Real-world asset (RWA) tokens have become 2025’s favorite blockchain story. Treasuries, real estate, even whisky casks — around $24 billion worth — now sit on public ledgers.

Indeed, the value on-chain is growing fast, but what really matters is what’s still missing underneath. Legal uncertainty, tech bottlenecks, and custody blind spots — any one of these could bring the whole experiment to a deadlock.

With billions already on-chain and institutional players watching, tokenization has moved beyond theory, but its foundations are still fragile. If we don’t fix the basics, the momentum could stall before this thing really takes off. Who owns what? How does the system talk to itself? And is there anyone actually holding the real asset?

Let’s break down the three biggest challenges holding the sector back and what needs to happen if we want this $24 billion market to mean something more than another crypto “flash-in-the-pan.”

Tokens Without Title

The biggest blind spot in the tokenization boom is also the most basic: a token isn’t ownership, it’s a claim to ownership that only matters if the legal system agrees.

In a few forward-looking jurisdictions, like Luxembourg, digital securities now have legal status, but most of the world still treats on-chain tokens as representations, not rights. A trust may hold the underlying bond or property, and the token becomes a digital IOU. On paper, it’s elegant. In court? Not guaranteed.

In a bankruptcy, a judge could treat a tokenized bond the same as any other unsecured claim, folding it into the estate with no special priority. Even in major markets, registry systems for property or securities are still paper-based, meaning there’s no clean way to reconcile digital claims with real-world ownership. As for cross-border operations, the problem gets even worse. Enforcement hinges on conflicting legal doctrines, not code.

In this situation, I’m sure that regulators should build harmonized definitions of digital assets that are portable across borders and enforceable in court. Until this happens, tokenization remains fragile. So far, we’re just giving financial infrastructure a slick new front end that still relies on old-world trust.

Fragmented Tech and Compliance

Even where the law isn’t a barrier, the technology still is. Tokenized assets move on infrastructure that was never designed to interoperate, and it shows.

Ethereum remains the main hub, but it’s rarely the cheapest or most efficient. Transactions can cost several dollars apiece, and while Layer-2 solutions like Arbitrum help, they introduce other problems. Which ones? Liquidity is fragmented, bridging adds risk, and users must manage separate environments that don’t talk to each other cleanly.

Compliance is just as fractured. Most token issuers run their own permission systems — who can hold a token, who can redeem it, and under what rules. That means even if your wallet passed KYC for one asset, it may have to go through the process all over again for another. The result is a disjointed market where every on-chain interaction becomes a new onboarding event.

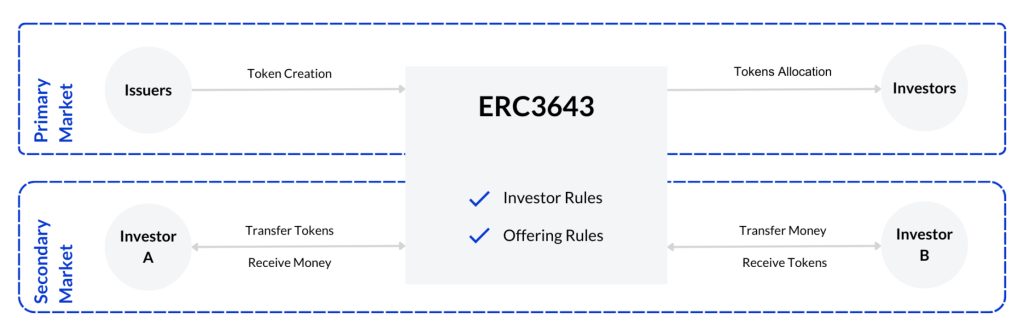

What would change that? Shared compliance rails, like ERC-3643, if adopted widely and aligned with regulation, are a viable way forward. Otherwise, we’re just rebuilding legacy silos with sleeker tools.

Data and Custody Risk

Tokenization may be digital, but it still leans heavily on offline facts. Every token tied to a bond, a property, or a warehouse needs someone (or something) to verify that the asset is real and still where it’s supposed to be. That’s where things get unclear.

Oracles feed external data into smart contracts: prices, ownership changes, and payments. But those feeds can lag or fail, and smart contracts have no idea what’s happening off-chain. If an update is late or wrong, redemptions can freeze or misfire, and in volatile markets, even small delays turn outdated data into real liabilities.

Custody, in turn, brings its own risks. You might hold the token, but someone else holds the real-world asset. If that custodian lacks transparency, proper auditing, or legal accountability, the token becomes a digital receipt with no proof behind it. Outside well-regulated trust banks, custody standards are all over the place, and investors often have no idea what kind of protection, if any, they actually have.

To fix that, tokenized markets need real-time reserve proofs, stronger oracle standards, and custodians who are transparent, accountable, and auditable. Some of the infrastructure already exists.

Tokenization Only Works if It Scales

From my perspective, tokenization is already proving itself — in controlled pilots, closed systems, and sandboxed rollouts. But that’s not how financial infrastructure scales. Without legal alignment and shared compliance rails, this space risks remaining a patchwork of “gated” corridors.

I’m not watching for the next flashy protocol. I’m currently watching for convergence — lawmakers who define digital ownership clearly and platforms that stop reinventing KYC from scratch.

Disclaimer: The opinions in this article are the writer’s own and do not necessarily represent the views of Cryptonews.com. This article is meant to provide a broad perspective on its topic and should not be taken as professional advice.

The post The Tokenization Hype Is Real — So Are the Three Gaps That Could Stall It appeared first on Cryptonews.