Tom Lee, Chairman of Bitmine, has disclosed exclusive insights regarding Ethereum’s price direction, forecasting a temporary decline to the $4,075-$4,150 range before a subsequent rally toward new highs near $5,100.

Through an August 19 post on X, Lee shared a confidential screenshot featuring correspondence from Mark Newton, Fundstrat Global’s Global Head of Technical Strategy.

The email contained Elliott Wave technical analysis suggesting a constructive correction for Ethereum during this week, followed by a potential move above $5,000.

This revelation emerges as Ethereum holders face uncertainty about whether ETH has reached its peak and may decline below $4,000, or if the current movement represents a healthy pullback before another upward surge.

Institutional Accumulation Continues Despite Profit-Taking

The uncertainty is reflected in recent selling pressure from whales, ETFs, and retail investors, which has pushed Ethereum’s price down from a local peak of $4,793 to a low of $4,198, before experiencing a modest recovery to $4,278 at the time of writing.

The selling pressure intensified on August 18 as Ethereum-focused exchange-traded funds transitioned from positive to negative territory, experiencing outflows totaling $196.6 million, based on SoSoValue data.

Despite recent price weakness, current market statistics reveal that Ethereum exchange-traded funds still control approximately 6.5 million ETH in assets under management, representing roughly $27.5 billion at present prices.

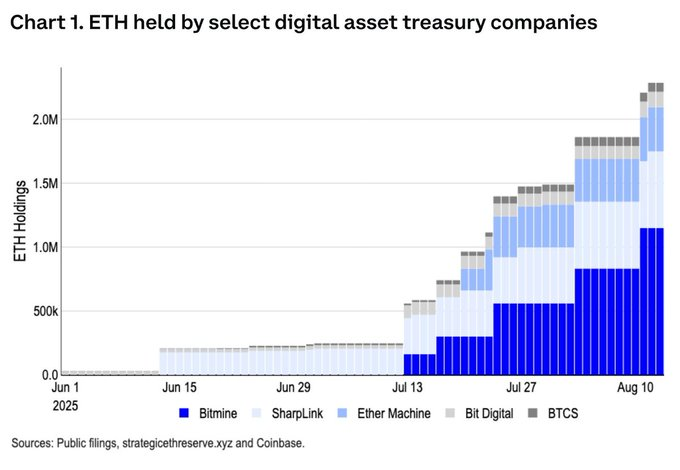

Corporate Digital Asset Treasuries (DATs), including companies like Bitmine and Sharplink Gaming, are similarly building their Ethereum positions.

These entities collectively hold an estimated 2.2% of ETH’s total supply, worth over $10.2 billion.

Bitmine’s Tom Lee is Bullish on Ethereum Rally to $5,100

Bitmine’s Tom Lee, who accurately predicted Ethereum’s $4,000 level when it was trading below $3,000, is now reinforcing his conviction that Ethereum’s rally is far from complete.

During a recent Bankless interview, Lee highlighted the ETH/BTC ratio of 0.05, which marked the previous cycle’s peak in 2021 and currently translates to approximately $6,000 at today’s Bitcoin valuation.

He emphasized that with more corporate treasuries entering the market and adoption increasing, Ethereum maintains significant growth potential.

In his assessment, “by year-end, it’s not unreasonable to consider $7,000—even $12,000 to $15,000” as possible targets.

Lee also referenced the ongoing Ethereum supply shock, noting that ETH holdings on centralized exchanges have reached their lowest level in nine years.

Historically, when ETH balances reached similar lows, the price surged from $30 to $1,500.

He anticipates a substantial rally for ETH, drawing comparisons to Wall Street’s boom period following 1971 when the USD departed from the gold standard.

The Fundstrat CIO believes Ethereum is positioned to capitalize on the White House’s GENIUS Stablecoin Act and the SEC’s crypto initiatives, potentially becoming one of the most significant macro trades over the next 10-15 years.

Technical analyst and Bitward Invest Co-founder Dariusz Kowalczyk aligns with Tom Lee’s perspective but emphasizes that the current week is crucial for ETH’s price trajectory and the broader crypto market.

In his short-term analysis, he notes that if Ethereum can recapture the $4,550–$4,571 zone, a new all-time high could be imminent. Currently, support levels are identified at $4,240–$4,190.

However, the broader context includes key events expected to unfold this week that could impact both crypto and macro markets.

These began with Monday’s Trump-Zelensky meeting in Washington, followed by Tuesday’s FOMC Minutes release, Thursday’s U.S. Initial Jobless Claims data, and Fed Chair Jerome Powell’s anticipated speech on Friday.

These developments are expected to generate significant market volatility.

