The crypto market is down today after a brief jump. The cryptocurrency market capitalisation decreased by 2.2% over the past 24 hours, pulling back to $3.11 trillion. At the time of writing, 70 of the top 100 coins have seen their prices drop. The total crypto trading volume stands at $110 billion.

TLDR:

Crypto Winners & Losers

As of Friday morning (UTC), 8 of the top 10 coins per market capitalisation have seen their price drop over the past 24 hours.

Bitcoin (BTC) fell by 0.4%, currently trading at $89,477. This is the smallest drop on the list,

Ethereum (ETH) decreased by 2%, changing hands at $2,945. This is the second-highest drop in the category.

The highest fall among the top 10 is XRP’s 2.2%, now standing at $1.91.

On the other hand, two coins are currently green. Tron (TRX) appreciated by 3.3% to the price of $0.309.

Binance Coin (BNB) is technically also green, but its increase is so low that the price is practically unchanged. It’s up 0.1% to $890.

At the same time, of the top 100 coins per market cap, 70 have seen their price drop today.

Pump.fun (PUMP) fell the most among these: 6.4% to $0.002481.

It’s followed by Provenance Blockchain (HASH) with a 4.2% drop to $0.0242.

On the green side, Rain (RAIN) appreciated the most: 8.4% to $0.00997.

River (RIVER) is next, with a rise of 7.4% to $49.83.

Meanwhile, in the US, SEC Chairman Paul Atkins and CFTC Chairman Michael Selig will hold a joint event on 27 January to discuss ending regulatory chaos, as well as efforts to make the United States the global crypto capital.

“For too long, market participants have been forced to navigate regulatory boundaries that are unclear in application and misaligned in design, based solely on legacy jurisdictional silos,” the chairmen said in their statement.

How Will Ukraine-Russia Talks Influence Markets

According to Bitunix analysts, the recent developments around the Russia-Ukraine war may be beneficial for the markets, but possibly only in the short term. The US will facilitate talks between Ukraine and Russia in Abu Dhabi today.

At the macro level, analysts say, “this initiative may help ease markets’ tail-risk fears of a full-scale escalation in the near term, but it does not imply a rapid end to the conflict.” A limited ceasefire could be more realistic.

Moreover, geopolitical risk premia could ease in the short term, supporting risk assets and dampening volatility in energy prices, they add.

Yet, the symbolism of these talks may outweigh any immediate breakthroughs. Over the medium term, “markets will need to see tangible room for Russian concessions; absent that, sentiment is likely to swing back and forth.”

For crypto markets, “a scenario in which geopolitical uncertainty merely ‘cools but does not thaw’ would leave Bitcoin oscillating between its safe-haven narrative and its role as a high-beta risk asset,” they conclude.

BTC is No Longer in State of Euphoria

Linh Tran, Senior Market Analyst at XS.com, commented that Bitcoin’s short-term outlook is centred on interest rates, liquidity, and institutional capital flows.

“After the sharp volatility seen toward the end of 2025, BTC is no longer trading in a state of euphoria, but instead reflects the cautious sentiment of global investors amid persistently high rates and financial conditions that have yet to meaningfully ease,” Tran writes.

One of the most important factors influencing BTC is the level of U.S. Treasury yields. “BTC struggles to attract sustained new inflows unless markets begin to believe that the monetary policy cycle is approaching a turning point.”

Meanwhile, the US Federal Reserve will likely hold a cautious stance at the late-January meeting. Therefore, “only sufficiently strong economic data capable of shifting expectations around the rate path are likely to generate meaningful volatility in BTC; otherwise, the market is likely to remain locked in a tug-of-war,” the analysts argue.

Still, the most decisive factor for BTC’s near-term outlook are institutional flows, they conclude. “Bitcoin only establishes a durable uptrend when ETF flows remain consistently positive, rather than through sporadic inflows that are quickly reversed.”

Moreover, the dip-buying demand has not been strong enough to push prices through key resistance levels. Therefore, “without the support of fresh inflows, each rebound risks turning into a profit-taking opportunity, leaving the short-term trend choppy and lacking clear direction.”

“From my perspective,” Tan writes, “the most plausible near-term scenario is for Bitcoin to continue consolidating in a cautious manner, with downside risks persisting if ETF outflows continue. For a more constructive scenario to emerge, the market would need to see improvement on two fronts simultaneously: easing financial conditions and a steady return of institutional net buying.”

Conversely, Tan says, “if yields rebound or global markets shift decisively into a defensive, risk-off stance, Bitcoin is likely to face renewed downside pressure in the short term, given its high sensitivity to changes in risk appetite.”

