Bitcoin’s sudden drop to $74,500 has started a strong debate among experienced traders, highlighting the market’s dependence on concentrated capital and a shortage of new liquidity. This analysis looks at the weaknesses shown by the recent sell-off and asks if the long-term bullish outlook can last in a market with a stalled realized cap and high-leverage liquidations.

The Bitcoin market faced a major turning point on February 1 and 2, 2026, when a 13% weekly drop broke through the $80,000 level. Some investors see this as a chance to buy at a lower price, but analysts say the crash was not random.

Instead, it was a chain reaction that started with small-cap stocks and the dollar, moved to precious metals, and finally hit the highly leveraged crypto market. This sell-off highlights a growing conflict between those who keep buying with strong conviction and signs of deeper market weakness.

Key Takeaways

- Technical Rejection: Bitcoin hit a nine-month low of $74,500 on February 2, confirming a decisive breach of the $80,000 psychological milestone.

- Liquidity Gap: CryptoQuant data highlights a lack of new capital inflows and a flatlined Realized Cap, suggesting the downturn is driven by profit-taking rather than sustainable growth.

- Institutional Threshold: Michael Saylor’s Strategy holdings briefly turned underwater as BTC dipped below the firm’s $76,037 average cost basis, though no immediate liquidation risk exists for their unencumbered coins.

- Macro Catalyst: The nomination of Kevin Warsh as Fed Chair sparked a “risk-off” rotation, strengthening the U.S. Dollar and pressuring risk assets globally.

Bitcoin’s Structural Vulnerability Exposed

The recent price swings have shown a clear problem: when only a few big players keep buying, any pause can quickly lead to a lack of liquidity. This sell-off shows that the market often pushes the limits of investor confidence. When large investors like Strategy slow down their buying, it becomes obvious that there is not enough demand from regular buyers.

Even so, some data models show that Bitcoin may be undervalued by 35% compared to its 15-year trend. Investors such as Robert Kiyosaki see this drop as a buying opportunity, and long-term forecasts still expect prices to recover to around $113,000 by mid-2026.

Bitcoin Braces for a “Golden Ratio” Retest as Strategy’s Treasury Hits Break-Even

On February 2, 2026, Bitcoin faced a major technical shift after a sharp 13% weekly drop that brought prices down to a nine-month low of $74,500. The main reason for this “liquidity hunt” was the nomination of Kevin Warsh as the next Fed Chair, which led investors to move away from riskier assets and strengthened the U.S. Dollar.

Technical Analysis & Support Levels

The daily chart shows that Bitcoin has clearly fallen below the important $80,000 level, and prices are now moving in a downward trend.

- Fibonacci & Support: Bitcoin is currently testing the 0.236 Fibonacci level ($78,400). A failure to reclaim this zone could trigger a deeper retracement toward the $74,666 horizontal support or even the $70,837 liquidity pool.

- Momentum Indicators: The RSI (Relative Strength Index) has plummeted into oversold territory near 28, suggesting that while the immediate sell-off is extreme, a “squeeze risk” for late shorts is building.

- Moving Averages: The price remains trapped below the 50-day EMA and 200-day SMA, which have now flipped into formidable dynamic resistance.

Trade suggestion: Consider buying if Bitcoin bounces off the $74,700 support level. Aim for a rally up to $80,700, and set a stop-loss below $72,000.

Bottom Line: Narrative vs. Reality

The 2026 “liquidity hunt” has shown that Bitcoin is still affected by global economic changes. While some investors remain optimistic based on long-term trends and institutional use, the main weakness—reliance on a few large investors—has become clear. Investors should watch Realized Cap data and ETF inflows to see if future growth is based on real demand or just more risky leverage.

Bitcoin Hyper: The Next Evolution of BTC on Solana?

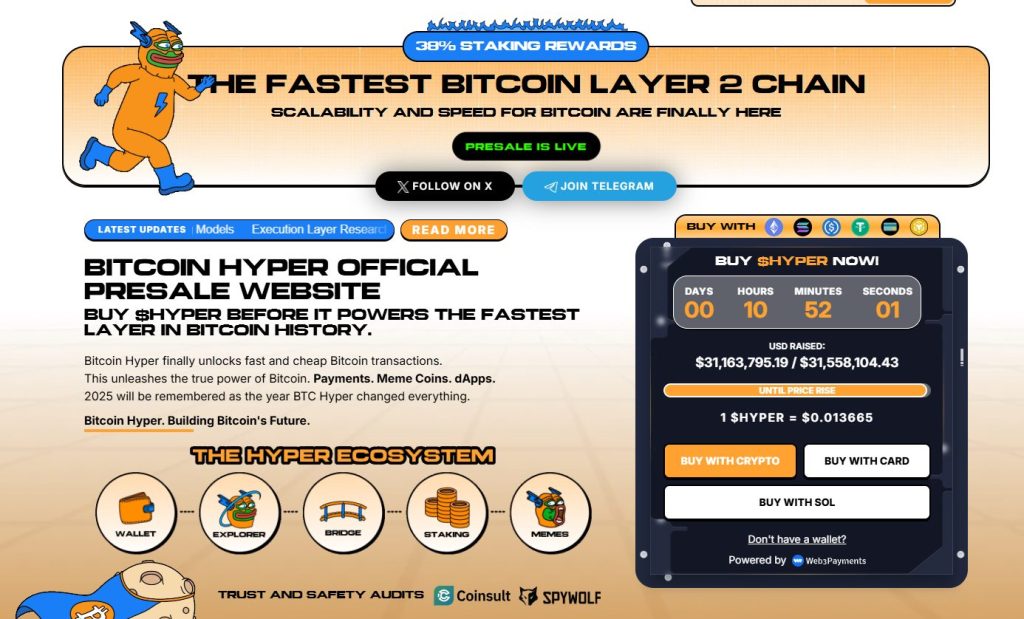

Bitcoin Hyper ($HYPER) is bringing a new phase to the BTC ecosystem. While BTC remains the gold standard for security, Bitcoin Hyper adds what it always lacked: Solana-level speed. The result: lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation, all secured by Bitcoin.

Audited by Consult, the project emphasizes trust and scalability as adoption builds. And momentum is already strong. The presale has surpassed $31.4 million, with tokens priced at just $0.013665 before the next increase.

As Bitcoin activity climbs and demand for efficient BTC-based apps rises, Bitcoin Hyper stands out as the bridge uniting two of crypto’s biggest ecosystems. If Bitcoin built the foundation, Bitcoin Hyper could make it fast, flexible, and fun again.

Click Here to Participate in the Presale