Circle CEO Jeremy Allaire dismissed banking industry warnings that stablecoin rewards could destabilize traditional finance, calling such concerns “totally absurd” during a World Economic Forum panel discussion on Thursday.

His remarks came amid escalating tensions between crypto platforms and banks over provisions in pending U.S. market structure legislation.

Speaking at the Davos summit, Allaire defended the stablecoin industry’s growth trajectory while addressing claims from Bank of America CEO Brian Moynihan that yield-bearing digital dollars could trigger massive deposit flight from commercial banks.

The panel, which included International Monetary Fund First Deputy Managing Director Dan Katz and development finance expert Vera Songwe, examined stablecoins’ expanding role in global payments following last year’s passage of the GENIUS Act.

Banks Warn of “Parallel Banking System”

Banking executives have intensified lobbying against stablecoin rewards programs, with JPMorgan CFO Jeremy Barnum recently warning that interest-paying tokens create “a parallel banking system that sort of has all the features of banking, including something that looks a lot like a deposit that pays interest, without the associated prudential safeguards.“

The Community Bankers Council of the American Bankers Association also urged Congress earlier this month to close what it called a “loophole” allowing stablecoin issuers to indirectly fund yield through exchange partners.

Community bankers warned that large-scale deposit outflows could reduce credit availability for small businesses and homebuyers.

Allaire countered that such arguments ignore financial market history and mischaracterize how stablecoins function within regulatory frameworks.

“Rewards around financial products exist in every balance that you have with a credit card that you use,” he said, noting these incentives help with customer retention without functioning as monetary policy dampeners.

Money Market Funds Precedent Cited

The Circle chief executive drew parallels to government money market funds, which banking groups once claimed would devastate deposit bases.

“The exact same arguments were made,” Allaire stated, pointing out that roughly $11 trillion in money market funds has grown without preventing lending activity.

He argued that lending itself has shifted toward private credit markets, with “the vast vast majority of GDP growth in the United States” historically funded through capital market formation around junk bonds rather than bank credit.

Allaire emphasized that all major stablecoin regulations (including the GENIUS Act, Europe’s MiCA framework, and laws in Japan, UAE, Hong Kong, and Singapore) explicitly prohibit stablecoin issuers from paying interest.

“Payment stablecoins” are legally defined as cash instruments used for settlement and require cash-level safeguards under supervision by central bankers and global standard-setters.

While Circle generates income from reserves and revenue-sharing partnerships with platforms like Coinbase, Binance, and Visa, the company itself cannot pay interest directly to tokenholders.

Partner platforms may offer rewards based on their own commercial arrangements, but Allaire argued that this mirrors loyalty programs across traditional financial products.

IMF Acknowledges Benefits Amid Risks

The IMF’s Katz acknowledged stablecoins present “very significant potential benefits” for cross-border payments and financial inclusion while noting risks including banking disintermediation and currency substitution in emerging markets.

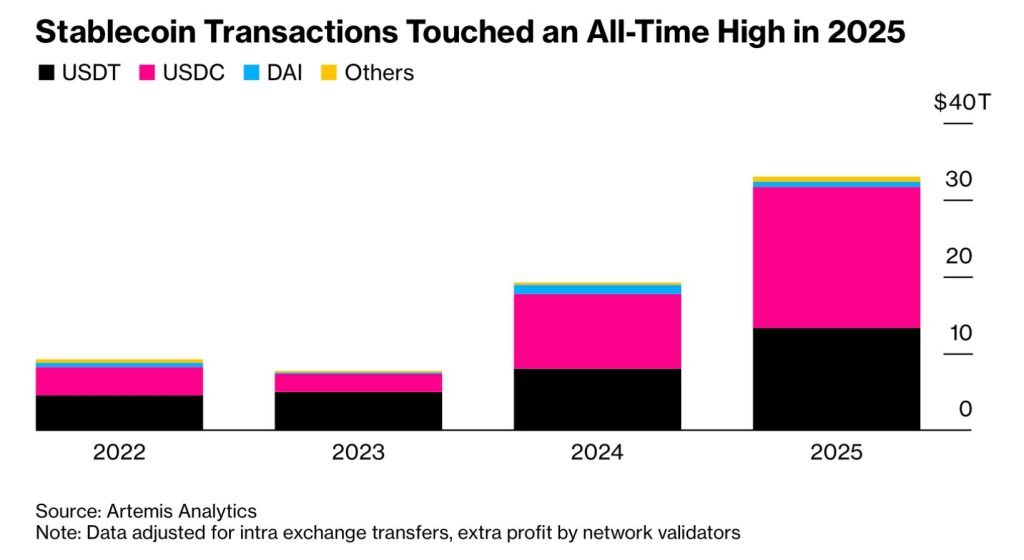

Transaction volumes reached $33 trillion in 2025, up 72% from the previous year, with USDC processing $18.3 trillion to lead all stablecoins by payment flow.

Katz emphasized the importance of international regulatory interoperability, stating that realizing stablecoins’ full benefits requires scale and effective cross-border frameworks.

He pointed out the competitive pressures stablecoins create for traditional finance and weak fiscal regimes alike.

Songwe detailed stablecoins’ transformative impact across Africa, where remittance costs averaging 6% can drop to under $1 with digital dollar transfers that complete in minutes, versus five-day settlement delays.

With 650 million Africans lacking bank accounts and 12-15 countries experiencing inflation above 20%, stablecoins provide dollar-denominated savings accessible via smartphones.

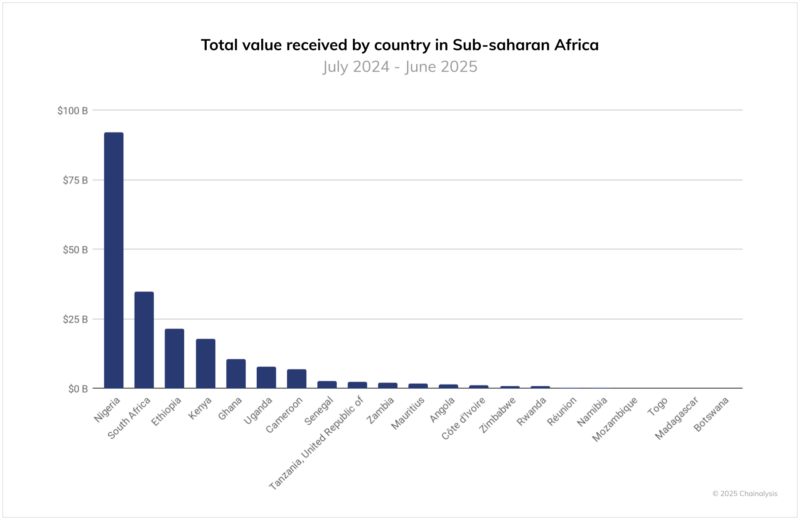

Egypt, Nigeria, and Ethiopia lead African adoption, with most transactions below $1 million, indicating heavy small-business use.

In fact, according to Chainalysis, Sub-Saharan Africa received over $205 billion in on-chain value, up roughly 52% from the previous year between July 2024 and June 2025.

However, Songwe noted that 75% of stablecoin reserves remain dollar-denominated, prompting the development of SDR-backed alternatives to reduce dollar dependency and improve transparency around illicit financial flows.

Allaire concluded that stablecoins should remain “cash instrument money, credentially supervised, very very safe money,” with efficient credit delivery systems built atop them through decentralized finance protocols that can be “safer, more transparent, more efficient, more inclusive, and more globally available than what we have with bank credit today.“