Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Warren Buffett’s Berkshire Hathaway continued to sell off stakes in publicly traded companies, shedding more than $5bn of exposure to US and foreign stocks in the third quarter as the firm struggled to find appealing investments in a volatile market.

The sales mean the sprawling conglomerate has sold stocks for four straight quarters, with divestments approaching $40bn. It has cut positions in companies such as oil major Chevron, automaker General Motors and insurer Marsh & McLennan.

The value of Berkshire’s stock portfolio shrank to $319bn from $353bn at the end of June, a decline fuelled by the slide in the broader market as investors came to believe that the Federal Reserve would keep interest rates higher for longer.

That has weighed on the valuations of publicly traded companies and prompted some portfolio managers to search for better returns in fixed income markets.

Buffett’s investment shifts are closely followed by fund managers and the wider public for clues as to where the 93-year-old investor sees attractive returns.

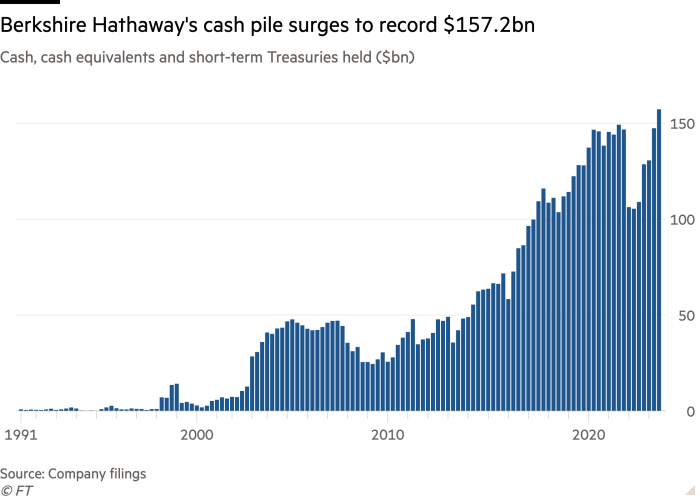

He directed the proceeds of those stock sales, as well as the cash flows Berkshire’s many businesses generated, into cash and Treasury bills. The company’s cash pile surged nearly $10bn to a record $157.2bn at the end of September, a sum that gives it formidable firepower for acquisitions.

Berkshire has been one of the big beneficiaries of rising interest rates, which in the US climbed above 5 per cent this year. The company disclosed that the interest income it was earning on its insurance investments climbed to $1.7bn in the quarter, lifting the sum to $5.1bn over the past 12 months. That eclipsed the total interest Berkshire earned on its cash reserves in the preceding three years combined.

Buffett disclosed that the company repurchased $1.1bn worth of Berkshire stock in the quarter, down from the $1.4bn it spent in the second quarter.

The company’s operating businesses, which span the BNSF railroad, Geico insurer and aircraft parts maker Precision Castparts, reported a 41 per cent rise in profits to $10.8bn during the quarter. The gains were fuelled by its insurance unit, which reported strong underwriting profits of $2.4bn, offsetting weakness at BNSF and its large utility business.

Ajit Jain, a Berkshire vice-chair who oversees its insurance operations, told shareholders in May that the company had wagered heavily on the Florida insurance market and had written policies in the hurricane-prone state.

It was a risky bet that Jain estimated could cost Berkshire as much as $15bn if the state was hit by powerful storms. But this year, the state experienced a relatively tame season.

Berkshire on Saturday reported that significant catastrophe losses — individual insurance losses that top $150mn — had only reached $590mn in the first nine months of the year. That figure is down from $3.9bn in the same period last year, when Hurricane Ian pummelled Florida.

“While the margins have been healthy, we have a very unbalanced portfolio,” Jain said at the annual meeting. “What that means is if there’s a big hurricane in Florida, we will have a very substantial loss.”

He estimated in May that Berkshire could register a profit of $7bn if hurricane season ended without a big storm.

The company’s overall results were dragged down by declines in the value of its stock portfolio, which it must account for in its profit statement. Berkshire said it registered a net loss of $12.8bn, or $8,824 per class A share, compared with a $2.8bn net loss a year before.

Buffett has long characterised the net earnings figures as meaningless, saying the figures can be “extremely misleading to investors who have little or no knowledge of accounting rules”.

Shares of the company have climbed 13.9 per cent this year, below the 15.1 per cent total return of the S&P 500 stock index.