Ether.fi is migrating its payments rail, Ether.fi Cash, to OP Mainnet, moving roughly 70,000 active cards and 300,000 accounts away from the Scroll Layer 2 network, according to a recent blog post.

The transition, announced Wednesday, involves shifting millions in Total Value Locked (TVL) over the coming months to integrate with Optimism’s broader Superchain ecosystem.

This strategic pivot underscores the fierce competition among Layer 2 solutions for high-volume consumer applications, with Ether.fi citing access to a larger DeFi ecosystem as a primary driver.

Key Takeaways

- Mass Migration: Approximately 70,000 active cards and 300,000 accounts are moving to Optimism.

- Volume Impact: Ether.fi Cash processes roughly $2 million in daily spend volume.

- Incentives: Gas fees for card transactions will be fully absorbed by Ether.fi during and after the transition.

Why Is Network Choice Critical?

Ether.fi initially built its reputation on asset restaking but successfully pivoted to consumer payments with Ether.fi Cash in 2024.

The product allows users to spend stablecoins or borrow against staked assets like eETH to fund real-world Visa purchases.

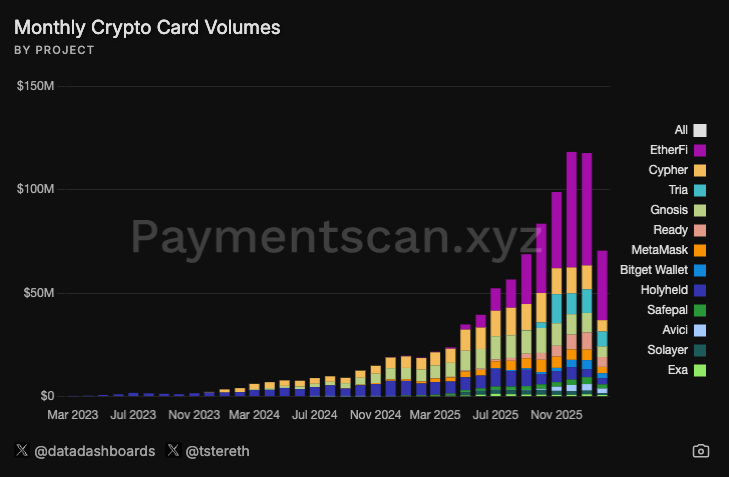

According to Paymentscan, these cards now facilitate nearly half of all crypto-native card transactions.

The choice of underlying network defines transaction speed and liquidity depth.

Operational stability is paramount for consumer products; just look at what happened to what happened to Moonwell this week.

Payment providers must mitigate infrastructure risks by selecting mature execution layers. Ether.fi’s move signals that liquidity depth on OP Mainnet currently outweighs the ZK-rollup advantages offered by Scroll for this specific use case.

Discover: The best crypto presales right now

Breaking Down the Migration

The migration utilizes an OP Enterprise partnership, providing Ether.fi with dedicated support and shared codebase tooling.

Transaction costs for card usage will be absorbed by the protocol, ensuring users experience no friction during the switch. This is critical as Ether.fi Cash currently processes roughly 2,000 internal swaps and 28,000 spend transactions daily, metrics that have reportedly doubled every two months.

Capital efficiency is the core technical driver here. Much like how new frameworks are introducing unified liquidity and staking solutions, Ether.fi expects deeper liquidity for swaps on OP Mainnet compared to its previous deployment.

Optimized liquidity pools mean lower slippage for users converting crypto to fiat at the point of sale.

The OP Stack itself processed a staggering 3.6 billion transactions in the second half of 2025, representing 13% of all crypto transactions in that period.

What Does This Mean for the L2 Landscape?

For Scroll, this represents a notable loss of volume. The ZK-powered chain had relied on Ether.fi as a significant driver of daily activity.

Conversely, Optimism reinforces its position as a dominant hub, securing a high-retention consumer product just as internal ecosystem dynamics shift, notably with Base signaling moves toward a bespoke chain platform.

This consolidation reflects a maturing Ethereum ecosystem where projects prioritize battle-tested liquidity over novel tech stacks.

It aligns with broader institutional positioning, similar to how funds like Founders Fund have adjusted their ETH-related exposure to align with prevailing market realities.

For the end user, the backend plumbing changes, but the card in their digital wallet simply becomes more efficient.

Discover: Diversify your crypto portfolio with these top picks