The crypto market is down today, posting a notable decrease. It fell 6.4% over the past 24 hours to $2.49 trillion. Moreover, 92 of the top 100 coins saw their prices drop. Also, the total crypto trading volume stands at $216 billion, higher than what we’ve been seeing over the past few days.

TLDR:

Crypto Winners & Losers

On Thursday morning (UTC), all top 10 coins per market capitalisation have recorded price falls.

Bitcoin (BTC) dropped by 7%, now trading at $70,884.

Ethereum (ETH) is down 7.7%, now changing hands at $2,097.

The highest decrease in the category is 10.6% by XRP (XRP), now standing at $1.43.

It’s followed by Binance Coin (BNB)’s fall of 9.1% to the price of $691.

Furthermore, of the top 100 coins per market cap, 92 have posted price drops today. Three of these saw double-digit pullbacks, including XRP.

Zcash (ZEC) fell 12% to $245.81, while Morpho (MORPHO) decreased by 10.9% to $1.17.

At the same time, Hyperliquid (HYPE) is the category’s best performer, having increased by 3.2% to $34.3.

A7A5 (A7A5) is next. It appreciated 2% to the price of $0.01283.

Meanwhile, the Royal Government of Bhutan has moved over $22 million in BTC out of sovereign wallets over the past week alone. This triggered speculation over possible sell-offs.

Arkham noted that “from our observations, Bhutan periodically sells BTC in clips of around $50M, with a particularly heavy period of selling around mid-late September 2025.”

‘Bitcoin Capitulation’

Nic Puckrin, investment analyst and co-founder of Coin Bureau, commented that “as Bitcoin continues its slide toward the psychological barrier of $70,000, it’s clear the crypto market is now in full capitulation mode.

“If previous cycles are anything to go by, this is no longer a short-term correction, but rather a transition from distribution to reset – and these typically take months, not weeks.”

Puckrin now expects BTC to fight to defend the $70,000 threshold. If it breaks below, it could be heading for its bear market low around $55,700-$58,200.

Moreover, Bitcoin whales are going for large-scale selling. Institutional outflows are increasing. Yet, while Bitcoin ETFs are seeing negative flows, the majority of ETF holders are sitting on paper losses, while Bitcoin OGs are doing most of the selling, per Bloomberg data.

“This is Bitcoin’s institutionalisation in action,” the analyst says.

Meanwhile, Puckrin also commented on the regulatory situation in the US, specifically when it comes to the much-anticipated Clarity Act.

“The rumours that crypto firms are discussing a stablecoin compromise for the Clarity Act that would involve community banks are a clear sign that it is no longer an ‘us versus them’ situation.”

For a global stablecoin ecosystem to thrive, banks must be part of it. Therefore, “involving community banks is a smart move – both politically and economically.”

Puckrin argues that community banks are more vulnerable to deposit flight but are nimbler and more open to innovation than larger institutional banks.

“They also carry real influence within Washington,” he says. “Turning them from an obstacle to part of the solution may well be the missing piece of the puzzle here.”

Levels & Events to Watch Next

At the time of writing on Thursday morning, BTC was trading at $70,884. The price saw a relatively gradual decrease from the intraday high of $76,472 to the intraday low of $70,119.

Over the past 7 days, BTC saw its price decrease by 19.3%. The highest point it recorded in this timeframe is $88,269.

Now that the price approached the $70,000 level, the critical floor stands at $68,400. A fall below this level would lead to $65,500. If it manages to reclaim $72,000 and the support-turned-resistance at $83,598, BTC could shift to a more bullish path.

At the same time, Ethereum was changing hands at $2,097. The price decreased from $2,278 to $2,077 in a single day. It is now dangerously close to dropping below the $2,000 mark.

ETH is also down 28.8% over the past week. It moved between $2,083 and $2,947.

Another day of pullbacks would take ETH to the $1,990 level, followed by $1,930 and $1,850. Should it manage to reclaim the $2,250 and $2,320 levels, it could negate the bearish trend and move towards $2,500 and higher.

