Bitcoin is trading sideways near $88,700 on 31 December 2025, as fading momentum meets steady institutional demand. With spot Bitcoin ETF assets holding above $116 billion, traders are watching whether renewed inflows can break the current consolidation and define the first move of 2026.

Why Is Bitcoin Trading Sideways Near $88,700 Today?

Bitcoin is wrapping up 2025 in a bit of a holding pattern, hovering around $88,700 after a wild final quarter that just couldn’t seem to build on any momentum. BTC has stabilised around $1.77 trillion, and the 24 hour trading volume has ticked back up to about $33.9 billion, a sign that people are still participating, just with a bit more caution.

Looking at the price action over the past couple of weeks, you can tell that buyers are determined to hold onto the $87,900-$88,000 zone. On the other side, the momentum just isn’t there to push any higher than $90,000. As a result, the market is stuck in a pretty narrow range as the year comes to an end.

Can Spot Bitcoin ETF Inflows Restart BTC Momentum in 2026?

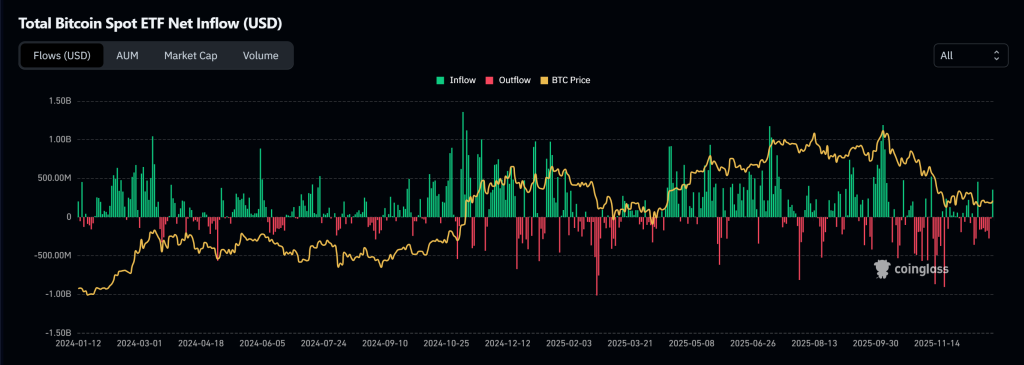

The spot Bitcoin ETFs continue to play a significant role in supporting the market. According to the data from CoinGlass, the total amount of new money flowing in is now at around 612,000 BTC, with total assets now sitting at a pretty impressive $116.5 billion.

Trading volume on December 31 was pretty flat, but $4.21 billion is no small amount – it suggests that institutions are still interested, even if they’re not quite as excited about it as they used to be.

This matters because ETF demand has shifted Bitcoin’s behavior. Instead of sharp drawdowns, pullbacks are increasingly met with absorption. Even during periods of muted inflows, BTC has struggled to break below medium-term support, reinforcing the idea that institutional capital is smoothing volatility.

Bitcoin Price Prediction: Technical Standpoint, it Looks Like a Wait-and-See Situation

Looking at the technical analysis, the Bitcoin price prediction appears neutral, as BTC is still stuck in a symmetrical triangle, with the highs and lows bouncing between $92,200 and $87,700. The 50-day and 100-day EMAs on the 2-hour chart are stuck right on top of each other, indicating that market participants are completely unsure about what’s going on. Meanwhile, the price keeps bouncing around the $88,000 pivot zone.

The momentum indicators also suggest that Bitcoin is in a consolidation phase rather than a full-on crash. At the same time, the RSI is hovering around 50, neither overbought nor oversold, which says that the market is in a state of equilibrium.

Lastly, the candlestick patterns, such as spinning tops and long wicks all over the place, mean that there is definitely two-way trade going on.

BTC Price Outlook: Breakout or Extended Consolidation Ahead?

If we break above $90,000, the next stop is probably around $92,200, then $94,000. But if we can’t hold $87,700, the next stop could be $86,700 – although it’s worth noting that the ETFs are absorbing some of that downward pressure.

In this kind of environment, it’s hard to see Bitcoin as anything other than a market quietly building up a bit of tension.

As we head into 2026, the fact that people are still buying up ETFs, the reduced supply of coins on the market, and the liquidity suggest that this consolidation phase is probably a prelude to something more, rather than the end of the road.

PEPENODE: A Mine-to-Earn Meme Coin Nearing Presale Close

PEPENODE is gaining momentum as a next-generation meme coin that blends viral culture with interactive gameplay. With over $2.48 mn raised and the presale approaching its cap, interest is building fast as the countdown enters its final stretch.

What makes PEPENODE stand out is its mine-to-earn virtual ecosystem. Instead of passive holding, users can build digital server rooms using Miner Nodes and facilities, earning simulated rewards through a visual dashboard. The concept brings gamification and competition into the meme coin space, giving holders something to do before launch.

The project also offers presale staking, allowing early participants to earn boosted rewards ahead of the token generation event. Leaderboards and bonus incentives are planned post-launch to keep engagement high.

With 1 $PEPENODE priced at $0.0012161 and limited allocation remaining, the presale is entering its final opportunity window for early buyers.

Click Here to Participate in the Presale

The post Bitcoin Price Prediction: BTC Price Trading Sideways on 31 December 2025, Could ETF Inflows Reverse the Trend? appeared first on Cryptonews.