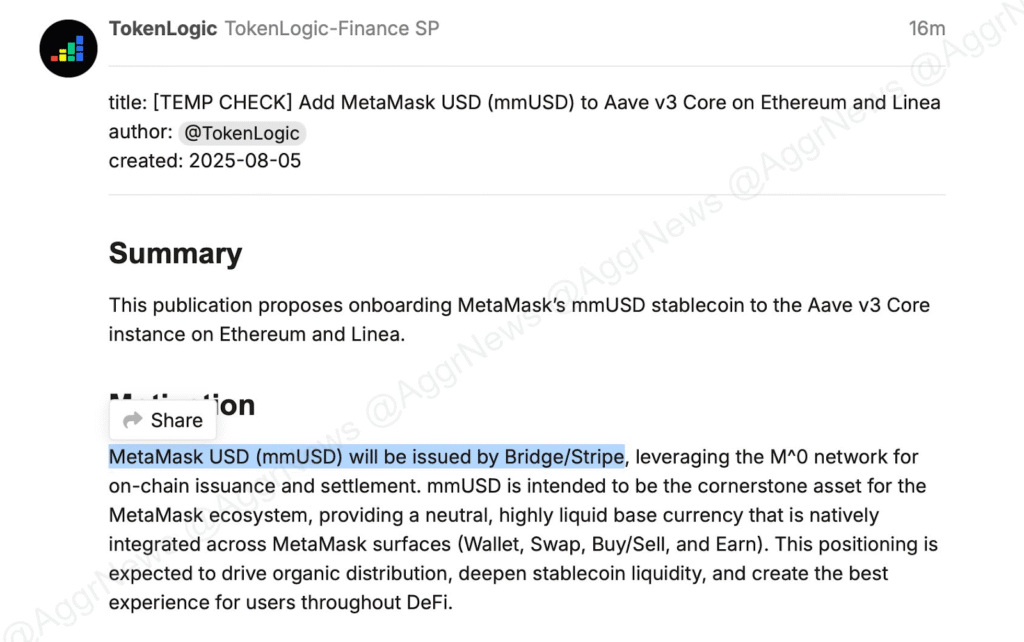

A governance proposal circulating within MetaMask’s community reveals plans to launch “MetaMask USD” (mmUSD) through a partnership with Stripe’s payment infrastructure, potentially creating a direct competitor to established stablecoins like USDC and USDT.

The proposal outlines building mmUSD on the M⁰ network for decentralized issuance and settlement, with Stripe serving as the issuing partner to provide regulatory clarity and trusted fiat backing.

MetaMask Leverages 30M User Base to Challenge USDC Dominance

MetaMask serves over 30 million monthly active users globally through one of the most widely used non-custodial wallets in Web3.

The proposed mmUSD would function as a base currency throughout MetaMask’s ecosystem while integrating with DeFi protocols like Aave for lending, borrowing, and yield opportunities.

The stablecoin initiative follows MetaMask’s recent card launch in partnership with Baanx and Mastercard, enabling users to spend crypto directly from self-custody wallets without surrendering control to banks or exchanges.

Neither MetaMask nor Stripe has officially confirmed the development, leaving key details about reserve models and regulatory compliance unaddressed. In fact, the initial governance post has been made private.

The proposal aligns with an industry-wide stablecoin rush following the GENIUS Act passage, which established a federal regulatory framework for stablecoin issuance.

The legislation sparked interest from major corporations, including Western Union, Interactive Brokers, and Remitly, all exploring stablecoin integration for payment modernization.

Stablecoin Market Explodes as GENIUS Act Unlocks Corporate Interest

The stablecoin sector has expanded rapidly to over $250 billion in market capitalization, with Ripple CEO Brad Garlinghouse projecting growth to $1-2 trillion within the next few years.

The GENIUS Act, signed by President Trump in July, distinguishes stablecoins as payment tools rather than investment products while establishing clear regulatory guidelines.

Western Union CEO Devin McGranahan announced pilot programs in South America and Africa to modernize global remittance operations through stablecoins.

The company views stablecoins as opportunities to streamline cross-border transfers and improve currency conversion in underserved markets where global remittance fees average 6.6%.

Interactive Brokers founder Thomas Peterffy has also confirmed the firm is exploring stablecoin launch options, potentially enabling real-time funding for brokerage accounts.

The $110 billion market value company serves nearly 3.9 million customers and already supports crypto trading through partnerships with Paxos and Zero Hash.

Most recently, Remitly launched beta testing for its multi-currency digital wallet supporting both fiat and stablecoins, with live deployment scheduled for September.

The Seattle-based fintech added stablecoin payout options through Bridge, a Stripe-owned infrastructure provider, while integrating USDC into internal treasury operations.

All these corporate adoptions come as Federal Reserve Governor Christopher Waller acknowledged the significance of stablecoins, noting that 99% of stablecoin market capitalization is linked to the US dollar.

The federation believed that “stablecoins can keep the dollar the world’s reserve currency” by making it more accessible worldwide.

Corporate Giants Defy New Regulations While Adoption Accelerates

Coinbase and PayPal continue offering stablecoin yield programs despite the GENIUS Act provisions explicitly banning interest payments from stablecoin issuers.

Both companies argue the restrictions don’t apply because they operate as intermediaries rather than direct issuers of the stablecoins they reward.

Coinbase CEO Brian Armstrong stated, “We are not the issuer,” while defending the company’s 4.1% APY rewards on USDC holdings.

Though Coinbase co-developed USDC with Circle, it ceased formal issuing responsibilities in 2023, with Circle now serving as the sole issuer without offering direct yield.

PayPal offers 3.7% annual returns on PYUSD holdings through both PayPal and Venmo platforms.

While PYUSD bears PayPal’s name, technical issuance by third-party firm Paxos allows PayPal to claim exemption from GENIUS Act restrictions.

Previously, Senator Elizabeth Warren warned that private stablecoin launches could create privacy invasions and systemic risks, predicting companies would “come begging for bailout when it inevitably blows up.”

Despite criticism, global corporations, including Amazon, Walmart, JD.com, and Alipay, continue exploring stablecoin integration.

The competitive stablecoin space has intensified with approximately 20 million addresses now transacting with stablecoins on public blockchains.

MetaMask’s proposed entry would leverage its massive user base and Stripe’s compliance infrastructure to claim its share of the market.

The post MetaMask Plans USD Stablecoin Launch with Stripe Partnership, Governance Proposal Reveals appeared first on Cryptonews.

Payments processor

Payments processor