Solana (SOL) is trading around $97 after a sharp sell-off that pushed the token below the key $100 mark. The recent decline comes after a tough stretch for the crypto market overall, but Solana has dropped more than most due to new security concerns affecting investor confidence.

SOL has dropped from the $140–$145 range in just a few weeks, wiping out much of its recovery from late 2025. For newer investors, this kind of decline usually comes from fear, forced selling, and uncertainty, not a sudden failure in the technology itself.

Step Finance Hack Exposes $30M SOL Vulnerability, Raises Security Concerns in Solana DeFi

A major reason for the recent drop was a security breach at Step Finance, where about $30 million in SOL was taken from treasury wallets. Around 261,854 SOL was moved quickly, leading to worries that someone with internal access, not just an automated hack, was involved.

Step Finance has said that user funds were safe, but the incident still shook the Solana DeFi community. Big treasury wallets are increasingly becoming targets, and this event shows why stronger protections, such as multi-signature approvals and stricter access controls, are needed.

For the market, the news itself was more important than the details. When stress is high, security scares often speed up selling as traders rush to cut their risk.

Jupiter’s New Explorer Offers a Long-Term Positive

There are also some positive updates. Jupiter has launched explore.ag, a new tool for the Solana ecosystem that brings together data from Solscan and DeFiLlama in one place. This tool helps users track projects, transactions, and DeFi stats more easily, making the network more transparent.

For newcomers, this might not change prices right away, but it shows that Solana’s ecosystem is still growing. Improved data and analytics often bring in developers and long-term investors, even when the market is down.

Solana Technical Analysis: Can SOL Reclaim $100?

Looking at the charts, Solana price prediction is clearly in a short-term downtrend. The price is still moving within a downward channel that started in late 2025. When the price fell below the 100-day and 200-day EMAs near $140, it quickly dropped through $119 and $111, which points to forced selling instead of regular profit-taking.

Key levels to watch now:

- Resistance: $105–$111, where previous support has turned into a selling zone

- Support: $90–$81, aligned with prior demand and Fibonacci extensions

- Deeper risk: A move toward $70 if broader market weakness intensifies

The RSI is now in the mid-20s, which means the market is oversold. This can sometimes cause a short-term bounce, but it does not promise a quick turnaround.

For a more positive outlook, SOL needs to hold above $100, set a higher low, and close above $111 on the daily chart. This could lead to a recovery toward $120–$130 later on.

For now, Solana seems to be in a tough but common reset phase, which often comes before stronger and more lasting gains once the selling slows down.

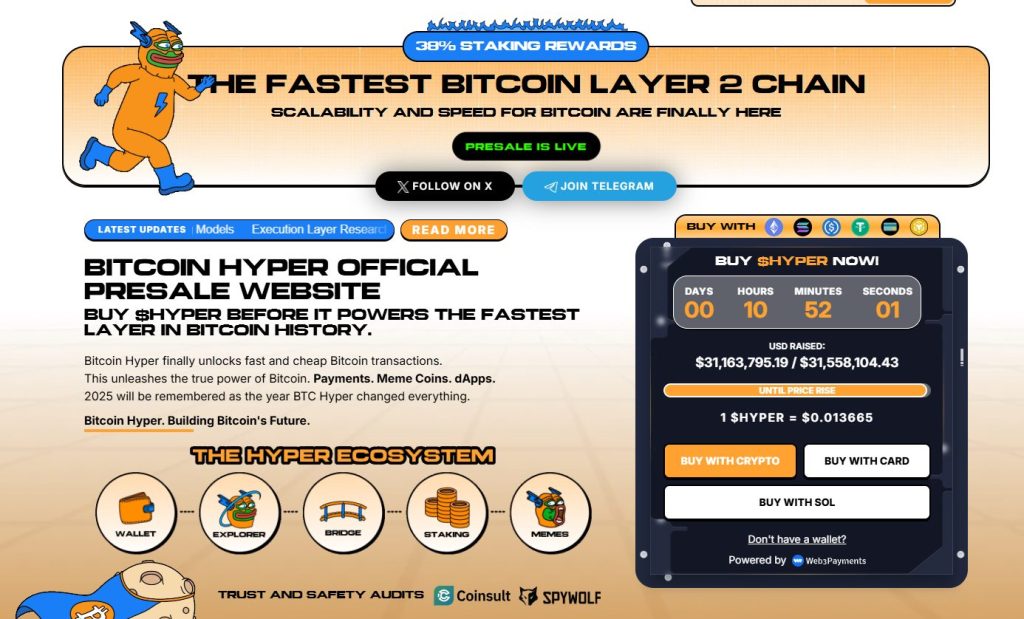

Bitcoin Hyper: The Next Evolution of BTC on Solana?

Bitcoin Hyper ($HYPER) is bringing a new phase to the BTC ecosystem. While BTC remains the gold standard for security, Bitcoin Hyper adds what it always lacked: Solana-level speed. The result: lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation, all secured by Bitcoin.

Audited by Consult, the project emphasizes trust and scalability as adoption builds. And momentum is already strong. The presale has surpassed $31.4 million, with tokens priced at just $0.013665 before the next increase.

As Bitcoin activity climbs and demand for efficient BTC-based apps rises, Bitcoin Hyper stands out as the bridge uniting two of crypto’s biggest ecosystems. If Bitcoin built the foundation, Bitcoin Hyper could make it fast, flexible, and fun again.

Click Here to Participate in the Presale