Levels & Events to Watch Next

At the time of writing on Friday morning, BTC was changing hands at $89,477. It was quite a choppy trading day for the coin. The coin initially and briefly climbed to the intraday high of $90,159 and then dropped to the day’s low of $88,557. It continued trading in this range.

Over the past 7 days, BTC decreased by nearly 7%, trading in the $87,653–$95,649 range.

We now found the support at $89,300, followed by the $87,400 level. The latter previously acted as demand. On the other hand, the resistance levels stand at $91,800 and $94,200.

At the same time, Ethereum was trading at $2,945. It saw a similarly choppy trading day. Earlier in the day, it fell from $3,012 to the intraday low of $2,909. For most of the day, it traded in the $2,944-$2,953 range.

Moreover, ETH fell 11.3% over the past seven days, moving between $2,898 and $3,361.

Should the downward push continue, the price may fall further below $2,900, followed by $2,830 and $2,745. If the tide turns, ETH may reclaim the $3,000 level, and if it manages to hold it firmly, the move could open doors for additional notable increases.

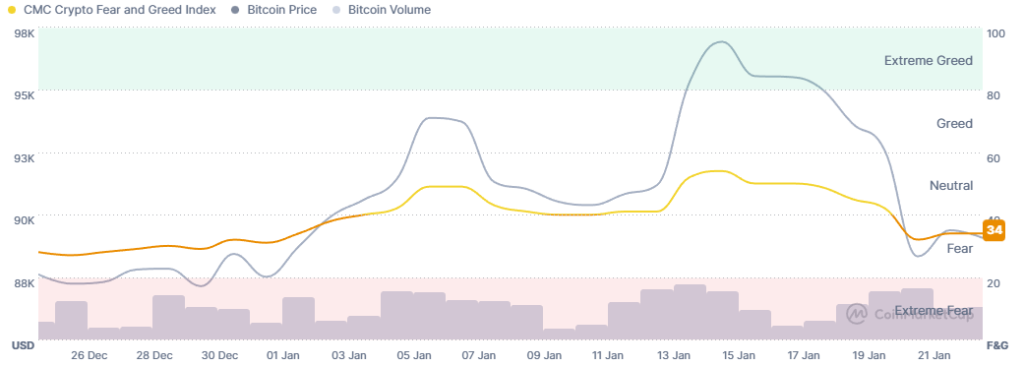

Meanwhile, the crypto market sentiment remained unchanged over the past day, firmly maintaining its position within the fear zone.

The crypto fear and greed index currently stands at 34 today, the same level as yesterday.

This highlights the overall uncertainty and caution in the market, with participants waiting to see in which direction the needle will move.

ETFs See the Highest Drop in Two Months

The US BTC spot exchange-traded funds (ETFs) posted minor outflows on 22 January, totalling $32.11 million. This is the lowest amount of flows in nearly a month. The total net inflow now stands at $56.6 billion.

Of the twelve ETFs, only two recorded outflows, and none saw inflows.

BlackRock let go of $22.35 million, and Fidelity followed with $9.76 million in outflows.

Additionally, the US ETH ETFs posted minor negative flows as well, with $41.98 million. Like their BTC counterparts, this is also the lowest amount since late December. With this, the total net inflow pulled back further for a third day in a row to $12.34 billion.

Of the nine funds, two ETH ETFs posted outflows, and two saw inflows. Grayscale took in 17.63 million in total.

At the same time, BlackRock recorded $44.44 million in outflows, followed by Bitwise’s $15.16 million.

Meanwhile, major French hardware wallet manufacturer Ledger is reportedly planning a US initial public offering (IPO) that could value the company over $4 billion.

It would do so in collaboration with Wall Street banks Goldman Sachs, Jefferies, and Barclays.

Quick FAQ

- Did crypto move with stocks today?

After a single day of increases, the crypto market reverted to downward action that governed this week. Meanwhile, the US stock market closed the Thursday session higher for the second consecutive day. By the closing time on 22 January, the S&P 500 was up 0.55%, the Nasdaq-100 increased by 0.76%, and the Dow Jones Industrial Average rose by 0.63%. Presumably, the TradFi markers are still digesting the US’s apparent decision not to use military force in Greenland or impose tariffs on eight NATO allies.

- Is this drop sustainable?

For now, we may continue to see further decreases in the crypto market, at least in the short term. Nonetheless, the price action is not closed for a renewed upward trajectory, though how stable it would be is still unclear.