Bitcoin slid toward the $88,000 price on Monday as Strategy Inc. disclosed another large purchase of the cryptocurrency, showing the contrast between short-term market weakness and continued institutional accumulation.

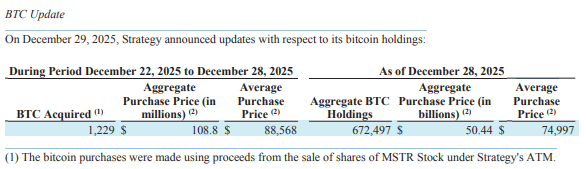

According to a December 29 filing with the U.S. Securities and Exchange Commission, Strategy acquired 1,229 bitcoin over the week ending December 28, spending about $108.8 million at an average price of $88,568 per coin, including fees and related costs.

The purchase was funded entirely through proceeds from the company’s ongoing at-the-market offering of its Class A common stock.

During the same period, Strategy sold roughly 663,450 shares of MSTR stock, generating net proceeds equal to the amount deployed into bitcoin. The company did not issue any preferred shares during the week.

Strategy Grows Bitcoin Stack to 672,000 BTC Despite Market Dip

Michael Saylor, Strategy’s executive chairman and a longtime bitcoin advocate, confirmed the transaction in a post on X, stating that the firm has achieved a bitcoin yield of 23.2% year-to-date in 2025.

As of December 28, Strategy holds 672,497 BTC acquired for approximately $50.44 billion, with an average purchase price of $74,997 per bitcoin.

The filing reiterated that the company uses a public dashboard on its website to disclose bitcoin-related metrics as part of its Regulation FD compliance.

The latest purchase comes as bitcoin trades lower after failing to hold recent highs. The largest cryptocurrency reached an intraday peak near $89,894 earlier in the day before slipping to around $87,234, down about 0.5% over the past 24 hours and roughly 3.1% over the last seven days.

Since the start of the month, Bitcoin has moved within a wide range, topping out near $93,000 and dipping to lows just above $84,000.

Trading activity has picked up sharply, with 24-hour volume rising more than 185% to about $44.6 billion, signaling heightened market participation amid the pullback.

Bitcoin remains about 30% below its all-time high of $126,080 recorded in October.

Strategy’s Bitcoin Hoard Gains 16% as Stock Trades Near Parity

Strategy’s growing bitcoin treasury now stands among the largest in the market. Based on current prices, the company’s holdings are valued at roughly $58.65 billion, leaving them up about 16% relative to the firm’s average acquisition cost.

Strategy, which trades on Nasdaq under the ticker MSTR, has a basic market capitalization of around $46 billion and a fully diluted market cap near $51 billion, with enterprise value estimated at $59 billion.

Its market net asset value metrics show the stock trading below the value of its underlying bitcoin on a basic and diluted basis, while trading close to parity on an enterprise value basis. Shares of MSTR were last seen at $158.81, unchanged on the day.

The disclosure follows a series of large purchases by the company earlier this month. On December 15, Strategy reported acquiring 10,645 BTC for $980.3 million at an average price of $92,098 per coin, bringing its total holdings at the time to 671,268 BTC.

A week later, the company revealed it had raised $747.8 million through stock sales under its ATM program, boosting its U.S. dollar reserves to $2.19 billion.

Strategy said those reserves are intended to cover at least 12 months of dividend payments and interest expenses, with a longer-term goal of covering 24 months or more.

While Strategy continues to add to its bitcoin position, Bitcoin is on track to close 2025 in the red unless it rallies more than 6% above its yearly open, which would mark the first post-halving year to end lower.

The post Bitcoin Falls to $88K Strategy Pours Another $108M Adding 1,229 BTC appeared first on Cryptonews.