U.S. spot Bitcoin ETFs have recorded eight consecutive days of institutional selling, with total outflows reaching approximately $825 million as year-end tax strategies dominate market behavior.

According to analyst Alek, the sustained selling pressure stems primarily from tax loss harvesting.

He claimed it is a temporary phenomenon expected to conclude within the coming week, alongside de-risking ahead of Bitcoin’s quarterly options expiry.

On December 24 alone, U.S. spot Bitcoin ETFs witnessed net outflows of $175 million, with BlackRock’s IBIT leading the exodus at $91.37 million.

Ethereum spot ETFs recorded $52.70 million in outflows, while newer products showed resilience, with Solana ETFs attracting $1.48 million and XRP ETFs drawing $11.93 million in fresh capital.

Regional Shift Creates New Market Dynamic

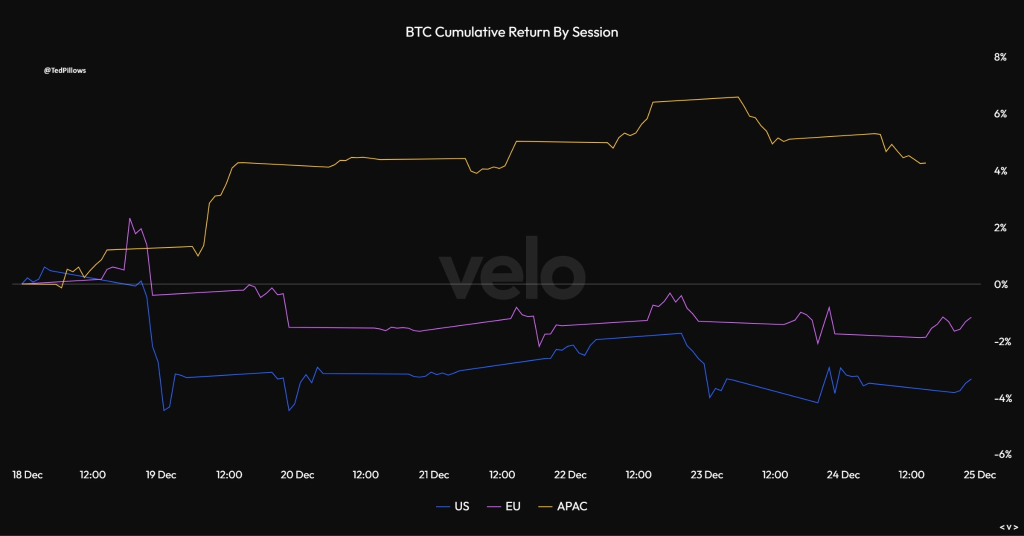

A notable geographic rotation has emerged in Bitcoin markets, with the United States becoming the dominant seller while Asian buyers step in as the primary accumulation force, as noted by analyst Ted Pillows.

This is quite notable as it is a reversal that’s quite different from traditional capital flow patterns that have historically characterized crypto trading.

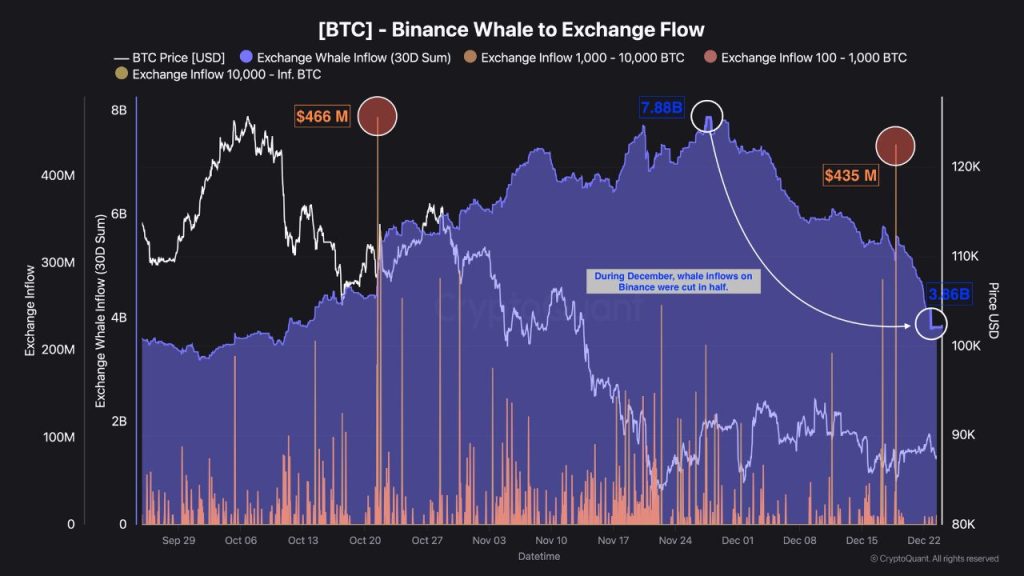

Meanwhile, whale activity on Binance has contracted sharply, with large holder deposits plummeting nearly 50% from $7.9 billion to $3.9 billion.

