The S&P 500 (SP500) on Tuesday slipped 2.20% for the month of October to close at 4,193.80 points. Its accompanying SPDR S&P 500 Trust ETF (NYSEARCA:SPY) lost 2.17% for the month.

The benchmark index slumped to its third straight monthly decline, its longest such slide since the first quarter of 2020. Moreover, Bespoke Investment Group on X (formerly Twitter) noted that 2023 would be “just the 9th year since 1928 that the S&P (SP500) fell in each of August, September, and October. 1990 and 2016 were the last two times it happened.”

Compared to a September that lived up to its historical trend of being the worst month of the year for markets, October’s fall in equities was more contained. Still, sentiment was largely negative and the mood hit its lowest point last Friday, a day which saw Wall Street’s benchmark index end more than 10% below its 52-week closing high – a definition of a technical correction. The Nasdaq Composite (COMP.IND) achieved the same negative milestone just two days before the S&P 500 (SP500).

Several factors have weighed on markets in October: hotter-than-expected labor, inflation and GDP data; geopolitical concerns stemming from fresh conflict between Israel and armed group Hamas; a brutal bond sell-off that saw the U.S. 10-year Treasury yield (US10Y) hit 5% for first time since July 2007; and disappointing quarterly results from members of the “Magnificent 7” which also sparked concerns over their outsized valuations and weightage.

Other notable developments during October included the potential end of a nearly six-week strike by the United Auto Workers against “Detroit Three” carmakers Ford (F), General Motors (GM) and Stellantis (STLA), after the union reached tentative labor deals with the companies. Meanwhile, the oil and gas sector saw some major consolidation in the form of two mega-mergers. First, Exxon Mobil (XOM) said it would buy Pioneer Natural Resources (PXD) in a deal worth $59.5B. Then, Chevron (CVX) joined the party by snapping up Hess (HES) for $60B.

As the year moves into November, market participants will be closely watching out for the Federal Reserve’s penultimate monetary policy decision of the year.

“October marks the third consecutive month of losses for equity indices, as elevated interest rates, nose-bleed valuations, and uninspiring earnings prospects weigh on buying activity,” José Torres, senior economist at Interactive Brokers (IBKR), said.

“As we flip the calendar and look forward to the rest of the week, however, Federal Reserve Chairman Powell’s presentation, earnings from Apple (AAPL), and Nonfarm Payrolls data may propel the bulls as we enter a seasonally strong period,” Torres added.

Turning to the monthly performance of the S&P 500 (SP500) sectors, all 11 ended in the red, with the exception of Utilities. Energy was the top loser with an outsized fall of more than 6%. The decline came amid volatility in crude oil prices following the Israel-Hamas conflict. See below a breakdown of the performance of the sectors as well as their accompanying SPDR Select Sector ETFs from September 29 close to October 31 close:

#1: Utilities +1.23%, and the Utilities Select Sector SPDR ETF (XLU) +1.29%.

#2: Information Technology -0.07%, and the Technology Select Sector SPDR ETF (XLK) +0.05%.

#3: Consumer Staples -1.37%, and the Consumer Staples Select Sector SPDR ETF (XLP) -1.38%.

#4: Communication Services -2.00%, and the Communication Services Select Sector SPDR Fund (XLC) -1.30%.

#5: Financials -2.62%, and the Financial Select Sector SPDR ETF (XLF) -2.44%.

#6: Real Estate -2.93%, and the Real Estate Select Sector SPDR ETF (XLRE) -2.85%.

#7: Industrials -2.97%, and the Industrial Select Sector SPDR ETF (XLI) -2.98%.

#8: Materials -3.22%, and the Materials Select Sector SPDR ETF (XLB) -3.17%.

#9: Health Care -3.33%, and the Health Care Select Sector SPDR ETF (XLV) -3.26%.

#10: Consumer Discretionary -4.51%, and the Consumer Discretionary Select Sector SPDR ETF (XLY) -5.52%.

#11: Energy -6.08%, and the Energy Select Sector SPDR ETF (XLE) -5.75%.

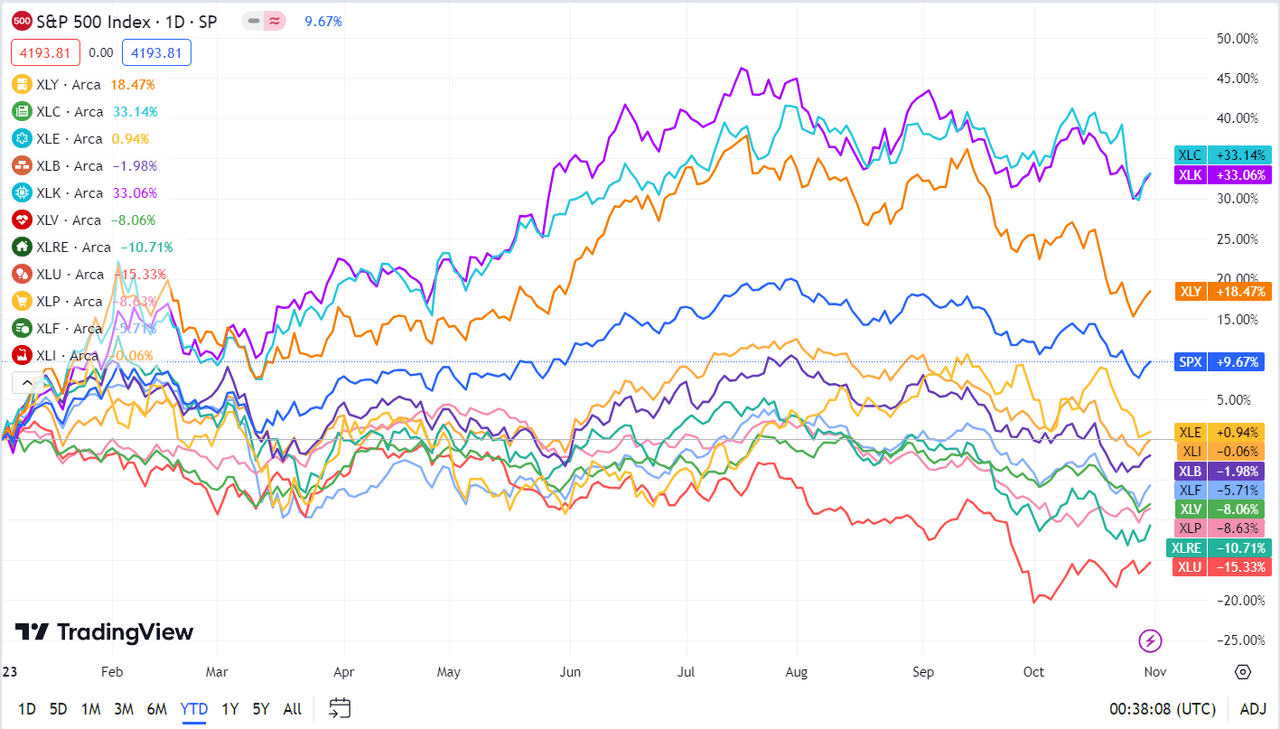

Below is a chart of the 11 sectors’ YTD performance and how they fared against the S&P 500 (SP500).