Kwarkot

REITs outperformed broader markets this week, helped by macro factors and strong quarterly earnings.

The Federal Reserve kept its policy rate at 5.25%-5.50% for the second straight meeting and the third time this year, with a growing sentiment that the Federal Open Market Committee has ended, or should end, its rate-hiking campaign.

Major REITs such as AGNC Investment (AGNC) and Simon Property Group (SPG) beat Wall Street expectations, helping the sector’s overall weekly returns.

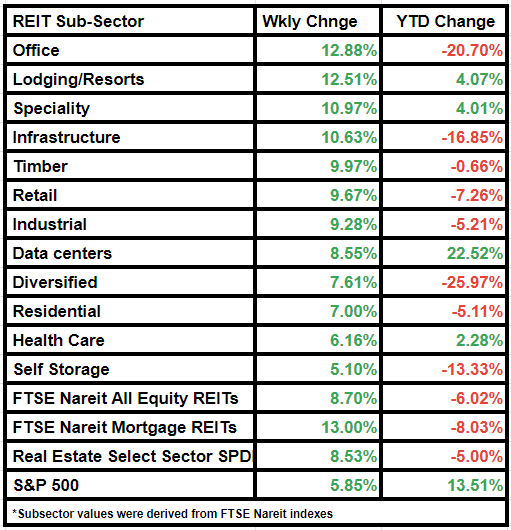

The FTSE Nareit All Equity REITs index increased by 8.70%, while the Dow Jones Equity All REIT Total Return Index gained by 8.74%.

Comparatively, S&P 500 was up 5.85% on a weekly basis.

The Real Estate Select Sector SPDR ETF rose by 8.53% and the FTSE NAREIT Mortgage REITs index by 13.00%.

Office was the biggest gainer among subsectors, having gained 12.88% on a weekly basis. Equity Commonwealth (EQC) and Piedmont Office Realty Trust (PDM) were notable movers in the subsector.

Hotel REITs followed with an increase of 12.51%. Park Hotels & Resorts (PK), RLJ Lodging Trust (RLJ), Xenia Hotels & Resorts (XHR) and Host Hotels & Resorts (HST) were the notable movers in this subsector.

Here is a look at the overall subsector performance: