Billionaire Michael Saylor’s Strategy has added another 22,305 bitcoin to its balance sheet spending approximately $2.13 billion as the company continues its aggressive accumulation strategy.

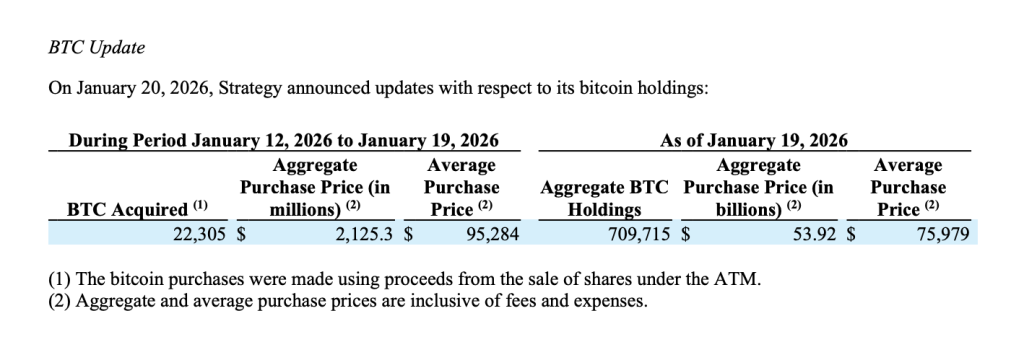

The purchase disclosed on January 20, follows sales conducted under Strategy’s at-the-market (ATM) equity and preferred stock programs between January 12 and January 19, 2026. The bitcoin was acquired at an average price of approximately $95,284 per BTC, inclusive of fees and expenses.

As of January 19, Strategy now holds a total of 709,715 bitcoin, acquired for roughly $53.92 billion at an average price of $75,979 per BTC.

ATM Program Funds Latest Bitcoin Acquisition

According to the filing, Strategy raised approximately $2.125 billion in net proceeds during the period through a combination of equity and preferred stock issuance. The majority of capital was generated through sales of STRC variable-rate preferred shares and MSTR Class A common stock.

Notably, Strategy sold 2.95 million STRC shares for $294.3 million in net proceeds and issued 10.4 million MSTR shares, generating $1.83 billion. Smaller amounts were raised through STRK preferred stock sales, while no issuance occurred under STRF or STRD during the period.

The company confirmed that proceeds from the ATM program were used directly to fund bitcoin purchases, reinforcing its long-standing capital markets-to-bitcoin conversion strategy.

Bitcoin Holdings Continue to Scale

With the latest acquisition, Strategy’s bitcoin holdings have grown by more than 22,000 BTC in a single week, cementing its position as the largest corporate holder of bitcoin globally.

At current levels, the company’s aggregate holdings represent over 3% of bitcoin’s total circulating supply. While the average purchase price of recent acquisitions sits above Strategy’s historical cost basis, management has repeatedly emphasized long-term accumulation over short-term price sensitivity.

The disclosure shows that while the latest tranche was acquired near recent market highs, Strategy’s blended acquisition price remains materially lower due to earlier purchases made at discounted levels.

Capital Markets Strategy Remains Intact

Strategy’s continued use of preferred stock issuance and equity sales reflects a deliberate effort to diversify funding sources while minimizing operational cash flow dependence.

The firm still has more than $8.4 billion of MSTR stock and billions in preferred securities available for future issuance under its ATM programs.

Despite heightened volatility in crypto markets and ongoing regulatory uncertainty, Strategy has maintained its bitcoin-centric capital allocation framework, positioning BTC as its primary treasury reserve asset.

Long-Term Conviction Unchanged

The latest purchase shows Strategy’s unwavering conviction in bitcoin as a long-duration store of value and monetary asset. By systematically converting capital raised in traditional markets into bitcoin exposure, the company continues to operate as a leveraged proxy for institutional bitcoin adoption.

As of January 19, Strategy’s balance sheet reflects not just scale but persistence — a defining feature of its approach as bitcoin enters a more institutionally driven phase of market maturity.