The crypto market is down today again, with the vast majority of the top 100 coins turning red over the past 24 hours. Overall, the cryptocurrency market capitalization has decreased by 2.4%, now standing at $3.96 trillion. At the same time, the total crypto trading volume is at $187 billion.

Crypto Winners & Losers

At the time of writing, all top 10 coins per market capitalization have decreased over the past 24 hours.

Bitcoin (BTC) fell 2.8% and below $112,000, now standing at $111,806.

At the same time, Ethereum (ETH) is down by 3.2%, now trading at $4,625.

Dogecoin (DOGE)decreased the most today. It’s down by 4.9% to the price of $0.2219.

The smallest fall in this category is BNB’s 1.2%, now changing hands at $862.

As for the top 100 coins, three coins appreciated above 1%: Provenance Blockchain (HASH), VeChain (VET), and Monero (XMR). They’re each up between 2% and 3%.

On the other hand, Mantle (MNT) is down 11% to $1.14.

It’s followed by Pudgy Penguins (PENGU), which decreased by 9.6% to the price of $0.0322.

The markets recorded a jump on Friday following the speech by the US Federal Reserve Chair Jerome Powell, in which he indicated incoming rate cuts. The “shifting balance of risks may warrant adjusting our policy stance,” he said.

The speech reignited investors’ risk appetite, and with the ongoing bull market, many turned to cryptocurrencies.

However, some analysts had noted before the speech that the event had already been priced in.

Meanwhile, a Bitcoin whale sold 24,000 BTC on Sunday, worth $2.7 billion. This sparked significant liquidations and BTC’s move to a key support zone near $113,000.

Some argued, however, that whales selling is healthy for the market in the long run.

Is a Rate Cut Really Coming?

In an email to Cryptonews, Bitunix analysts noted that historically, rate cuts after long pauses supported equities. However, “tariff-driven price pressures could offset some of the easing impact.”

They argued that the US is “entering a phase of policy tug-of-war between ‘rate-cut tailwinds’ and ‘tariff-driven inflation risks’.” If food prices in that country continue rising, “the Fed’s room for easing may be constrained.”

“Investors should closely track upcoming PCE and nonfarm payroll data. While short-term sentiment remains bullish, the medium-term risk is that inflation erodes the benefits of rate cuts,” the analysts said.

Moreover, Katalin Tischhauser, Head of Research at Sygnum Bank, said that for crypto markets, the reaction to the speech was “swift and positive,” with investors being “eager to seize any dovish hint to fuel the uptrend.”

Even if a September rate cut doesn’t happen, she said, the market has already proven resilience, “digesting multiple disappointments over the past two years while still achieving new highs.”

Therefore, “the prevailing optimism means momentum could continue regardless of near-term policy outcomes, although at higher market volatility.”

Notably, Tischhauser argued that Powell’s speech could be seen as contradictory, possibly leaving markets “debating his true intentions.” While he indicated September rate cuts, “he stressed that for now the labour market is still “in good shape,” the economy remains “resilient,” and that tax, trade, and immigration changes carry risks of higher inflation.”

Hence, she said, “this mixed messaging might leave observers unsure whether he was seriously considering a cut or simply bowing to external pressures.”

Levels & Events to Watch Next

At the time of writing on Thursday morning, BTC trades at $111,806. The coin saw a plunge from $114,666 to $112,174, and then further below the $112,00 level.

Its intraday low was $111,473 while the day’s highest point was $114,927. Looking at the weekly level, the highest price was $117,016. BTC is down 3.3% in a week and 5% in a month, while it’s up 74% in a year.

It is now 10.2% away from its previous all-time high of $124,128. The price may continue to fall further towards the $109,000 level, which could be an indicator of additional dips.

Ethereum is currently trading at $4,625. It first increased to $4,946, finally hitting a new all-time high. But much like BTC, it then saw a sharp drop to $4,738, before relatively gradually decreasing to the current level.

Over the past week, the price has made significant movements. Its lowest point was $4,080.65, and the highest was the ATH of $4,946. Overall, it’s up 7.7% in a week, 22.5% in a month, and 66.5% in a year.

It’s notably outperforming BTC and may see further increases before Bitcoin does. That said, as the larger market in general, ETH may continue to decrease in the short term, below $4,600.

Bitunix analysts suggested that investors monitor support at $4,600–$4,650 and resistance at $4,850–$5,000.

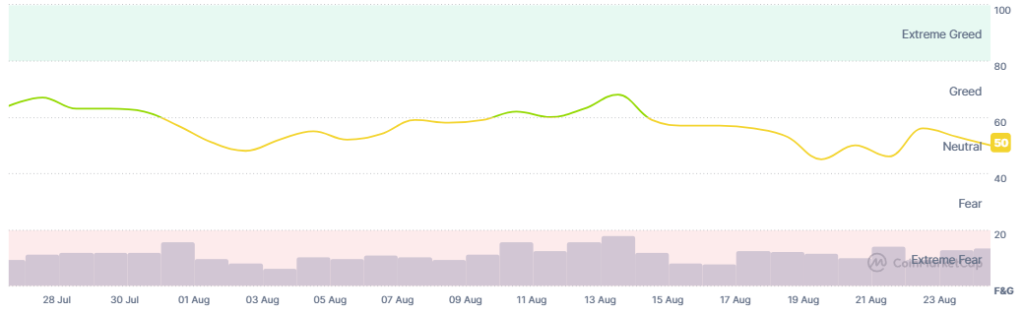

Moreover, with the rise and drops in the market, the crypto market sentiment increased, then dropped again within the neutral zone. The crypto fear and greed index rose from 46 on Friday to 56 over the weekend, before falling back to 50 today.

This shows uncertainty in the market, with a notable amount of caution and fear among investors, but also a dose of bullish sentiment.

Meanwhile, as of 21 August, the US BTC spot exchange-traded funds (ETFs) saw more outflows on Friday of $23.15 million. They weren’t able to maintain positive flows.

Notably, six funds did see inflows, with Ark&21Shares and Fidelity at the top, taking in $65.74 million and $50.88 million. However, BlackRock noted outflows of $198.81 million.

On the other hand, the US ETH ETFs saw more inflows on Friday of $341.16 million. With this, it has started another green streak.

Seven of the nine funds saw inflows. Fidelity and BlackRock took in $117.9 million and $109.37 million, respectively.

Meanwhile, Tokyo-listed Metaplanet bought more BTC, acquiring 103 coins for about $11.8 million. This comes just a week after the company added 775 BTC to its balance sheet.

Quick FAQ

- Why did crypto move against stocks today?

The crypto market fell over the past day, but we still don’t have Monday data for the stock market. On its last trading day, the stocks were up. By Friday’s closing time, the S&P 500 was up by 1.52%, the Nasdaq-100 increased by 1.54%, and the Dow Jones Industrial Average rose by 1.89%. The markets jumped on Friday after the US Federal Reserve Chair Jerome Powell suggested that an interest rate cut is incoming.

- Is this dip sustainable?

Dips may still continue. Overall, analysts argue that there’s room for the crypto market to rally some more, but the prices could decrease further in the short term.

But what else is happening in crypto news…

The post Why Is Crypto Down Today? – August 25, 2025 appeared first on Cryptonews.