JONGHO SHIN/iStock via Getty Images

The Industrial Select Sector (XLI) rose +2.26% for the week ending Dec. 1, while the SPDR S&P 500 Trust ETF (SPY) climbed +0.83%.

XLI was among the 9 of the 11 S&P 500 sectors which ended the week in green. Year-to-date, XLI has gained +10.72%, while SPY has soared +20.05%.

The top five gainers in the industrial sector (stocks with a market cap of over $2B) all gained more than +12% each this week. YTD, only 2 out of these 5 stocks are in the green.

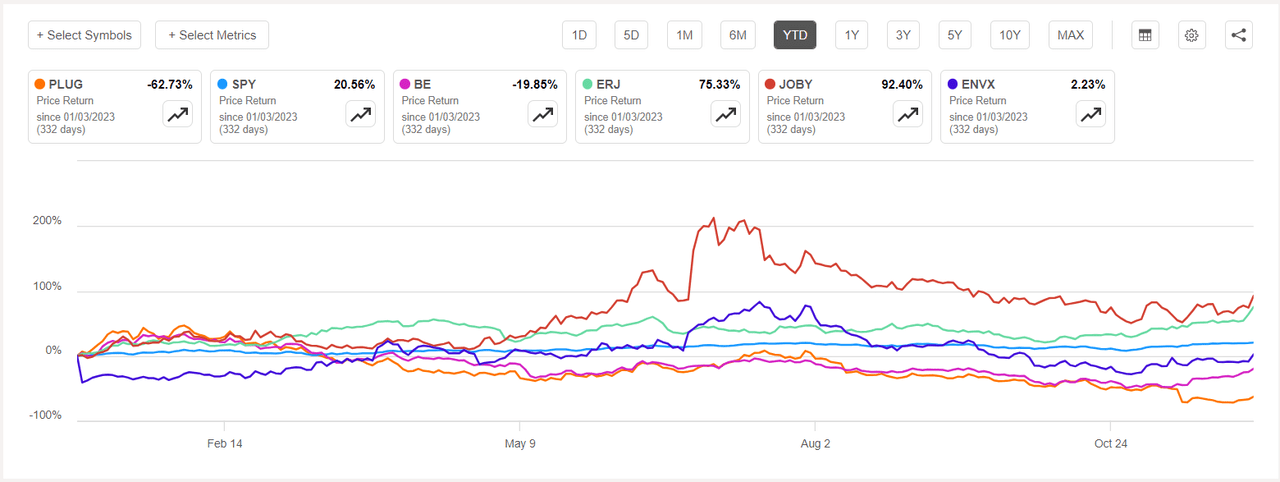

Plug Power (NASDAQ:PLUG) +30.84%. The Latham, N.Y.-based company’s shares surged the most on Friday +12.38%. However, YTD, the stock has slumped -63.30%, the most among this week’s top five gainers for this period.

Plug has a SA Quant Rating — which takes into account factors such as Momentum, Profitability, and Valuation among others — of Strong Sell. The stock has a factor grade of F for Profitability and C+ for Growth. The average Wall Street Analysts’ Rating disagrees and has Buy rating, wherein 11 out of 30 analysts tag the stock as Strong Buy.

Bloom Energy (BE) +16.43%. The San Jose, Calif.-based company was among alternative energy stocks which gained on Friday (+6.51%). The stock was the top industrial gainer (in our segment) two weeks ago.

The SA Quant Rating on Bloom is Hold with score of D+ for both Momentum and Valuation. The average Wall Street Analysts’ Rating has a more positive view with a Buy rating, wherein 9 out of 25 analysts see the stock as Strong Buy. YTD, -19.56%.

The chart below shows YTD price-return performance of the top five gainers and SPY:

Embraer (ERJ) +14.80%. The Brazilian aircraft maker said on Wednesday that Porter Airlines exercised purchase rights to place a firm order for 25 E195-E2 passenger jets. YTD, the stock has soared +71%.

The SA Quant Rating on ERJ is Buy with score of A for Momentum and A- for Growth. The average Wall Street Analysts’ Rating concurs with a Buy rating of its own, wherein 7 out of 13 analysts view the stock as such.

Joby Aviation (JOBY) +18.80%. The electric air-taxi maker’s stock again made it to the top five gainers after two weeks. This week gaining the most on Friday +10.40%. YTD, the stock has soared +96.42%, the most among this week’s top five gainers for this period. The SA Quant Rating on JOBY is Hold and so is the average Wall Street Analysts’ Rating.

