SEC Chair Paul Atkins has acknowledged that the U.S. is ’10 Years Behind’ in crypto regulation and pledges to fast-track crypto progress.

According to him, “The crypto aspect is our job one,” marking it as a priority for the regulatory body.

During the DC Fintech Week event at Amazon HQ on Wednesday, Atkins stated that the SEC intends to build a robust framework to bring back industry participants who may have left the country, enabling innovation to flourish.

Atkins Vows to Fast-Track U.S. Crypto Progress

“I like to say that we’re the securities and innovation commission now,” he added.

When asked how regulatory bodies support innovation, Atkins responded that the past approach to the digital asset industry had been somewhat disingenuous, but confirmed the situation has changed.

The SEC is now working full-time on crypto regulation and will introduce an “innovation exemption” to permit experimentation with new ideas.

“We at SEC with respect to our statutes have pretty broad authority for exemptions to be made, and so I think we can be, you know, very forward-leaning in that in order to accommodate new ideas,” he said.

“And if the ideas are not good, the free market reaction would tell.”

He noted that the crypto industry benefits from having pro-crypto executives at the SEC, like “crypto mama,” whose understanding of the space helps the agency embrace innovation.

He emphasized that crypto is the agency’s top priority to close the 10-year gap created by previous regulatory approaches.

When questioned about tokenization and real-world assets, Atkins replied that tokenization is essential because blockchain technology is the most exciting aspect of crypto.

“Tokenization is not necessarily the numerous crypto coins as many would come and go, but I think putting things on-chain presents huge potential benefits for the financial industry and elsewhere.”

He added that blockchain’s transparency makes it incredibly powerful for solving compliance issues.

The 1946 Howey Test Struggles With Modern Crypto

Atkins’ comments have renewed attention on how existing securities laws, particularly the Securities Act of 1933 and the Securities Exchange Act of 1934, apply to digital assets.

Under the 1933 Act, any asset classified as a “security” must be registered with the SEC unless an exemption applies.

The 1934 Act extends oversight to secondary markets, regulating broker-dealers, exchanges, and market manipulation.

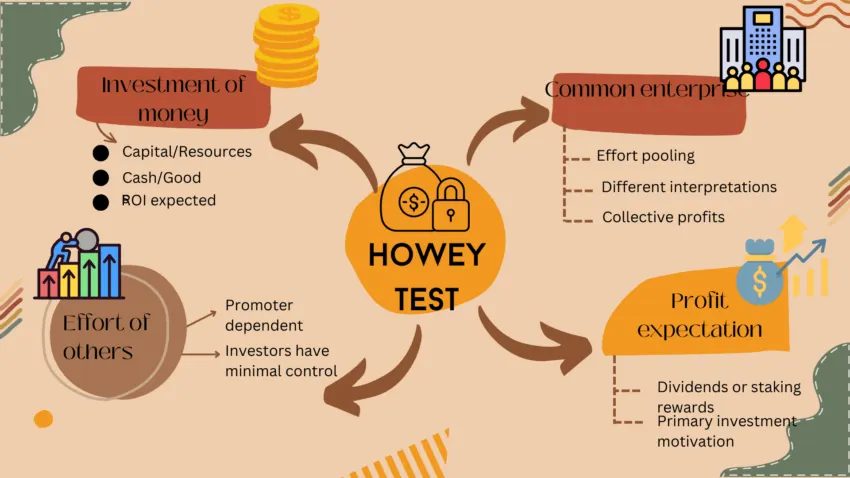

The classification question often depends on the Howey Test, a 1946 Supreme Court standard determining whether a transaction constitutes an “investment contract.”

The SEC has used this test to pursue enforcement actions against token issuers like Ripple and Coinbase, arguing that many crypto offerings meet these criteria.

However, the test’s application to decentralized networks remains disputed.

Critics argue that blockchain tokens, which can power networks, enable governance, or represent stable value, don’t fit neatly into the traditional definition of a security.

SEC’s Innovation Exemption Coming by Year-End

Atkins acknowledged that the regulatory lag is hurting U.S. competitiveness, as jurisdictions like the UAE and Singapore advance clearer digital asset frameworks.

He hinted at moving away from the agency’s enforcement-first strategy toward a more collaborative framework balancing investor protection with innovation.

This may include expanding no-action letters and closer coordination with the CFTC and the Treasury Department.

In September, Atkins said the SEC is working closely with Congress to provide technical support on securities law.

“We want to see this get over the finish line,” he said, pointing to the GENIUS Act’s passage, which gave statutory recognition to stablecoins, as evidence of growing momentum.

Speaking on Fox Business, Atkins confirmed that by year-end, the agency intends to roll out an “innovation exemption” designed to let crypto firms bring new products to market without immediately facing burdensome requirements.

The post “We’re 10 Years Behind”, SEC Chair Vows to Fast-Track U.S. Crypto Progress appeared first on Cryptonews.