Gold futures surged past $4,000 per ounce on Monday as the U.S. Senate advanced a bipartisan deal to end the 40-day government shutdown.

Meanwhile, Bitcoin jumped from $100,000 to around $106,000, driven by expectations that reopening the federal government indicates a return to deficit spending and monetary expansion.

The breakthrough came after eight Democratic senators crossed party lines to support a compromise that would reopen federal operations through January, reverse shutdown-related layoffs, and guarantee back pay for furloughed workers.

However, deep divisions remain over healthcare tax credits, which are set to expire in December.

President Donald Trump confirmed late Sunday that “we are getting close to the shutdown ending,” just after Treasury Secretary Scott Bessent had warned the economic impact would only worsen without resolution.

The shutdown, which began on October 1 after lawmakers disagreed on funding for the new fiscal year, disrupted welfare benefits for over 40 million Americans relying on SNAP assistance and forced airlines to cancel more than 2,700 flights on Sunday alone.

Market Rally Reflects Return to Deficit Spending

Spot gold climbed nearly 3% above $4,113 per ounce, hitting its highest level since October 27, while US gold futures rose to $4,089.

Peter Schiff noted the rally across stocks, precious metals, and Bitcoin indicates “it’s back to business as usual in Washington, D.C.,” where “deficits and inflation will rise, and investors will continue to seek alternatives to depreciating U.S. dollars.“

The dollar index fell 0.1%, making gold more affordable for overseas buyers amid growing concerns about U.S. economic data.

Market participants now see a 65% chance of a Federal Reserve rate cut in December, following weak October employment figures and a decline in consumer sentiment to its lowest level in nearly three and a half years.

Ray Dalio addressed the broader debt crisis at the Greenwich Economic Forum, explaining that “when you get into the point in this cycle where debt is needed to pay debt and compounds, it becomes a problem also for central banks.“

He noted central banks losing money on debt holdings face “asset liability problems” and must “monetize essentially the other government’s debt,” producing “a dissolution, deterioration in the monetary order.“

Central banks purchased a record 220 tons of gold in Q3 2025, reflecting a shift away from U.S. Treasuries due to rising global debt and geopolitical tensions.

Bitcoin Positioned as Digital Alternative to Gold

Coinbase CEO Brian Armstrong declared, “It’s clear at this point that Bitcoin is a better form of money than gold” at a World Economic Forum discussion.

He argued that Bitcoin “is provably scarce, just like gold, but it’s more portable and divisible so you can actually use it” while noting it “has higher utility” and “was the best performing asset over the last 10 years.“

Armstrong predicted that governments might start with Bitcoin comprising “1% of their reserves, but I think over time it’ll come to be equal or greater than gold reserves.“

However, tech investor Balaji Srinivasan observed yesterday that “the S&P 500 is up in nominal terms, flat in gold terms, and down in Bitcoin terms,” questioning whether “the Bitcoin to gold exchange rate may become the true price.“

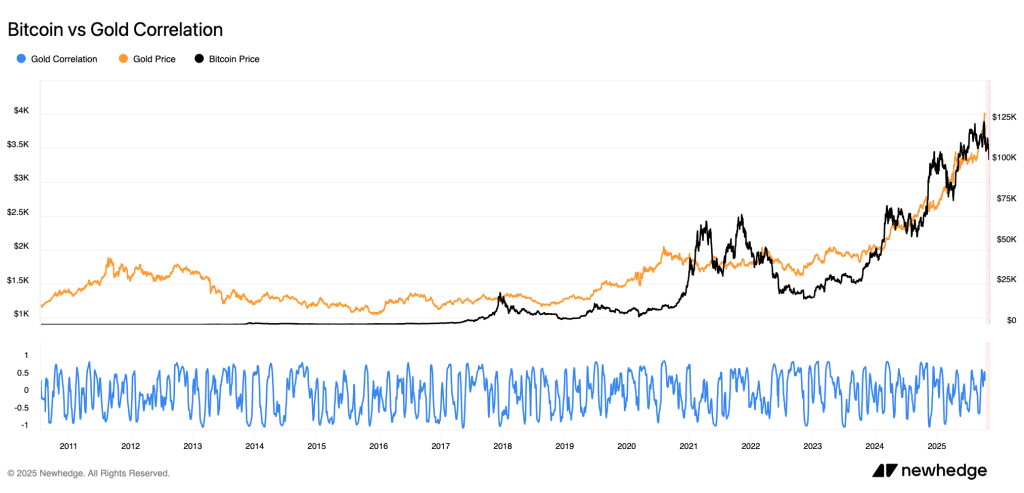

Gold’s 53% year-to-date gain pushed prices above $4,000 per ounce, while Bitcoin’s price, slightly above $100,000, represented a return of over 390% in three years.

Just like many other key financial experts, Robert Kiyosaki recently reaffirmed his $250,000 Bitcoin target for 2026, arguing the U.S. Treasury and Federal Reserve “print fake money to pay their bills” while “the USA is the biggest debtor nation in history.“

Bitcoin is now facing key resistance at $110,000 to $111,000 after breaking above $105,000, with analyst Pan C predicting that the recovery will take 1-2 weeks to establish $110,000 as support.

Large liquidity clusters await at $106,800 on the upside, while downside liquidity formed at $105,400, $104,000, and $102,200.

U.S. stock futures rose 0.7% for the S&P 500 and 1.2% for the Nasdaq 100 on Monday morning, while 10-year Treasury yields climbed 0.04 percentage points to 4.14% as markets anticipated the shutdown’s end would reverse recent safe-haven flows.

The post Gold Surges above $4000 as U.S. Nears Deal to End Shutdown – Will Bitcoin Follow? appeared first on Cryptonews.

(@GoldTelegraph_)

(@GoldTelegraph_)