -16.83%. The electric air-taxi maker’s stock fell throughout the week. However, YTD the stock is in the green +54.93%.

The SA Quant Rating on JOBY is Hold with score of B for Growth and B- for Valuation. The average Wall Street Analysts’ Rating agrees with a Hold rating of its own, wherein 2 out of 7 analysts tag the stock as such.

The chart below shows YTD price-return performance of the worst five decliners and XLI:

Symbotic (SYM) -14.98%. The company, which provides warehouse automation systems, saw its stock dip throughout the week, with the most on Wednesday -5.86%. The shares have made it to our gainers and losers list several times; and YTD, the stock has rocketed +162.81%, the most among this week’s top five gainers for this period.

The SA Quant Rating on SYM is Hold with score of F for Profitability and C+ for Growth. The average Wall Street Analysts’ Rating differs and has a Buy rating, wherein 8 out of 13 analysts view the stock as Strong Buy.

CNH Industrial (CNHI) -13.99%. The shares tumbled -10.58% on Tuesday after Q3 revenue missed estimates and the maker of farming and construction machinery said that revenue growth will be less than previously estimated because of weakness in South America. YTD, -37.98%. The SA Quant Rating on CNHI is Hold, while the average Wall Street Analysts’ Rating is Buy.

Sterling Infrastructure (STRL) -12.37%. The Texas-based company’s stock fell -15.91% on Tuesday after Q3 revenue missed estimates. However, YTD, the shares have soared +102.93%. The SA Quant Rating on STRL is Strong Buy, and so is the average Wall Street Analysts’ Rating (1 analyst in this case).