The crypto market is mostly flat today, with the global market cap slipping slightly by 0.1% to $3.99 trillion. 24-hour trading volume remains steady at $163.7 billion. Most top cryptocurrencies are showing mild 24-hour moves, with several still in the red over the past week.

Key Takeaways:

- 8 of the top 10 cryptos are down over the week; BTC trades at $113K, ETH at $4,180;

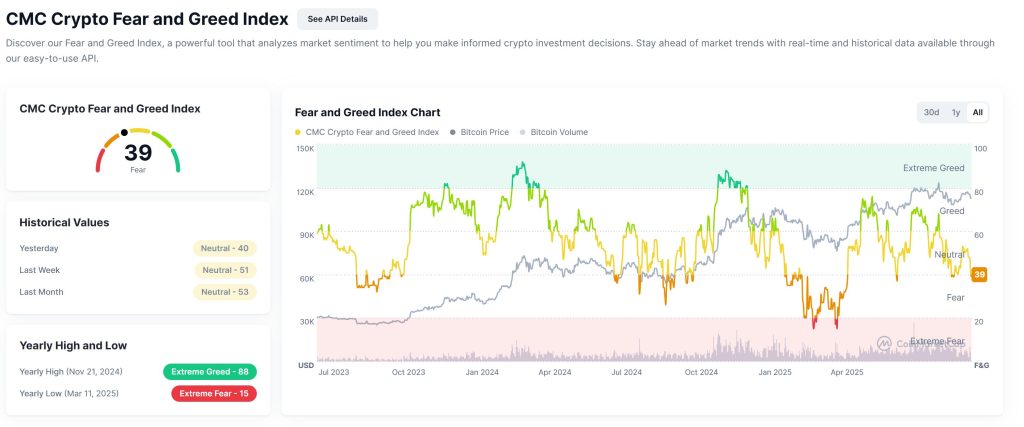

- Fear & Greed Index drops to 39, signaling rising caution;

- River says companies now hold more BTC than ETFs, helping offset whale sell-offs;

- CFTC pushes tokenized stablecoin collateral into derivatives markets, calling it a “killer app”;

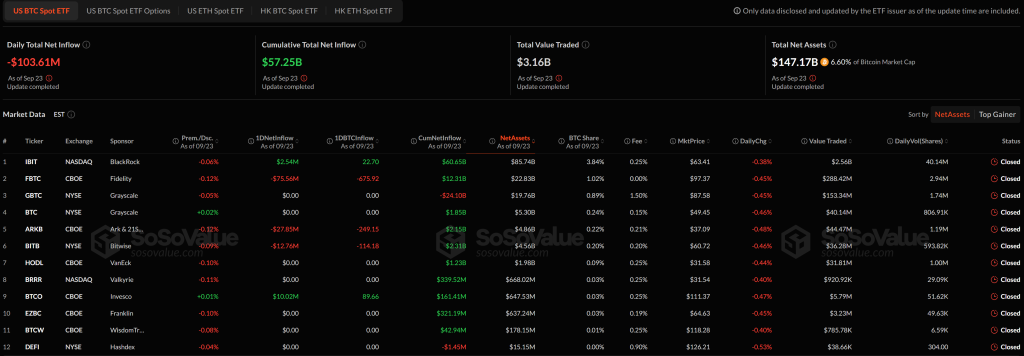

- US BTC spot ETFs lost $103.61M on Sep 23, led by a $75.56M outflow from Fidelity’s FBTC;

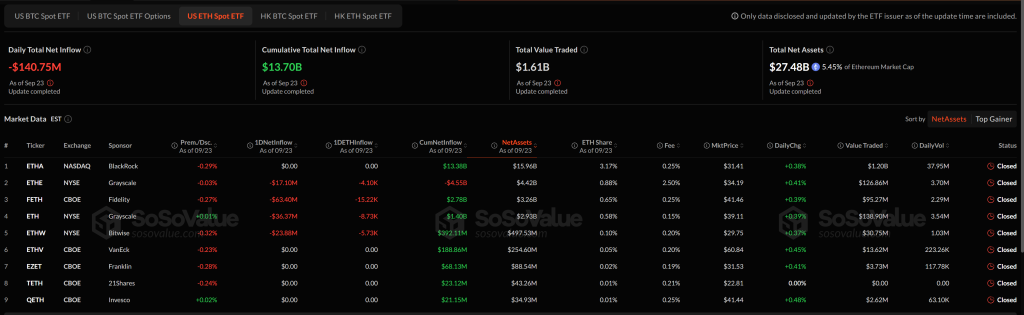

- US ETH spot ETFs saw $140.75M in outflows, with FETH shedding $63.40M;

- Altcoin gainers include Quanto (+52.4%), Slash Vision Labs (+52.4%), Aster (+24.8%).

Crypto Winners & Losers

At the time of writing, 8 of the top 10 cryptocurrencies by market cap are in negative territory over the past 7 days.

Bitcoin (BTC) is trading at $112,975, showing no 24-hour change, but down 2.8% on the week.

Ethereum (ETH) sits at $4,177.52, down 0.3% in 24h and 7% over 7 days.

Solana (SOL) continues to slide, dropping 2.9% to $212.74 today and 9.2% on the week.

Dogecoin (DOGE) leads the 7-day losses, down 8.5%, now trading at $0.2429.