Enovix (ENVX) +12.33%. The lithium-ion battery maker’s stock also surged on Friday (+11.92%). The SA Quant Rating on ENVX is Hold, which differs from the average Wall Street Analysts’ Rating of Strong Buy. YTD, ENVX -0.40%.

This week’s top five decliners among industrial stocks (market cap of over $2B) all lost more than -3% each. YTD, 2 out of these 5 stocks are in the red.

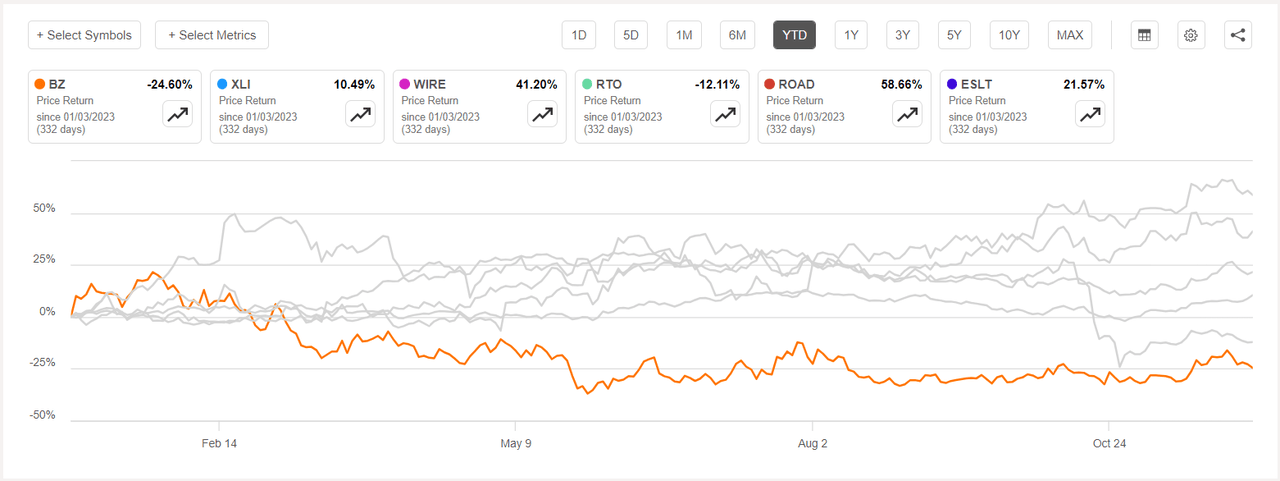

Kanzhun (NASDAQ:BZ) -10.08%. The Chinese online recruitment platform’s stock fell the most on Tuesday (-4.79%). The SA Quant Rating on BZ is Hold with a factor grade of B+ for Profitability and F for Valuation. The rating is in contrast to the average Wall Street Analysts’ Rating of Buy, wherein 9 out of 16 analysts view the stock as Strong Buy. YTD, stock has fallen -20.72%, the most among this week’s top five decliners for this period.

Encore Wire (WIRE) -4.31%. The Texas-based company stock dipped the most on Tuesday -4.43%. YTD, +36.95%. The SA Quant Rating on WIRE is Hold with score of D- for Growth and B for Momentum. The average Wall Street Analysts’ Rating disagrees and has a Strong Buy rating, wherein 2 out of 3 analysts tag the stock as such.

The chart below shows YTD price-return performance of the worst five decliners and XLI:

Rentokil Initial (RTO) -4.29%. The British pest control company has seen its stock decline -10.97% year-to-date. The SA Quant Rating on RTO is Sell with a factor grade of B for Profitability and C+ for Growth. The rating is in contrast to the average Wall Street Analysts’ Rating of Buy rating, wherein 2 out of 3 analysts view the stock as Strong Buy.

Construction Partners (ROAD) -3.99%. The company reported fourth quarter results on Wednesday which beat estimates. YTD, the stock has soared +55.15%, the most among this week’s top five decliners for this period. The SA Quant Rating and the average Wall Street Analysts’ Rating, both, is Strong Buy for ROAD.

Elbit Systems (ESLT) -3.46%. The Israeli company — which develops airborne, land, and naval systems for the defense sector — reported third quarter results on Tuesday wherein non-GAAP EPS missed estimates. ESLT has a SA Quant Rating of Hold, while the average Wall Street Analysts’ Rating is Buy. YTD, the shares have risen +24.49%.