Cross-chain activity is no longer a niche behavior in crypto. It has become a core part of how capital moves across the market. As of January 2026, total bridge volume reached $14.9 billion over the past month alone.

Throughout 2025, cross-chain transaction volumes pushed to record levels, peaking at $56.1 billion in monthly volume in July. Much of this activity was driven by large-value transfers, with the average cross-chain transaction size climbing to $3,489 by late 2024.

Ethereum remains the dominant hub in this flow of capital, posting $10.1 billion in net inflows year-to-date through mid-2025. At the same time, newer ecosystems like Base recorded around $5 billion in net outflows, highlighting how liquidity is constantly shifting between networks.

This ongoing movement has exposed a structural issue: while capital moves freely in theory, execution across chains remains fragmented, slow, and operationally complex. That backdrop helps explain why infrastructure-focused projects like LiquidChain (LIQUID) are becoming popular by prioritizing execution.

Where LiquidChain Fits Into the Cross-Chain Growth Narrative

Rising cross-chain volumes signal demand, but they also reveal inefficiencies. Most of today’s activity still depends on bridges, wrapped assets, and chain-specific tooling. These solutions work, but they add friction, increase risk, and fragment liquidity across multiple venues.

LiquidChain says it positions itself as a Layer-3 execution and liquidity layer designed specifically for this environment. Instead of competing with existing blockchains, it sits above them, coordinating how liquidity is accessed and executed across Bitcoin, Ethereum, and Solana. The goal is not to encourage more bridging, but to reduce the need for it altogether by treating liquidity as a unified system.

As cross-chain transfers grow larger and more frequent, execution quality becomes more important than raw throughput. LiquidChain’s focus on settlement, verification, and coordination reflects that shift. Rather than chasing short-term narratives, it aligns itself with the underlying trend of capital moving across ecosystems at scale.

Presale Structure, Staking, and Tokenomics Context

LiquidChain’s crypto presale is unfolding against this backdrop of rising cross-chain demand. Despite broader bearish conditions, the presale has raised nearly $500,000, supported by a structured pricing model where entry levels increase on a predefined schedule, the team says. This rewards early involvement without relying on unrealistic expectations.

Staking adds another layer to the presale dynamic. Rewards are allocated from a defined pool rather than unlimited issuance, which helps avoid excessive dilution. This frames staking as a participation mechanism tied to ecosystem growth instead of a short-term yield tactic.

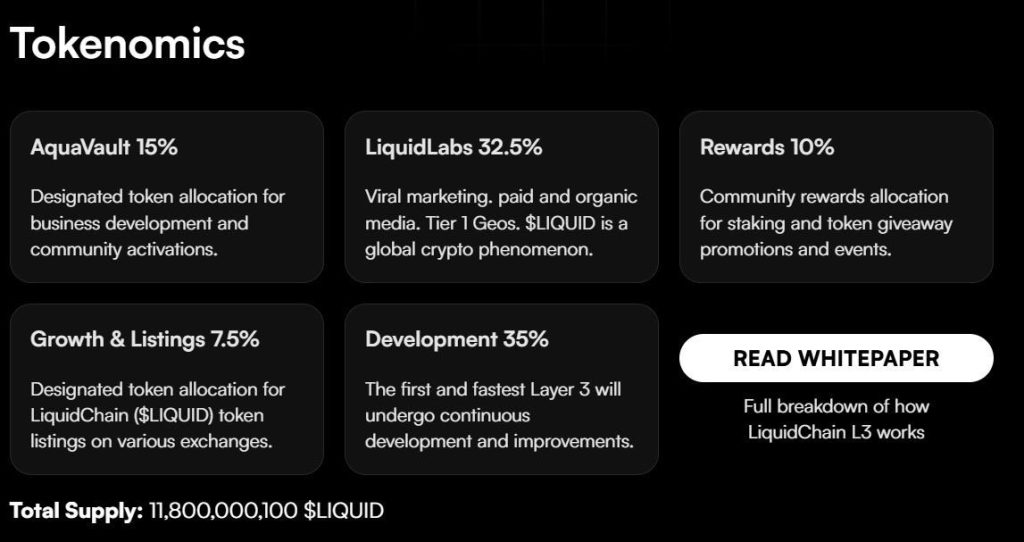

The total supply is set at 11,800,000,100 LIQUID, with allocations distributed to support long-term development, ecosystem expansion, and community incentives.

Development receives the largest share, reflecting the technical scope of building a Layer-3 settlement layer. Additional allocations support marketing, business development, staking rewards, and exchange access, creating a balanced structure rather than a front-loaded distribution.

Why Execution Matters More as Cross-Chain Volume Grows

As cross-chain activity continues to rise, the cost of inefficiency grows with it. Large transfers magnify delays, fees, and operational risks. In this environment, infrastructure that simplifies execution can become more valuable than new destinations for liquidity.

LiquidChain’s approach focuses on reducing friction at the settlement layer. By enabling secure, trust-minimized interaction between Bitcoin UTXOs, Ethereum accounts, and Solana state, it aims to make cross-chain liquidity behave more like a single market instead of a patchwork of bridges.

Wrap-Up: Infrastructure for a Multi-Chain Market

Overall, the pump in cross-chain activity shows that crypto is already multi-chain in practice. What remains underdeveloped is the infrastructure that makes this reality efficient and reliable. LiquidChain says it combines a structured crypto presale with a Layer-3 execution model built around that exact challenge.

By prioritizing coordination, settlement, and liquidity unification over hype-driven narratives, LiquidChain positions itself as infrastructure for where the market is already heading. As cross-chain volumes continue to grow, so do solutions that focus on execution.

Explore LiquidChain:

Website: https://liquidchain.com/

Social: https://x.com/getliquidchain

Whitepaper: https://liquidchain.com/whitepaper