Lido Staked Ether (STETH) and Wrapped Beacon ETH also show weekly drops of 7% each.

The only major coins in green over the week are:

BNB (BNB), up 6.6% over 7 days despite a slight dip today.

XRP (XRP), up 4.2% on the week and 0.8% in the last 24 hours.

A handful of altcoins are making waves today despite a largely stagnant market. Among the most trending tokens, Aster is up 24.8%, followed closely by SafePal with a 24.3% gain. Gaming-focused Undeads Games also saw a notable uptick of 5.8%, reflecting renewed interest in niche Web3 sectors.

In the top gainers category, Quanto and Slash Vision Labs both surged 52.4%, leading the pack with impressive one-day rallies. Fluid wasn’t far behind, jumping 47.8% in 24 hours. These sharp moves highlight ongoing volatility in the altcoin space, even as major assets remain range-bound.

Meanwhile, crypto firm River says companies now hold more Bitcoin than ETFs, with both continuing to accumulate. This corporate and ETF buying is helping offset whale sell-offs, creating a structural floor for BTC prices.

CFTC’s Tokenized Collateral Push Could Redefine DeFi Infrastructure

The CFTC’s move to allow tokenized assets, like stablecoins and tokenized treasuries, as collateral in derivatives markets is being seen as a breakthrough for digital finance, according to RedStone Co-Founder Marcin Kazmierczak.

Calling it a “watershed moment,” Kazmierczak said the shift marks tokenization’s transition from concept to real-world use. But he emphasized that real-time, trusted pricing infrastructure is essential: “Even a one-second delay or error in a price feed can destabilize a protocol.”

The bigger challenge, he added, is scale. With institutional players stepping in, systems must support thousands of chains and hundreds of thousands of assets while matching traditional finance’s standards for precision and risk.

“The CFTC leaning into tokenization is the right direction,” Kazmierczak said. “The next step is building a global-ready data backbone that’s transparent and bulletproof.” Traders and analysts alike are now watching whether market infrastructure can keep pace with regulatory green lights.

Levels & Events to Watch Next

As of Tuesday afternoon, Bitcoin (BTC) is trading at $113,063, up 0.93% on the day. The asset has bounced slightly after testing support near $112,000, but remains below key resistance around $115,000. Price action suggests ongoing consolidation, with no strong breakout yet.

Traders are eyeing the $114,000–$116,000 range as a key resistance zone. A clean move above could pave the way toward $117,500, with $120,000 as the next upside target. On the downside, if BTC drops below $111,000, the next supports to watch are $108,000 and $105,000.

Meanwhile, Ethereum (ETH) is trading at $4,180, up 0.38% in the past 24 hours. The price remains range-bound after a sharp drop from the $4,700–$4,800 zone earlier this month. Despite the mild rebound, momentum is limited.

Immediate resistance is seen at $4,300, with stronger levels at $4,500–$4,600. If ETH loses the $4,150–$4,100 range, downside targets include $3,950 and potentially $3,800. Volume has declined, suggesting traders are waiting for a clearer breakout or macro catalyst.

With regulatory developments in the US and Asia expected this week, markets may remain volatile in the short term.

Meanwhile, market sentiment has shifted slightly into the negative zone. The CMC Crypto Fear and Greed Index is now at 39, down from 40 yesterday and 51 last week, marking a move from neutral into fear territory.

This dip reflects growing trader caution as prices consolidate and macro uncertainty lingers. While not signaling panic, the move suggests sentiment is weakening, with fewer participants willing to take aggressive positions until stronger bullish signals emerge.

The US Bitcoin spot ETFs saw a net outflow of $103.61 million on September 23, pulling back from recent gains and highlighting cautious sentiment. Despite the dip, the cumulative net inflow across all ETFs still stands at a healthy $57.25 billion, with total assets under management at $147.17 billion, representing 6.60% of Bitcoin’s market cap.

Fidelity’s FBTC recorded the largest outflow of the day, losing $75.56 million and offloading 675.92 BTC. ARKB followed with a $27.85 million outflow. On the flip side, Invesco’s BTCO posted the only major inflow, adding $10.02 million and acquiring 89.66 BTC.

BlackRock’s IBIT saw a modest inflow of $2.54 million. Trading volumes were led by IBIT at $2.56 billion, while FBTC and GBTC trailed behind with lower daily activity.

The US Ethereum spot ETFs saw significant net outflows of $140.75 million on September 23, signaling a pullback in investor sentiment. Despite the drop, cumulative net inflows across all ETH funds remain at $13.70 billion, with total assets under management standing at $27.48 billion, or 5.45% of Ethereum’s market cap.

Fidelity’s FETH led the outflows, shedding $63.40 million and offloading 15.22K ETH. Grayscale’s ETFs also saw major exits, with $36.37 million leaving its ETH fund and $17.10 million from ETHE. Bitwise’s ETHW followed with a $23.88 million outflow. Only ETHA (BlackRock) ended the day in green, though with no new inflows.

Notably, the US CFTC has launched a new initiative allowing stablecoins to be used as tokenized collateral in derivatives markets, aiming to modernize financial infrastructure and cut costs. Acting chair Caroline Pham called it the “killer app” for markets, emphasizing the shift toward non-cash collateral and the growing role of tokenized assets.

The post Why Is Crypto Down Today? – September 24, 2025 appeared first on Cryptonews.