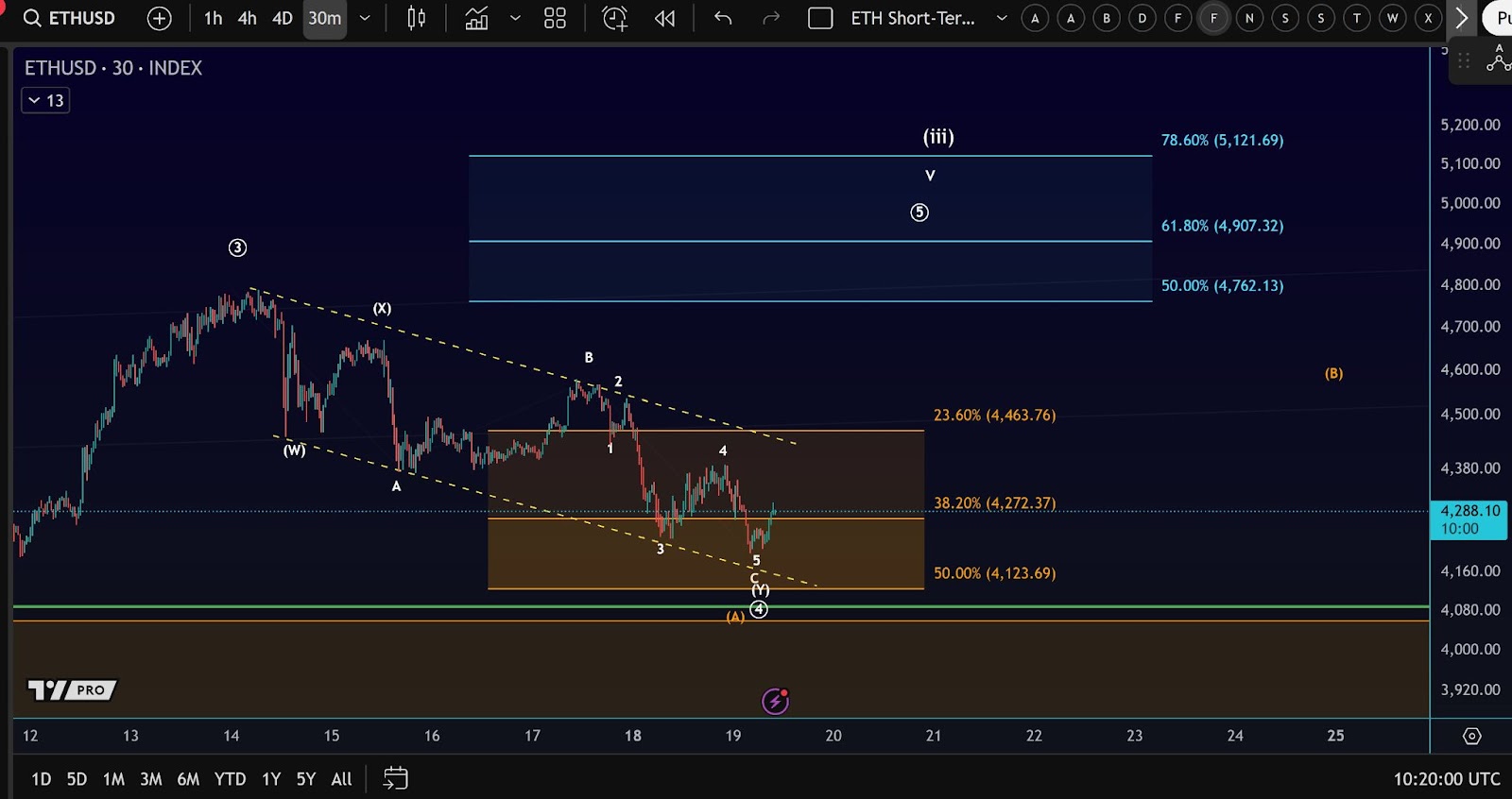

Technical Chart Analysis Supports ETH rally to $5,100

From a technical perspective, the ETHUSD 30-minute chart displays a completed corrective structure within a falling wedge pattern, where price action formed a W–X–Y corrective sequence, with the final movement concluding around 4,120–4,130.

The rejection from this area and subsequent upward movement suggest the correction has concluded and a new impulsive wave is developing.

Fibonacci extension levels between 4,760 and 5,120 indicate probable targets for the next bullish phase, with wave (iii) projected to advance higher from current levels.

In the near term, provided price maintains support above the 4,120–4,160 region, momentum favors continued upside movement, with initial resistance at approximately 4,460, followed by 4,760.

Should price clear these levels, the path toward 4,900 and 5,120 becomes increasingly likely, confirming strength in the broader bullish trend.

The post Bitmine’s Tom Lee Insider Insight Predicts Ethereum Dip to $4,075 Before Rally to $5,100 appeared first on Cryptonews.