Solana pretty much sums up the current market mood. The so called “coin of the cycle” is stuck in a boring range, and sentiment around it is at some of the lowest levels we have seen in a while.

SOL ETFs still recorded about $1.4M in inflows on December 24, which is one of the few positive signs right now, but it has not been enough to change the bigger picture.

Looking ahead to 2026, analysts like Umair Crypto point out that the core problem is still on the chart. Price has failed to flip the $127 level into support. Every attempt to break and hold above that area has been cleanly rejected, forcing SOL to roll over and search for lower support.

At the time of writing, Solana is holding around $123, which is now the key level bulls need to defend.

Solana Price Prediction: What Is The Next Move For SOL Price?

There are several scenarios that could play out here, but overall the bullish structure remains intact.

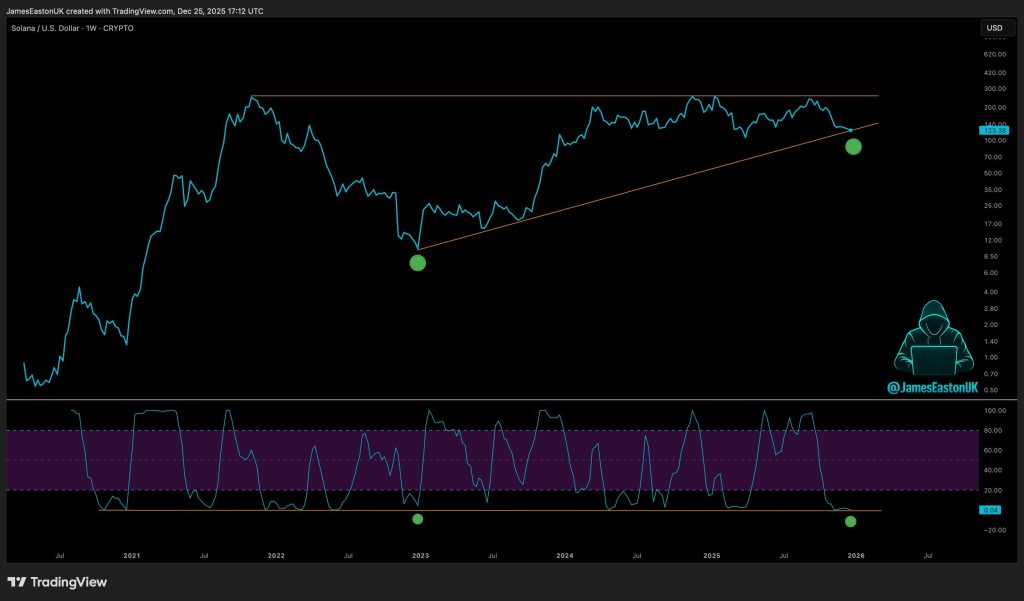

Analyst James Easton believes that as long as price stays above this wedge, the setup still supports a rally. What really stands out is the weekly RSI, which is actually lower now than it was at the bottom of the bear market, a condition that has historically lined up with strong upside moves.

One big thing that is missing right now is volume. Buying pressure is still pretty weak, which shows bulls are hesitant and not fully committing to this move yet.

Without a clear spike in volume, any push above resistance risks turning into just another fake breakout. What really changes the picture is a clean break above the $144 level with strong volume coming in. That kind of move would act like a trigger and could kick off the next leg higher.

Bitcoin Hyper Is Quietly Building While Solana Stalls

While Solana chops sideways and sentiment keeps sinking, Bitcoin Hyper is moving in the opposite direction, quietly stacking momentum while most traders are distracted.

This is usually how early cycle winners start, low noise, steady inflows, and no need for hype candles yet.

Bitcoin Hyper is designed to capitalize on exactly this kind of market environment. When majors stall and confidence drops, capital slowly rotates into projects with strong fundamentals, clear narratives, and asymmetric upside. That rotation almost always happens before the charts make it obvious.

The project has already raised over $29.8M, showing serious conviction from early backers even while the broader market hesitates. On top of that, the 39% APY staking rewards incentivize holders to stay put rather than flip for short term moves, which helps build real supply pressure over time.

While traders wait for Solana to finally flip resistance, Bitcoin Hyper is building its base. And when momentum returns to the market, the projects that were accumulated quietly during boredom phases are usually the ones that move first and hardest.

Visit the Official Bitcoin Hyper Website Here

The post Solana Price Prediction: SOL Is Pushing Against This Critical Level – But Traders Say the Next Move is What Matters Most appeared first on Cryptonews.