U.S. services activity unexpectedly slowed in September, pushing the ISM services PMI to 50 and reinforcing growing odds of near-term Fed rate cuts.

This macro pivot could help fuel a new leg higher for Bitcoin and put a $150K target back on the table.

September’s ISM services report showed meaningful weakness across the board, with the Business Activity index falling into contraction at 49.9, and New Orders weakened sharply, showing that service-sector growth is stalling.

Macro Context with PMI, Labor, and the Fed Could Trigger a Bitcoin $150k Rally

With U.S. labor market data also weakening and Core PCE inflation still running at 2.9%, its first such level in 30 years, the odds of Fed rate cuts have jumped.

Markets now expect at least two cuts beginning as soon as the October FOMC meeting, with one more possible before the end of 2025.

The macro backdrop has already helped Bitcoin rally to a 50-day high of $123,841, gaining over 11% in October’s so-called “Uptober” surge.

That change in expectations is a key bullish catalyst for risk assets, including Bitcoin.

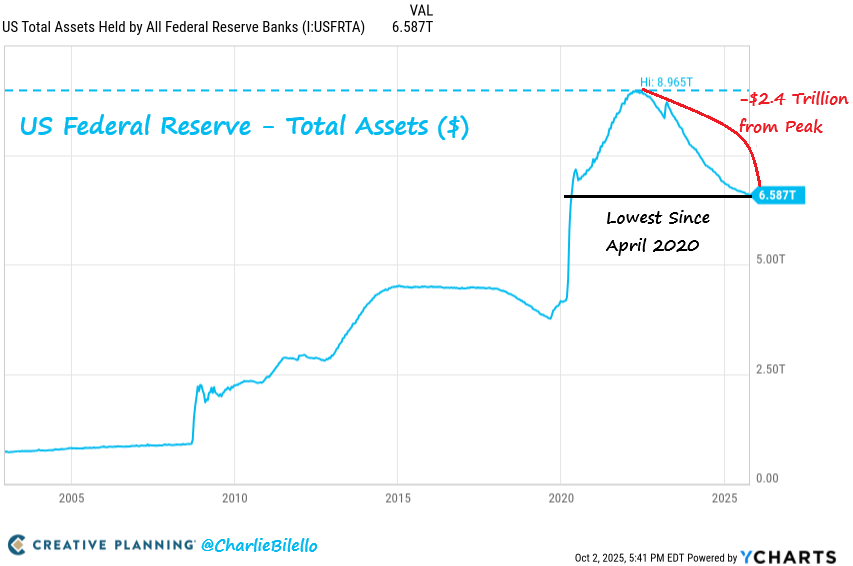

Compounding the policy picture, the Fed’s balance sheet has contracted substantially from its pandemic-era peak, leaving it at its lowest level since April 2020, after roughly $2.3T of runoff since 2022.

The move from quantitative tightening (QT) to a possible easing bias is part of why analysts are debating a rotation back into risk-on positioning. Monetary easing and the prospect of easier financial conditions historically lift risk assets and speculative flows.

When macro liquidity and derivatives demand line up, price discovery can accelerate quickly. Major banks and research desks have turned bullish on BTC’s upside in this environment.

Standard Chartered recently said Bitcoin could reach $135K soon and perhaps hit $200K by year-end.

At the same time, spot ETF demand, growing options activity tied to ETFs, and a rising share of long-term holders (those who’ve held since the ETF approvals) are shifting market structure away from pure short-term leverage toward more durable demand.

Spot ETFs Post $1.08B in Volume as Bitcoin Open Interest Hits $45.3B

Spot Bitcoin ETFs posted $1.08 billion in volume over the last four days, showing that institutional inflows remain robust.

At the same time, Bitcoin Open Interest just hit an all-time high of $45.3 billion, marking the largest leverage buildup the market has ever seen.

On-chain data shows another bullish shift, with the rising share of long-term holders who have kept their BTC for 18 months to two years.

