Asia’s wealthy investors are putting meaningful chunks of their money into digital assets, with almost half now allocating more than 10% of their portfolios to crypto and a clear majority planning to add more over the next few years.

Swiss Singaporean digital asset bank Sygnum found in its APAC HNWI Report 2025 that 87% of more than 270 respondents already hold digital assets.

The survey covered high net worth and professional investors across 10 markets, including Singapore, Hong Kong, Indonesia, South Korea and Thailand, and defined high net worth individuals as those with over $1M in investable assets and ultra high-net-worth investors as those with more than $25M.

High Net Worth Investors Embrace Crypto As A New Alternative Asset Class

For this group, crypto has become a core allocation, not a side bet. Median holdings sit in the 10% to 20% range, with a weighted average near 17%, putting tokens in the same conversation as equities and private markets inside portfolios.

Image Source: Sygnum

Motivation has shifted away from pure speculation. Sygnum reports that 90% of high-net-worth investors see digital assets as important for long-term wealth preservation and legacy planning.

Portfolio diversification drives a majority of decisions, with 56% citing it as a key reason to invest, and many framing crypto as a new alternative asset class rather than a short-term punt.

APAC Investors Expect A New Crypto Cycle Within Two To Five Years

Looking ahead, 60% of respondents say they plan to increase allocations. A bullish or very bullish long-term outlook comes from 57% of high net worth investors and 61% of ultra high net worth investors, with many expecting the next strong cycle to unfold over a two to five year horizon rather than in the next few weeks.

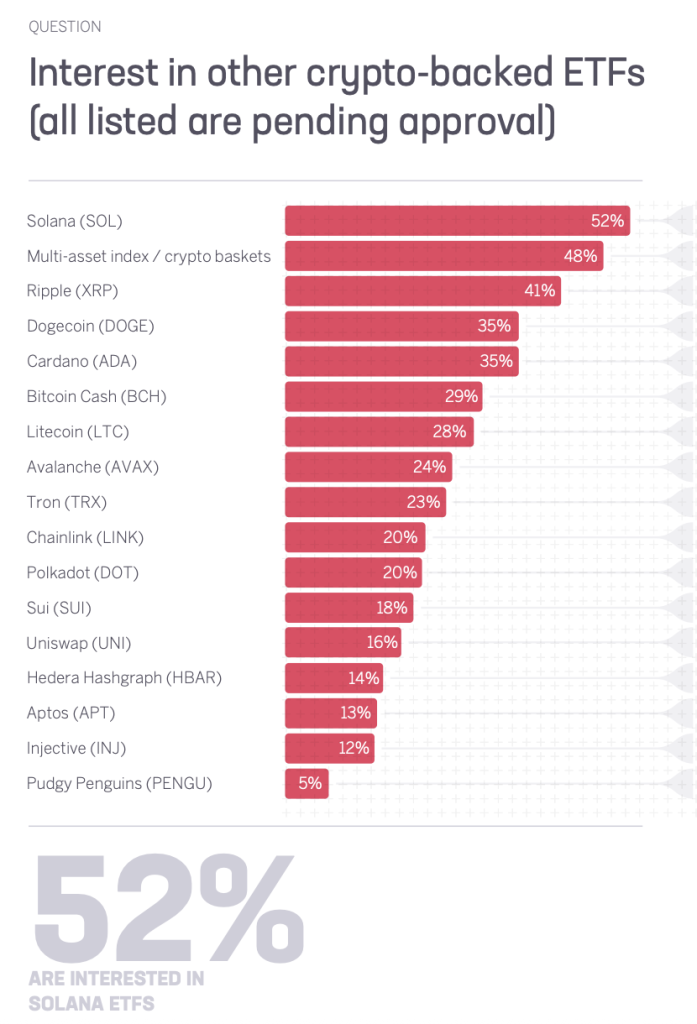

Product preferences tell a similar story of maturation. Beyond Bitcoin and Ethereum, 80% of investors want more crypto exchange-traded funds, with Solana drawing the strongest single asset demand at 52%.

Image Source: Sygnum

Multi-asset index products and XRP also attract interest, and 70% of respondents say they would allocate or allocate more if staking yield were bundled into ETF structures, a clear nod to yield-focused, regulated wrappers that sit comfortably in traditional wealth plans.

APAC Emerges As A Leading Gateway As Digital Assets Embed Into Wealth Portfolios

Security and rules still shape how fast this money moves. Around two thirds of investors say they need their private bank or wealth manager to demonstrate strong custody and security standards before they scale up exposure, while regulatory uncertainty and volatility remain key brakes.

At the same time, most respondents say regulatory clarity has improved and recent policy moves in major markets strengthen the long term case for digital assets.

“Digital assets are now firmly embedded within APAC’s private wealth ecosystem,” said Gerald Goh, Sygnum co founder and APAC chief executive.

He noted that frameworks in Singapore and Hong Kong have built the infrastructure for traditional wealth managers to offer crypto services and described Asia Pacific as one of the fastest growing gateways for digital assets, with momentum likely to build into 2026.

The post Half Of Asia Pacific’s High Net Worth Individuals Now Allocate Over 10% To Crypto appeared first on Cryptonews.