A prominent crypto analyst has told Cryptonews that it’s “inevitable” Bitcoin will hit $150,000 — and revealed when the historic milestone might be reached.

Copper’s head of research, Fadi Aboualfa, says BTC’s recent return to all-time highs has been primarily driven by institutional investors, with “leverage-driven retail mania fading into history.”

He believes Bitcoin “appears primed for another significant leg upward” based on a slew of key metrics — but argues that, from a data perspective, the world’s biggest cryptocurrency “isn’t exhibiting anything outside normal parameters.”

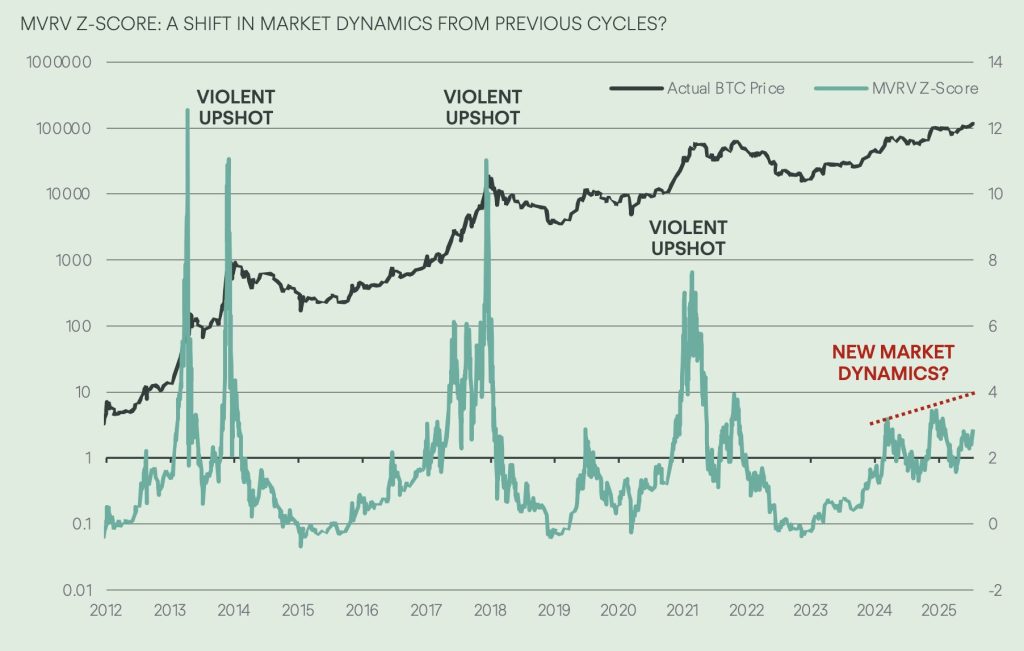

However, Aboualfa thinks the absence of “trigger-happy, shiny-button-pressing retail traders” does mean that BTC’s price movements might be a little different from past bull markets — and may now follow “a more tempered path.”

Earlier this year, Copper released research that suggested Bitcoin would begin to overheat between the $140,000 and $200,000 range, which could prompt traders to take profits off the table and begin scaling back their positions.

And in the absence of everyday consumers, purchasing activity across exchange-traded funds has played a key role in propelling this cryptocurrency higher. According to Copper, ETFs have hoovered up more than 165,000 BTC in the past 100 days — adding:

“For every 10,000 Bitcoins added to ETF holdings, the price has increased by an average of 1.8%.”

Aboualfa says maintaining this momentum could prove crucial if Bitcoin is to remain in price discovery mode for the rest of 2025.

“Should these inflows persist, challenging as that may be through the typically quieter summer months, Bitcoin could be on track to breach $140,000 in September. This may be followed by a potential surge toward $150,000 by early October.”

Copper anticipates such a surge — which would cap off a 60% rise since January — would indeed cause “overheating” to emerge. The speed with which BTC hits $150,000 is also set to depend on whether the market “successfully absorbs resistance at $125,000 and $130,000,” where “heightened sell orders” can be found. Aboualfa wrote in his research note:

“Some may argue this outlook is overly cautious. Industry optimists have predicted Bitcoin could reach anywhere from $200,000 to $500,000 this cycle. That might be possible, but the route to such highs will likely be very different.”

In his view, the arrival of institutional capital may mean we’re beginning to move away from the traditional four-year cycles of boom and bust — paving the way “for less dramatic peaks and less painful troughs.”

“From the backseats, that’s not a bad thing. A lower-volatility Bitcoin that doesn’t chew through capital is arguably a more attractive investment thesis, especially when compared to relatively stable assets like gold.”

That could help explain why retail traders — constantly chasing huge returns in quick timeframes — may no longer find Bitcoin as appealing a proposition.

Bitcoin Dominance Declining

Bitcoin’s flat as a pancake over a 24-hour and seven-day timeframe, as smaller cryptocurrencies rally higher. Both Ether and XRP have jumped 20% over the past week, with the likes of Stellar and Hedera spiking more than 30%.

BTC’s dominance — that is, its share of the overall crypto market — had reached highs of 65% in June. Fast forward to now, and it’s in retail danger of slipping below 60% as attention turns to ETH and other altcoins.

XRP in particular is one to watch. It’s risen by a staggering 494% over the past 12 months, as Ripple’s woes with the Securities and Exchange Commission reach a conclusion.

The world’s third-largest cryptocurrency is just 10.7% off a fresh all-time high of $3.84 — prices that were last seen all the way back in January 2018, in other words, seven-and-a-half years ago.

Just like Bitcoin hitting $150,000 seems inevitable, you could argue it’s a matter of time before XRP returns to price discovery mode as well. It’s highly likely that ETFs tracking the spot price of this altcoin will be approved this year, which could lead to billions of dollars in inflows from smart money.

While ETH ETFs have proven to have a somewhat disappointing performance since making their debut last summer, XRP’s astronomical returns could prove difficult to ignore for Wall Street. While nothing is certain, all signs point to the beginnings — and not the end — of a bull market.

The post Expert: Bitcoin Hitting $150,000 is ‘Inevitable’ — Here’s When appeared first on Cryptonews.