CryptoQuant data reveals that monthly whale inflows dropped from approximately $7.88 billion to $3.86 billion in December, effectively halving in just weeks.

Despite this broader slowdown, isolated spikes persist, with recent movements including $466 million across the 100 BTC to 10,000 BTC cohorts and over $435 million from the 1,000 to 10,000 BTC range.

The reduced whale deposit activity suggests diminished selling pressure, as fewer Bitcoin transfers to exchanges mechanically translate to less immediate liquidation risk.

However, Binance continues to capture the largest share of exchange flows.

Bitcoin Correlation Breakdown Signals Independence

Bitcoin’s market behavior has decoupled from traditional assets, with correlation to the Nasdaq approaching zero and turning negative against gold.

CryptoQuant analyst Maartunn noted that Bitcoin no longer trades like a tech stock or safe haven, instead “carving out its own market regime.”

This independence comes as gold and silver continue climbing while Bitcoin remains range-bound.

CryptoQuant analysis attributes the divergence to increased demand for traditional safe assets amid geopolitical uncertainty, expectations of lower real interest rates, and easier institutional allocation pathways to precious metals.

Bitcoin is treated primarily as a high-beta risk asset rather than a pure safe haven, making it secondary during risk-off environments when capital first flows into gold and government bonds.

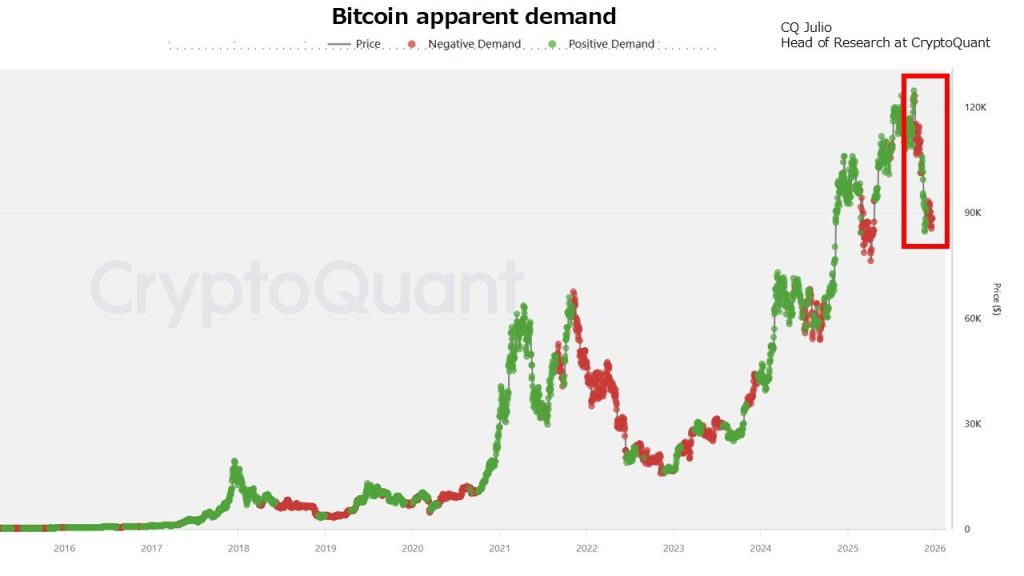

Bitcoin’s apparent demand recently turned negative, indicating stagnant new capital inflows despite elevated prices.

