Key Takeaways:

- Bitcoin continues to face pressure after losing the $100,000 support, with sentiment split between bearish signals and expectations of a rebound.

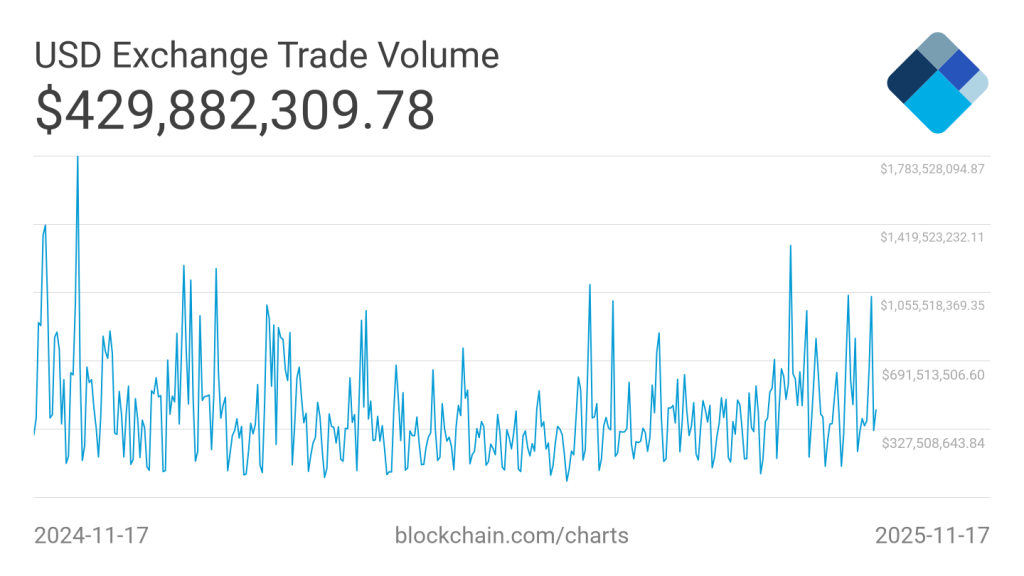

- Liquidity has dropped sharply since Oct.10, with trading volumes falling from $1.3 billion to around $430 million.

- Traders suspect that a major market participant may be quietly reducing exposure, creating persistent selling pressure without a clear catalyst.

- Analysts note that long-term holders might be shifting assets to institutional investors, adding to uncertainty around recent flows.

- A death cross on the chart and key macroeconomic data this week could determine whether Bitcoin stabilizes or moves lower.

Bitcoin (BTC) is moving lower, liquidity is dropping, and the consequences of Oct. 10 are still weighing on the market. Sentiment is divided, confidence is fading, and the coming days may be important for determining the next direction of the price.

Market sentiment among investors and traders has split into two camps. Some have turned pessimistic and exited their positions, while others argue that indicators still point to a bullish outlook. The levels around $92,000 have not been tested, but one thing is clear: the $100,000 support is no longer holding.

Cryptonews previously reported that Bitcoin price could move toward the $92,000 area. This is where the so-called CME gap is located, also known as a zone of seller inefficiency. Historically, Bitcoin often attempts to fill such gaps. The price dropped to $93,000 on Sunday, Nov. 16, after which buyers stepped in again and the price slightly recovered.

The Impact of Crypto Crash Continues: Bitcoin Liquidity Is Declining

According to Blockchain, Bitcoin trading volume on major exchanges has fallen below $1 billion and now sits around $430 million. For comparison, this figure was $1.3 billion on Oct. 11.

It is difficult to say whether this reflects a loss of interest from large players or an attempt to reduce losses. Some market participants see it as a strategic move intended to flush out weak hands.

After the events of Oct. 10, a growing number of traders noted that the market felt different, as if something much more serious had happened behind the scenes.

Unipics, a well-known crypto trader, believes that one large player may have faced critical issues and is now quietly reducing exposure without drawing attention. This could explain the selling pressure and declining trading volume:

This time around there is so much opacity around 10/10 that almost everyone knows someone major got hit big time. We just do not know who or by how much. And that makes assessing the extent of the pain a lot harder, since we are otherwise shooting in the dark.

This helps explain the prolonged selling pressure. There have been no public announcements of issues at funds, market makers, or exchanges. The possibility of an invisible liquidation keeps the situation unclear. The market senses stress but cannot identify its source or scale.

With Bitcoin liquidity dropping from $1.3 billion to roughly $430 million after Oct. 10, some analysts believe the market is not experiencing a loss of interest but rather a redistribution of capital.

Ki Young Ju, founder and CEO of CryptoQuant, suggests that long-term large holders are reducing their exposure and transferring assets to institutional investors with longer time horizons.

This kind of silent exit, combined with the lack of transparency around Oct. 10, reinforces the sense of pressure without a visible catalyst. The market sees selling and lower volumes, but the true driver remains unclear. As a result, it is difficult to assess the scale of what is happening, since the price drop may reflect a shift in ownership rather than broad capitulation.

Critical Week for Bitcoin

Benjamin Cowen, CEO of Into The Cryptoverse, notes that Bitcoin price has formed a bearish moving average pattern known as a death cross. This signal often appears after extended declines and sometimes coincides with a moment when sellers start losing momentum. If the market remains within a broader uptrend, a recovery should appear within a week. If the price does not bounce and continues to move lower, another drop may follow:

If no bounce occurs within one week, probably another dump before a larger rally back to the 200D SMA which would then mark a macro lower high.

Historical data shows that a death cross is not always a sign of a long bearish trend. More often, it appeared after a noticeable correction and coincided with markets moving closer to a local reversal. Still, it is not a guaranteed bullish signal either.

In cycles where the market did enter a bearish phase, the initial rebound tended to be weaker, forming only a temporary recovery before another decline.

This week also includes important macroeconomic releases. On Nov. 19, the market will see the FOMC minutes, followed by PMI data for November, including manufacturing and services on Nov. 1. These reports could influence sentiment and increase volatility.

Meanwhile, institutional headlines continue to emerge. Harvard University disclosed in its recent report that it significantly increased its Bitcoin exposure through BlackRock’s ETF. The position is now valued at roughly $442 million.

The combination of undisclosed selling, declining volumes, and mixed macro signals leaves the market without a clear direction. Bitcoin’s next move will likely depend on how traders interpret this week’s data and whether liquidity begins to recover.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

The post Bitcoin Price Falls as Analysts Point to Hidden Losses by a Big Player appeared first on Cryptonews.