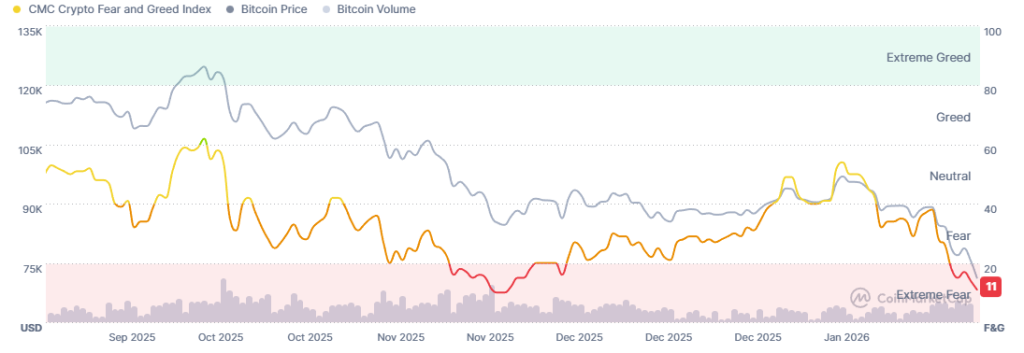

Moreover, the crypto market sentiment keeps falling lower within the extreme fear zone.

The crypto fear and greed index now stands at 11, down from 14 seen a day ago. This is the lowest level since 22 November 2025.

Sentiment reflects the market instability and volatility, as well as increasing general uncertainty. Yesterday’s minor increase in prices did nothing to abate fear among market participants.

ETFs See Another Day of Negative Flows

The US BTC spot exchange-traded funds (ETFs) closed the Wednesday session lower, with $544.94 million in negative flows. With this, the total net inflow fell below $55 billion to the current $54.75 billion.

Six of the twelve ETFs posted negative flows, and none saw inflows. BlackRock let go of $373.44 million on 4 February.

Fidelity recorded outflows of $86.44 million, followed by Grayscale’s $41.77 million.

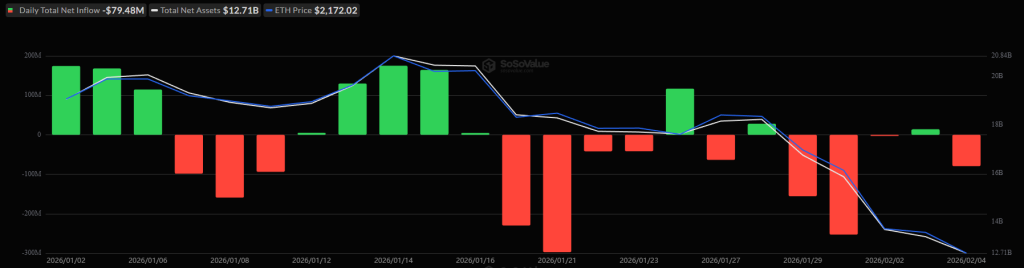

Additionally, the US ETH ETFs saw outflows on Wednesday as well, letting go of $79.48 million. The total net inflow decreased to $11.91 billion.

Of the nine funds, only two posted any flows, both negative.

BlackRock let go of $58.95 million, followed by Fidelity’s $20.53 million in outflows.

Meanwhile, BitMine Immersion Technologies, the Ethereum-treasury company led by Fundstrat’s Tom Lee, is facing massive unrealized loss after a sharp drop in ETH prices.

As of 5 February, BitMine holds roughly 4.285 million ETH with a paper loss exceeding $7 billion, -45% on its holdings.

Quick FAQ

- Did crypto move with stocks today?

The crypto market recorded another pullback in the last day. Also, the US stock market closed the Wednesday session lower, with some exceptions. By the end of trading on 4 February, the S&P 500 was down 0.51%, the Nasdaq-100 decreased by 1.77%, and the Dow Jones Industrial Average rose by 0.53%.

- Is this drop sustainable?

Short answer, yes. Longer answer: The prices are currently still trending lower. Yet, strong macroeconomic and geopolitical forces can still affect the market. The problem is, we can’t currently say in which direction.