Deutsche Börse Group has signed a Memorandum of Understanding (MoU) with Circle Internet Financial to integrate regulated stablecoins into European capital markets.

According to the announcement, the collaboration will focus on Circle’s USDC and EURC, connecting token-based payment networks with traditional financial infrastructure.

The partnership marks the first time a major European market infrastructure provider has formally teamed up with a global stablecoin issuer.

Both parties said the initiative represents a milestone for regulated digital finance in Europe, made possible by the EU’s Markets in Crypto-Assets Regulation (MiCA), the bloc’s new comprehensive framework for digital assets.

Partnership Bridges Traditional Finance and Crypto Settlement in Europe

Under the agreement, the initial rollout will take place through Deutsche Börse’s subsidiaries. Trading will be facilitated on 360T’s digital exchange, 3DX, and through the institutional crypto provider Crypto Finance.

Custody services will be provided via Clearstream, Deutsche Börse’s post-trade business, with Crypto Finance’s German entity serving as sub-custodian.

Jeremy Allaire, Circle’s co-founder and CEO, said the collaboration would reduce settlement risk, lower costs, and improve efficiency across banks, asset managers, and other market participants.

“As clear rules take hold across Europe, aligning our regulated stablecoins, EURC and USDC, with trusted venues will unlock new products and streamline workflows across trading, settlement, and custody,” Allaire said.

Executives at Deutsche Börse noted the potential of stablecoins to reshape European finance. Stephanie Eckermann, who oversees post-trading at the group, said the deal advances the company’s ambition to digitize securities issuance and post-trade processes.

Thomas Book, who is responsible for trading and clearing, added that the partnership positions Deutsche Börse to bridge traditional and digital markets by providing an integrated value chain across execution, settlement, and custody.

The agreement follows Circle’s regulatory breakthrough earlier this year. On July 1, Circle became the first global stablecoin issuer to secure an Electronic Money Institution (EMI) license under MiCA, issued by French regulators.

The license allows the company to issue both USDC and EURC across the European Union.

Circle described the approval as a major milestone for mainstream adoption, noting that MiCA sets the conditions for long-term growth in digital finance by ensuring stablecoin issuers meet strict consumer protection and reserve requirements.

The MiCA framework, passed by the European Parliament in April 2023, has been gradually implemented since June.

Circle’s head of policy, Dante Disparte, said the regulation closes the door on unregulated operations, while Allaire noted that it legitimizes the sector after years of skepticism from mainstream finance.

European Banking Giants Form Consortium for Euro Stablecoin

Amid Deutsche Börse Group’s efforts, nine of Europe’s largest lenders are joining forces to launch a euro-backed stablecoin in the second half of 2026, seeking to challenge the dominance of U.S. dollar-pegged tokens.

The consortium, which includes ING, UniCredit, CaixaBank, Danske Bank, KBC, DekaBank, SEB, Raiffeisen Bank International, and Italy’s Banca Sella, has set up a new company in the Netherlands to oversee the project.

It plans to seek a license from the Dutch Central Bank as an e-money institution under the European Union’s MiCA framework.

According to a joint statement, the stablecoin will provide near-instant cross-border payments, lower transaction costs, and round-the-clock access to settlements.

“This development requires an industry-wide approach, and it’s imperative that banks adopt the same standards,” said Floris Lugt, digital assets lead at ING.

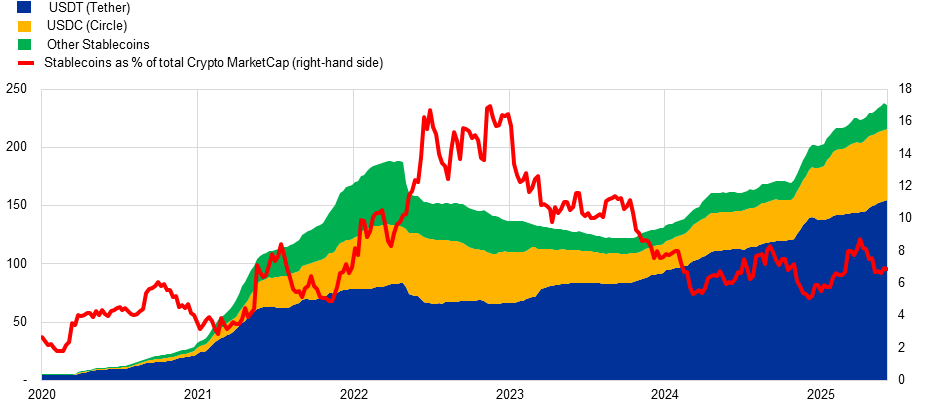

The move shows growing European efforts to reduce reliance on dollar-based stablecoins, which currently account for 99% of global supply.

Euro-pegged tokens remain a small fraction of the market, with less than €350 million in circulation, European Central Bank (ECB) data shows.

The initiative comes as the ECB advances its digital euro project, with Executive Board member Piero Cipollone suggesting a rollout could happen by mid-2029.

EU lawmakers are expected to weigh in on the legal framework later this year.

Together, the bank-led stablecoin and the ECB’s digital euro mark Europe’s bid to secure greater autonomy in digital payments and limit the influence of non-EU issuers in the region’s financial system.

The post TradFi Giant Deutsche Börse Taps Circle for Major European Stablecoin Push appeared first on Cryptonews.

Nine European banks will launch a MiCA-regulated, euro-backed stablecoin that will contribute to Europe’s strategic autonomy in payments.

Nine European banks will launch a MiCA-regulated, euro-backed stablecoin that will contribute to Europe’s strategic autonomy in payments.