Douglas Rissing

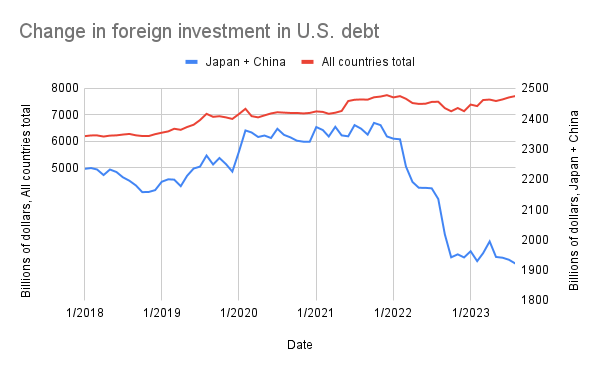

By international standards, the proportion of U.S. Treasury debt held by foreign investors remains high, about 30% as of Q2 2023, largely due to the U.S.’s standing as safe-haven.

That level has remained relatively robust recently, even as the amount held by China and Japan have been dropping, as pointed out by Wells Fargo Invstment Institute strategist analyst Jennifer Timmerman and global strategist Gary Schlossberg.

But that isn’t always the case. “Overseas investment in U.S. debt has been more volatile than domestic holdings when demand for the dollar and Treasuries is dampened by weak fiscal policy and poor economic performance, in part due to more attractive, global alternatives,” they wrote in a recent note.

“In the current cycle, the Federal Reserve’s credit tightening and perceived safe-haven demand during the global economic slowdown have so far supported the foreigh financing of the budget deficit.”

But investors shouldn’t count on that holding up, especially once the Fed starts to cut interest rates.

Source: U.S. Treasury

“We expect dollar demand to weaken temporarily in response to falling U.S. interest rates and stronger global risk appetite as investors favor other currencies and the world economy recovers later in 2024, perhaps aggravated by reduced demand for U.S. debt,” they said.

Relevant tickers include: Invesco DB US Dollar Index Bearish ETF (NYSEARCA:UDN), ProShares UltraShort 20+ Year Treasury ETF (NYSEARCA:TBT), Direxion Daily 20+ Year Treasury Bear 3X ETF (NYSEARCA:TMV).