XRP is trading at $3.09, with volume declining 13.36% to $6.66 billion. Bloomberg analysts have upgraded ETF approval odds to 95%, while technical indicators show mixed consolidation signs at key EMA resistance levels. This positions XRP for a potential breakout toward $3.50 or a deeper correction toward $2.88 support.

The following analysis synthesizes ChatGPT’s 28 real-time technical indicators, SEC lawsuit developments, ETF approval momentum, and institutional adoption metrics to assess XRP’s 90-day trajectory amid key regulatory inflection between continued legal clarity and explosive institutional adoption.

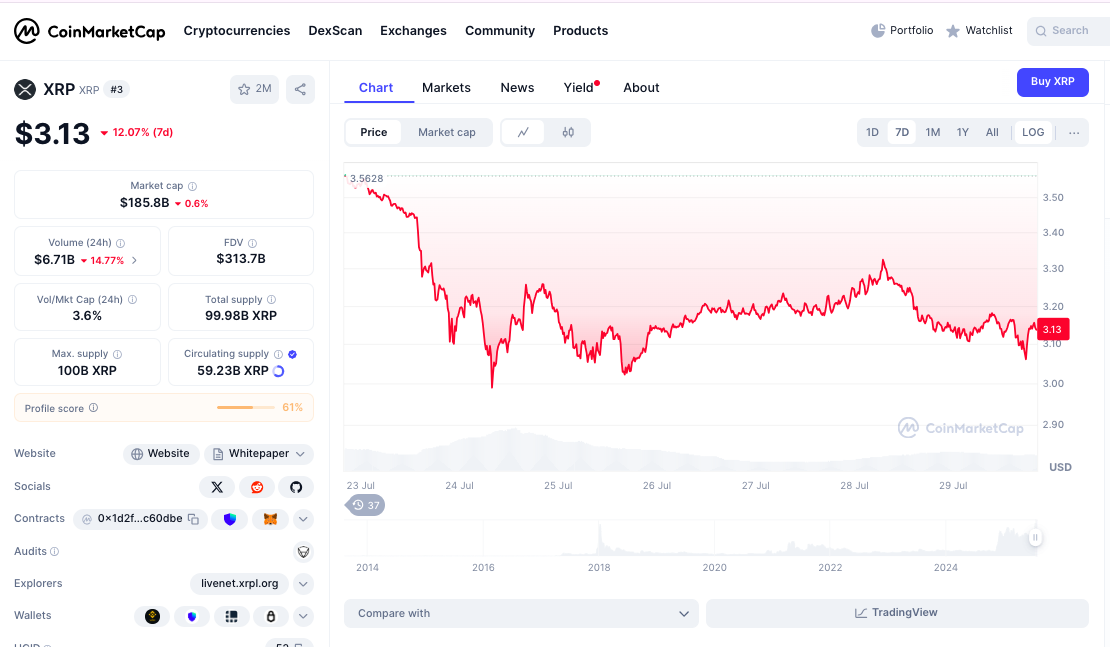

Technical Analysis: Consolidation Below Key EMAs

XRP’s current price of $3.09 reflects a -1.47% daily decline from an opening price of $3.14, establishing a trading range between $3.17 (high) and $3.09 (low).

This 2.9% intraday range demonstrates controlled volatility typical of consolidation phases following major rallies.

The RSI at 38.69 approaches oversold territory, indicating balanced momentum with potential for upward reversal.

Moving averages reveal challenging positioning with XRP trading below the 20-day EMA at $3.18, 50-day EMA at $3.20, and 100-day EMA at $3.11, while still maintaining strength above the 200-day EMA at $2.88.

MACD indicators show a bearish structure with the MACD line at -0.0058 trading below zero, though the negative histogram at -0.0246 suggests momentum may be stabilizing.

Volume analysis shows moderate activity with daily trading volume at $6.66 billion, representing a 13.36% decline. ATR readings at 2.93 indicate a high volatility environment, suggesting strong moves ahead once consolidation resolves with regulatory clarity.

Historical Context: Recovery from Regulatory Uncertainty

XRP’s 2025 performance demonstrates exceptional resilience through regulatory challenges, with dramatic recovery from April’s $1.61 low to current consolidation above $3.00. The year has showcased institutional confidence despite ongoing SEC proceedings.

January-March witnessed a gradual decline from $3.40 to $2.70, followed by April’s sharp correction to $1.80 as regulatory uncertainty peaked.

May marked the cycle bottom at $1.80, followed by an explosive June recovery to $2.19 and July’s continued momentum toward current levels around $3.09.

Current pricing sits 19.1% below the all-time high while maintaining extraordinary gains of over 110,000% from the 2014 all-time low.

This historical context shows both the strong remaining upside potential and XRP’s proven resilience through regulatory challenges.

Support & Resistance: Key Levels Define Breakout

Immediate support emerges at today’s low around $3.09, reinforced by the key psychological $3.00 level.

This confluence provides primary defense for continued bullish structure, making it the most important zone to monitor for consolidation strength.

Key support zones extend to the 50-day EMA at $2.74, representing major technical support and long-term trend definition.

A strong support base spans $2.80-$2.85, corresponding to historical accumulation areas and institutional buying zones.

