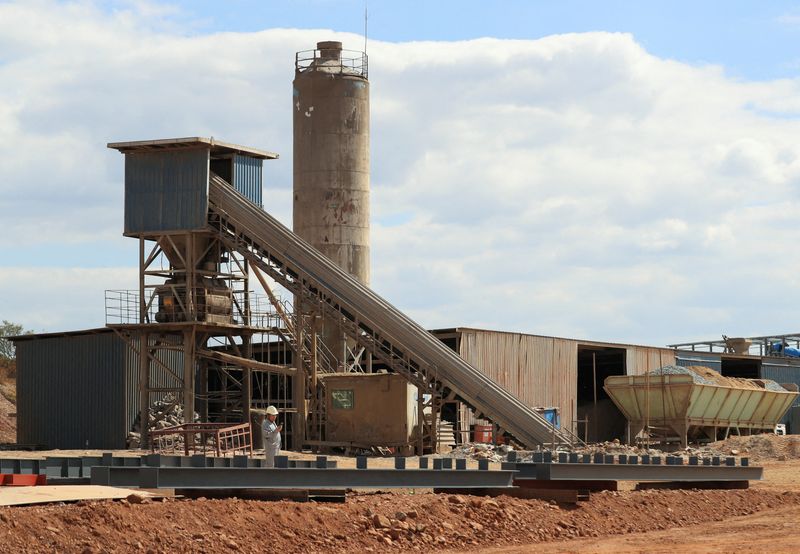

© Reuters. FILE PHOTO: A worker checks their mobile phone, as Zimbabwe’s President Emmerson Mnangagwa commissions the Prospect Lithium mine and processing plant in Goromonzi, Zimbabwe July 5, 2023. REUTERS/Philimon Bulawayo/File Photo

By Ernest Scheyder and Melanie Burton

(Reuters) – The world’s largest lithium producers say they remain bullish on long-term demand for the battery material in the midst of recent price drops fueled by growing worries that the global pace of electric vehicle adoption is slowing.

LG Energy Solution, General Motors (NYSE:), Honda (NYSE:) and other auto and battery makers have trimmed EV expansion plans in recent weeks, partly due to rising interest rates, which in turn has stoked concerns of a supply glut for the battery metal.

A basket of prices for lithium – which vary by region and by type – tracked by Benchmark Mineral Intelligence has dropped more than 60% this year.

While demand for the ultralight battery metal is still expected to rise this year from 2022 levels, investors’ expectations for white-hot industry growth were dampened by sluggish quarterly reports from Albemarle (NYSE:), Pilbara Minerals, Livent (NYSE:) and others.

In Australia, the world’s largest lithium-producing nation, Pilbara Minerals is the most-shorted stock on the Australian Stock Exchange, suggesting investors have a negative view on lithium demand.

The bearish sentiment has affected more than just lithium producers. Lithium Royalty Corp, a lithium investor, has lost more than 37% of its value since listing in Toronto earlier this year. The Global X Lithium & Battery Tech ETF has dropped 18% this year.

Chris Berry, an independent lithium analyst and consultant, advises clients to focus on a range of prices for the key battery metal, not just spot, adding that prices today remain far above historical trends.

“While the spot price has cratered, I haven’t seen an evaporating of demand which would validate the trajectory of the spot price,” Berry said.

In calls with investors and analysts in recent days, lithium producers said they saw the market volatility as short term, adding that they expect electrification to keep growing.

“We see what’s happening now as road bumps, but certainly not a determinant for the long-term growth we have,” Eric Norris, head of Albemarle’s Energy Storage division, told investors on Thursday after the company cut its annual forecast and reported disappointing quarterly results.

Livent, which supplies BMW (ETR:) and Tesla (NASDAQ:) said it continues to expect strong lithium sales despite its own weak results. “We see (lithium) supply continuing to be the constraint on demand,” said Livent CEO Paul Graves.

Pilbara last week flagged a “softening market backdrop” and ruled out share buybacks or special dividends for shareholders. Still, executives said that decision was born from a desire to be cautious for the time being.

“Demand is absolutely there,” said Pilbara CEO Dale Henderson. “It’s just a case of moderating pricing. It’s still a very healthy market.”

Mineral Resources, which operates lithium mines with Albemarle and Jiangxi Ganfeng Lithium, described the market’s current state as a “rebalancing” of supply chains.

And IGO, which holds a stake in a joint venture that controls Greenbushes, the world’s largest lithium mine, warned of ongoing market volatility earlier this week, but added it believed the industry’s troubles were only “near term”.