Bitcoin is trading around $89,000 this morning as crypto markets brace for the Federal Reserve’s policy announcement at 2:00 PM ET.

The FOMC meeting is expected to keep rates steady in the 3.5%-3.75% range with 97% market consensus, but Fed Chair Jerome Powell’s 2:30 PM press conference could trigger sharp volatility across digital assets.

XRP trades near $1.89 while Solana sits around $127, both consolidating after weekend weakness that erased over $100 billion from crypto markets in hours.

Beyond current price action, historical patterns suggest traders should approach today’s decision with caution. Bitcoin has declined in seven of the last eight FOMC meetings, averaging 9% drops following Fed announcements in 2025.

Critical support levels include the 100-week moving average at $87,145 and the ETF buyer cost basis near $84,099, which has held during recent consolidation.

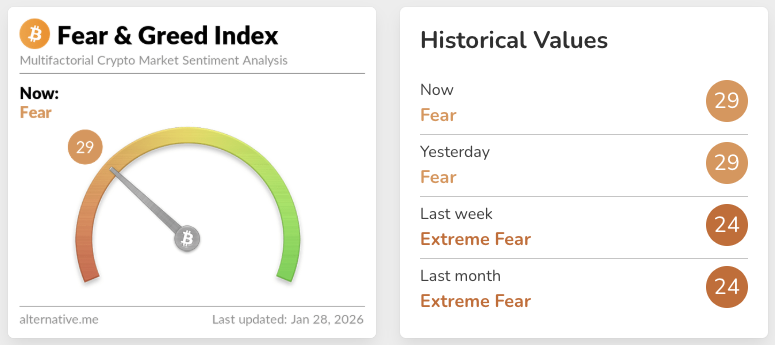

Adding to these technical concerns, spot Bitcoin ETFs shed $1.33 billion over the past week while Ethereum ETFs lost $611 million, reflecting weak institutional appetite. The Crypto Fear & Greed Index has also plunged to “extreme fear” territory earlier this week as markets position defensively.

Compounding the monetary policy uncertainty, macro crosscurrents are creating additional volatility triggers. The dollar hit a four-year low after Trump’s remarks dismissing currency weakness, briefly lifting Bitcoin above $89,000 before fading.

Gold surged past $5,200 as safe-haven flows intensified, with 76% Polymarket odds of a government shutdown by month-end adding political risk.

Trump’s expected Fed chair successor announcement this week and persistent tariff threats create additional wildcards that could overshadow Powell’s prepared remarks.

Given all the dynamics, analysts see Bitcoin trapped between the low $80,000s and mid-$90,000s until regulatory clarity improves, with Powell’s tone on inflation and rate path mattering more than today’s decision itself.

Whether the Fed chair delivers dovish reassurance or maintains hawkish vigilance could determine if crypto reclaims momentum or tests deeper support through February.

Live Updates: Bitcoin’s Reaction to Powell’s Press Conference