Resistance begins immediately at the 100-day EMA at $3.20, followed by the 20-day EMA at $3.18 and the 200-day EMA at $3.20.

This EMA cluster creates strong overhead resistance, requiring volume expansion for a breakthrough.

Successfully breaking these levels would indicate sustained uptrend resumption toward the psychological $4.00 target and beyond.

Regulatory Breakthrough: SEC Resolution Accelerates

The Ripple vs. SEC lawsuit approaches decisive resolution with both parties potentially dismissing appeals before the August 15 deadline, according to legal experts.

Legal clarity continues to build momentum with recent court victories establishing XRP’s non-security status for retail trading.

This precedent creates a foundation for institutional investment products and mainstream financial integration previously restricted by regulatory uncertainty.

ETF Momentum: 95% Approval Odds Drive Optimism

Bloomberg analysts have upgraded XRP ETF approval odds to 95% for 2025, representing a strong increase from previous estimates.

Ten XRP spot ETF applications await SEC decision with deadlines approaching October 2025.

The concentration of applications from prominent asset managers, including Grayscale, suggests institutional confidence in approval likelihood and market demand.

Bank of America contacts reportedly confirm 100% confidence in ETF approval, according to insider sources.

The ETF approval timeline coincides with Fed rate cut expectations, creating an optimal macro environment for risk asset appreciation.

Lower rates increase institutional appetite for alternative assets with growth potential like XRP.

Market Fundamentals: Consolidation Amid High Interest

XRP maintains its position as the third-largest cryptocurrency with a market capitalization of $185.8 billion, demonstrating strong institutional validation.

The 1.89% market cap decline accompanies the 14.77% volume reduction to $6.71 billion.

The volume-to-market cap ratio of 3.6% indicates healthy trading activity relative to market size, suggesting continued institutional interest despite recent consolidation.

Circulating supply of 59.24 billion XRP represents 59.2% of the maximum supply of 100 billion tokens, with Ripple’s controlled release schedule supporting price stability.

Market dominance of 4.77% positions XRP as a major cryptocurrency with substantial institutional recognition.

The $313.7 billion fully diluted valuation reflects long-term growth expectations based on payment infrastructure adoption and regulatory clarity.

LunarCrush data reveals solid social performance with XRP’s AltRank at 136, indicating strong social engagement relative to price performance.

Galaxy Score of 47 reflects building sentiment momentum around regulatory developments and ETF speculation.

Engagement metrics show substantial activity with 11.7 million total engagements, 57.21K mentions, and 9.18K creators actively contributing to discussions.

Social dominance of 3.75% demonstrates XRP’s ability to maintain attention despite market consolidation.

Sentiment registers at a robust 81% positive, reflecting community optimism around SEC case resolution, ETF approvals, and institutional partnerships.

Recent social themes focus on government insider reports, banking partnerships, and $1,000 price predictions.

Three-Month XRP Price Forecast Scenarios

Regulatory Clarity Breakout (50% Probability)

SEC case resolution combined with ETF approval could drive explosive appreciation toward $5.00-$6.00, representing 60-90% upside from current levels.

This scenario requires sustained volume above 8 billion daily and a successful break above $3.20 EMA resistance.

Technical targets include $3.50, $4.00, and $5.00 based on historical resistance levels and institutional flow projections following regulatory clarity.

Extended Consolidation (30% Probability)

Delayed regulatory resolution could result in extended consolidation between $2.80-$3.30, allowing technical indicators to reset while institutional positioning continues.

This scenario provides accumulation opportunities without significant downside risk.

Support at the 200-day EMA around $2.57 would likely hold during consolidation, with volume normalizing around 5-6 billion daily.

This sideways action could extend 8-12 weeks pending major regulatory developments.

Correction on Delays (20% Probability)

Major regulatory setbacks or ETF rejections could trigger selling toward $2.40-$2.60 support levels, representing 20-25% downside from current levels.

This scenario would require unexpected legal complications or broader crypto market weakness.

Recovery would depend on institutional buying at lower levels and the eventual resolution of the regulatory framework through alternative pathways or timeline extensions.

XRP Price Forecast: Regulatory Clarity Meets Institutional Validation

XRP’s current positioning reflects a key regulatory juncture coinciding with unprecedented institutional interest and ETF momentum.

The consolidation below EMA resistance requires monitoring for directional confirmation as legal catalysts accelerate.

Next Price Target: $5.00-$6.00 Within 90 Days

The immediate trajectory requires a decisive breakout above $3.20 EMA resistance to validate continued institutional momentum over technical consolidation.

From there, regulatory clarity acceleration could propel XRP toward the $5.00 psychological milestone, with sustained institutional adoption driving toward $6.00+, representing new cycle highs.

However, failure to break $3.20 resistance would indicate extended consolidation into the $2.80-$3.00 range as the regulatory timeline extends, creating an optimal institutional accumulation opportunity before the next legal victory wave drives XRP toward $10+ targets, validating the global payment infrastructure thesis.

The post ChatGPT’s 28-Indicator XRP Analysis: 95% ETF Odds Ignite Battle Over $3.11 Support Line appeared first on Cryptonews.

TRUMP: "Powell must cut rates by 3 points."

TRUMP: "Powell must cut rates by 3 points."