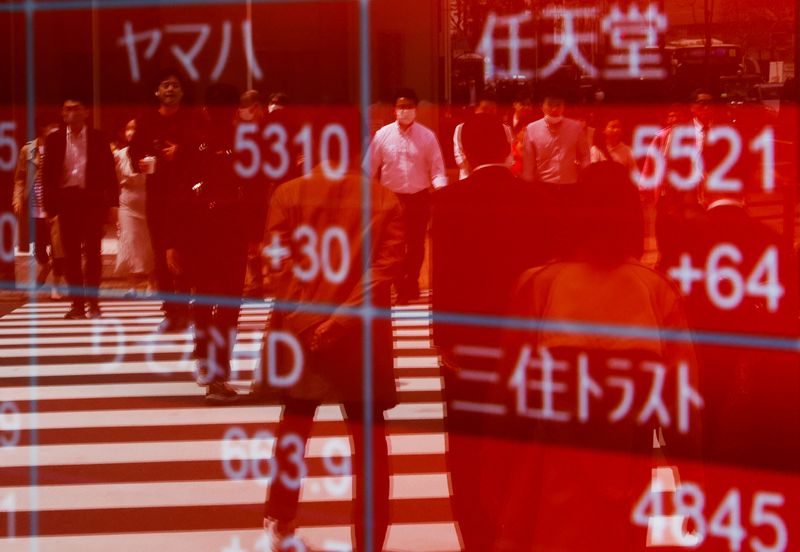

© Reuters. FILE PHOTO: Passersby are reflected on an electric stock quotation board outside a brokerage in Tokyo, Japan April 18, 2023. REUTERS/Issei Kato

By Jamie McGeever

(Reuters) – A look at the day ahead in Asian markets from Jamie McGeever.

Optimism and relief are likely to be the dominant emotions for investors on Monday, giving markets in Asia a lift as lawmakers in Washington reached a tentative agreement on the U.S. debt ceiling, thus removing the risk of a catastrophic default.

Trading and market liquidity in Asia will be lighter than usual, however, with U.S. and UK markets closed for holidays, opening up the potential for outsized market moves.

If so, they are likely to be outsized gains, certainly across risk assets – Wall Street rallied strongly on Friday, particularly the Nasdaq and mega tech stocks, and the news from Washington over the weekend will only be seen as positive.

After weeks of tough negotiations Republicans and Democrats reached a tentative agreement to suspend the $31.4 trillion debt ceiling, which now must get through the Republican-controlled House of Representatives and Democratic-led Senate before June 5 to avoid a crippling first-ever default.

Both sides are confident it will pass.

It could be a double-edged sword for Asian markets, if not on Monday than in the days and weeks ahead. A debt limit deal gives the Federal Reserve more room to tighten policy, which could push up U.S. bond yields and strengthen the dollar – not usually a good mix for emerging markets.

The dollar is already on a tear, reaching a two-month high on an index basis last week and six-month peaks against the Japanese yen and above 140 yen and 7.00 yuan, respectively. Japanese and Chinese policymakers are facing different challenges though.

Inflation in Japan is high and sticky, and the Bank of Japan is under pressure to tweak or abandon its ultra loose ‘yield curve control’ monetary policy. Tokyo may quietly prefer the yen to strengthen from here.

Beijing, on the other hand, might like the yuan to fall further. The economy’s post-pandemic lockdown recovery has been weaker than expected, to put it mildly, and inflationary pressures are evaporating. Barclays (LON:) economists predict 10-20 basis points of policy rate cuts and 25-50 bps of reserve requirement ratio cuts over the next six to nine months.

Japanese equity markets open on Monday near the 33-year highs reached last week, while Chinese stocks are languishing near six-month lows. So is the tech index, struggling under the cloud of rising U.S.-Sino trade tensions rather than benefiting from the U.S. tech boom.

Perhaps that changes on Monday, if only briefly.

The Asian economic data and events calendar is light on Monday but fills up later in the week, with the focus turning to Japanese unemployment on Tuesday, India’s first quarter GDP and Thailand’s interest rate decision on Wednesday, and South Korea’s Q1 GDP on Friday.

Purchasing managers index reports for several countries are scheduled for release too, with China’s May data on Tuesday and Wednesday likely to be the biggest market-movers.

Here are three key developments that could provide more direction to markets on Monday:

– Market reaction to U.S. debt limit deal

– Follow-up reaction to Nasdaq rally

– Thin trading conditions due to U.S., UK holidays

(By Jamie McGeever; Editing by Diane Craft)