Fasset, a Dubai and Jakarta-based digital banking and investment platform, has received a provisional banking license from Malaysia to operate the world’s first stablecoin-powered Islamic digital bank.

The regulatory approval enables Fasset to offer Shariah-compliant savings, zero-interest accounts, investment services using stablecoins and tokenized assets, and global payments on-chain, targeting financial inclusion gaps across Muslim-majority regions in Asia and Africa, where access to halal asset-backed products remains limited.

Customers will be able to hold deposits, invest in US stocks, gold, and crypto, and spend through a planned Visa-linked crypto card. Fasset also plans to roll out “Own,” an Ethereum Layer 2 network built on Arbitrum, to settle regulated real-world assets on-chain.

The company already processes more than $6 billion in annualized transaction volume across 125 countries and holds regulatory approvals in the UAE, Indonesia, the EU, Turkey, and Pakistan.

The firm has also received authorization from Bahrain’s Central Bank to test blockchain-based asset tokenization solutions in 2020, obtained a Category 3 Crypto-Asset Service Provider license, and secured a Virtual Asset Service Provider license from Dubai’s Virtual Asset Regulatory Authority in November 2023.

Malaysia Emerges as Hub for Shariah-Compliant Crypto Innovation

Malaysia’s crypto market revenue is expected to reach approximately $484.1 million in 2025, with active users plateauing around 2.8 million, placing the country in the top 50 globally for crypto adoption by transaction volume.

Stablecoins are gaining recognition as regulatory frameworks evolve to clarify their treatment under central bank authority, with ongoing discussions focused on facilitating stablecoin use in cross-border payments and local financial inclusion.

The country’s Securities Commission proposed sweeping changes to its digital asset exchange regulatory framework in July 2025, following record trading volume of RM13.9 billion ($2.9 billion) in 2024, more than double 2023 levels.

The proposed reforms would allow specific tokens that meet predefined eligibility standards to list on regulated platforms without first securing SC approval, thereby reducing regulatory delays while requiring exchanges to segregate client assets from operational funds.

A June 2025 report by the ACCESS Blockchain Association also predicted that formalizing Malaysia’s crypto mining sector could generate RM700 million in hardware and infrastructure investments, create 4,000 jobs, and contribute approximately RM150 million in annual tax revenue.

The report recommended developing Shariah-compliant mining models that leverage Malaysia’s leadership in Islamic finance by creating ethical operations that prioritize transparent governance and the use of renewable energy.

Growing Islamic Finance-Crypto Convergence Across the Middle East and Asia

Binance launched its Sharia-compliant multi-token staking platform, Sharia Earn, in July 2025, officially certified by Amanie Advisors as the first of its kind globally.

The product offers staking for Binance Coin, Ethereum, and Solana in 31 countries, including Afghanistan, Bangladesh, Egypt, Indonesia, Pakistan, Qatar, Saudi Arabia, Turkey, and the UAE.

All funds are staked through a Wakala agreement structure, enabling halal capital delegation with zero exposure to interest or excessive uncertainty.

Back in September 2024, Bybit also launched its Islamic Account, certified by ZICO Shariah and CryptoHalal, offering spot trading for 75 selected cryptocurrencies, along with DCA and Spot Grid Bot trading tools.

The account addresses demand in the $5 trillion Islamic finance sector, offering Shariah-compliant crypto trading options for Muslim traders worldwide, except in regions with legal restrictions.

Similarly, Crypto.com signed an agreement with Dubai Islamic Bank to introduce Sharia-compliant products, including tokenized Islamic sukuks and real-world asset tokenization.

The platform, which has over 100 million global users, has acquired Orion Principals Limited, a regulated entity by the Abu Dhabi Global Market, and launched its AED Wallet, allowing deposits and withdrawals in local currency.

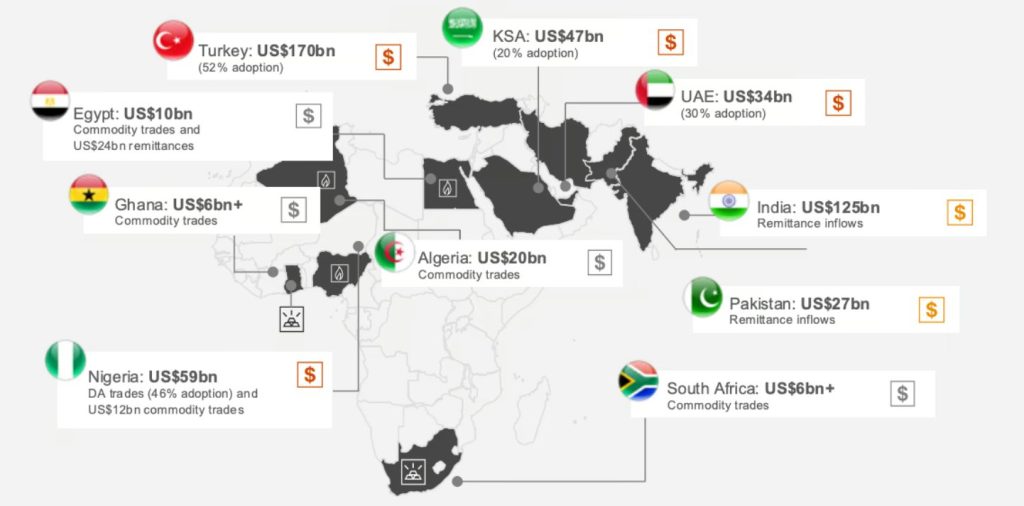

The UAE recorded $34 billion in crypto inflows for the year ending mid-2024, representing a 42% year-over-year growth and a crypto app user base of 15 million.

The Middle East, overall, attracted approximately $338.7 billion in crypto inflows last year, ranking as the seventh-largest crypto economy worldwide.

Saudi economist Ihsan Buhulaiga, a former member of the Shura Council, has recently called for Gulf Arab states to establish a unified regulatory framework for cryptocurrencies, urging GCC nations to collaborate on crypto regulations due to policy disparities across the region.

During the same period, the UAE issued regulatory approval for AE Coin, a new stablecoin pegged to the UAE dirham and fully backed by reserves held within the country.

The post Dubai Fasset Gets Malaysia Banking License to Launch Shariah-Compliant Stablecoin Bank – A First Globally appeared first on Cryptonews.