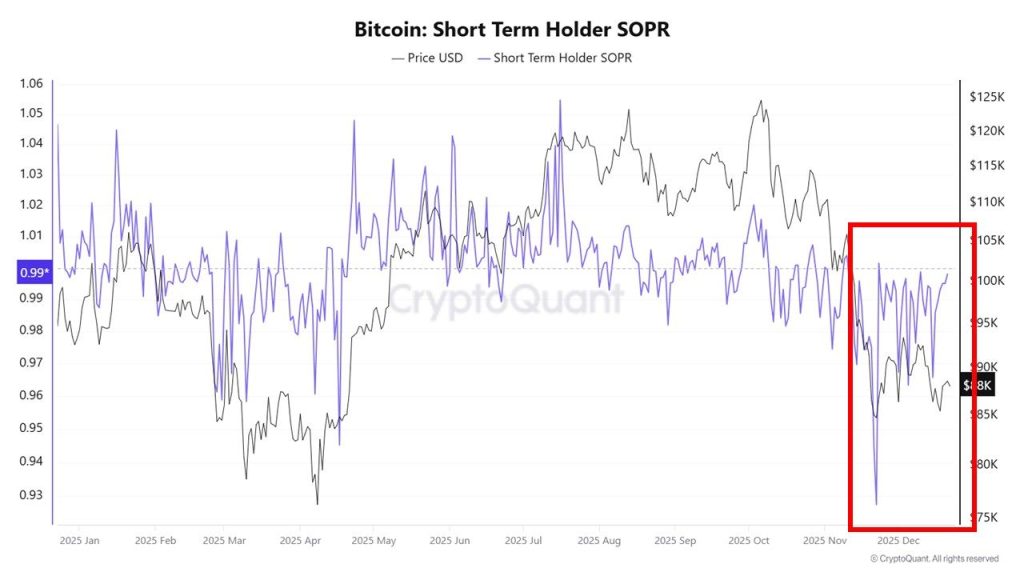

Short-Term Holder SOPR has also spent extended periods below 1, suggesting recent buyers are exiting at losses or breakeven, creating selling pressure on rebounds.

Gold trades above $4,500 per ounce while Bitcoin still struggles to break $90,000.

Bear Market Scenario Gains Credibility

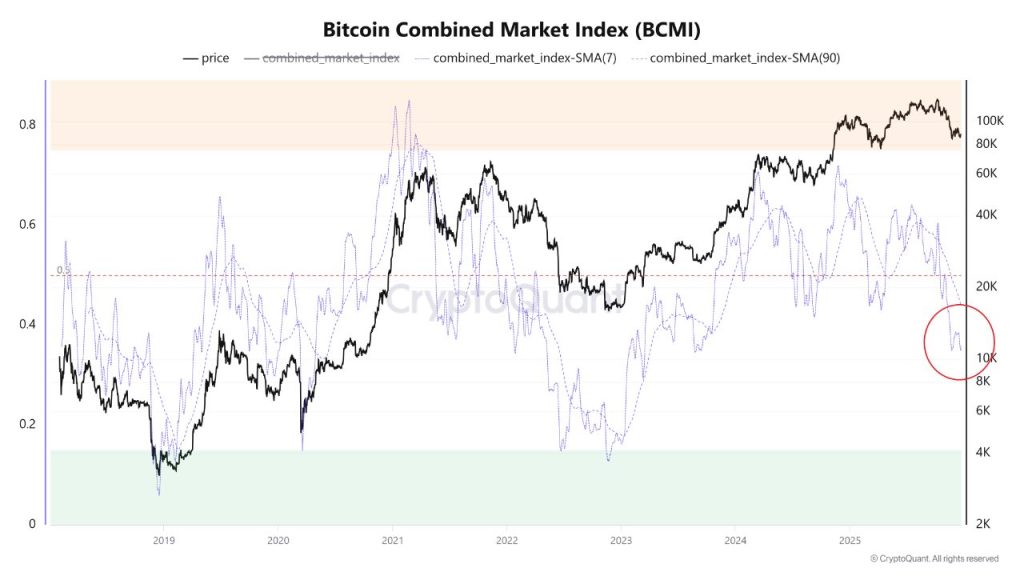

Notably, CryptoQuant’s Bitcoin Cycle Momentum Indicator (BCMI) has also fallen below equilibrium but remains above historical bottom zones of 0.25–0.35 seen during 2019 and 2023 cycle lows.

The current reading, according to analysts, suggests markets may be transitioning into a bear phase rather than experiencing a simple pullback.

However, they emphasize this remains a scenario rather than a forecast that requires further confirmation.

Adding to the waning demand, Polymarket odds for Bitcoin reaching $100,000 by year-end have collapsed to just 3%, which shows the perfect near-term sentiment.

Despite current weakness, analyst Plan C maintains conviction that “Bitcoin will have its moment in the spotlight” in 2026, predicting mean reversion against gold and silver’s outperformance in the relatively near term.

At the time of writing, Bitcoin is trading at $87,838, down nearly 30% from its October peak above $126,000.

The post “Tax Loss Harvesting” Drives $825M Outflow From Bitcoin ETFs This Week: Analyst appeared first on Cryptonews.