Adding to the bullish narrative, there are reports that President Trump is considering new stimulus checks of $1,000–$2,000 funded through tariff revenues.

A similar policy in 2021 helped fuel the last major bull run, when Bitcoin rallied from $17,572 to its then-record $69,000.

If confirmed, fresh fiscal stimulus would add another powerful liquidity injection into markets already preparing for Fed easing, potentially accelerating Bitcoin’s trajectory toward $150K and beyond.

Bitcoin Technicals Flash Green With $120K Breakout and Highest Weekly Close Ever

Bitcoin’s structure now mirrors past “price discovery” phases, with strong ETF inflows, record open interest, resilient spot demand, and aggressive futures buying.

Analysts argue BTC may be entering Price Discovery Uptrend 3, historically the stage where mega bull runs take shape.

As long as Bitcoin holds above $120K and the Fed follows through with rate cuts, the setup favors upside continuation.

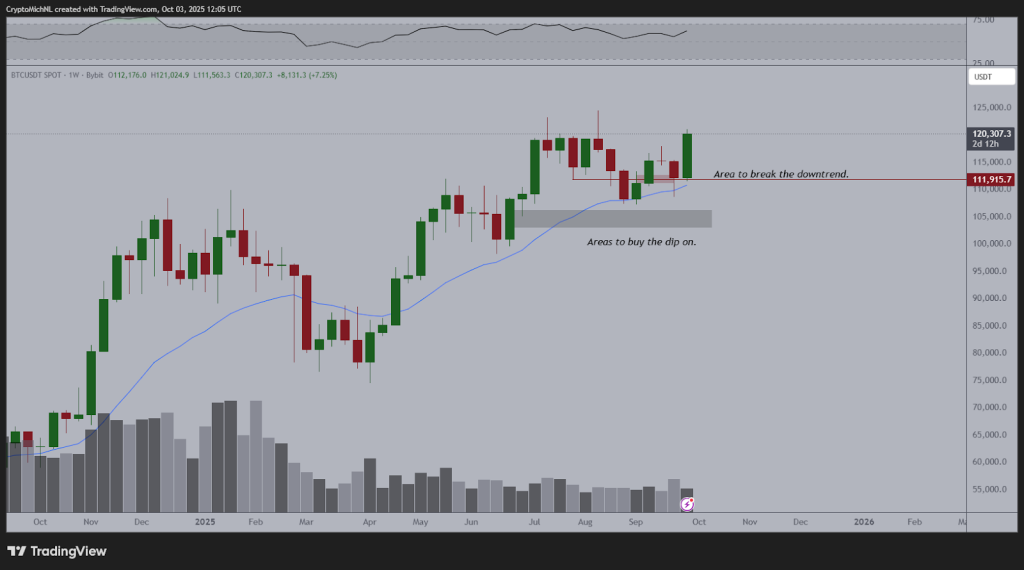

Examining the weekly chart of Bitcoin, the technical picture reveals clear signs of strength.

Price has successfully held the 20-week moving average as support, which has historically been one of the most reliable levels for sustaining long-term bullish trends.

The recent move also saw Bitcoin decisively break above the $112K downtrend resistance, a level that had capped momentum for several weeks.

That breakout now sets the stage for continuation higher.

What makes the current setup important is that Bitcoin is on track for the highest weekly close in its chart history, as the ongoing weekly candle is already showing a 7% gain.

With these technical confirmations lining up, the probability of Bitcoin reaching $150K this quarter looks increasingly realistic.

The post U.S. Services PMI Sinks Near Pandemic Lows, Increasing Fed Rate Cuts Odds – Catalyst for $150K Bitcoin? appeared first on Cryptonews.

President Trump considers sending US taxpayers up to $2,000 stimulus checks using tariff revenue.

President Trump considers sending US taxpayers up to $2,000 stimulus checks using tariff revenue.