Tokenized real-world assets (RWAs) have become one of the fastest-growing categories in crypto—second only to stablecoins, according to a comprehensive ‘RWA in On-chain Finance Report: H1 2025 Market Overview’ by modular blockchain oracle RedStone, in collaboration with Gauntlet and rwa.xyz.

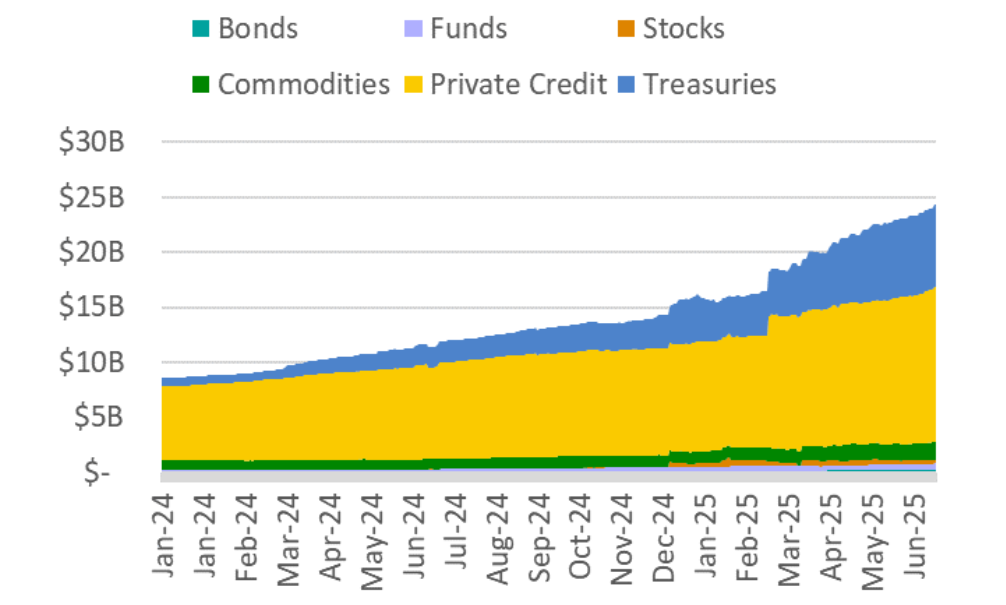

The tokenized RWA space has moved from a “buzzword into a multi-billion-dollar financial system,” the report says. Since January 2024, the total onchain RWA value (excluding stablecoins) has nearly tripled. By December 2024, it reached $15.2 billion, marking an 85% year-over-year growth.

By June 2025, this market reached an all-time high of $24.31 billion.

This is up from an estimated $5 million–$10 billion in 2022. In just the first half of 2025, the RWA token market surged some 260% from $8.6 billion. It’s projected to grow further.

Moreover, per the report, several specific elements have led to this growth. These include higher interest rates, which have boosted demand for tokenized yield-bearing assets. Moreover, major issuers brought institutional products to the market, while DeFi platforms started integrating tokenized assets into their collateral and liquidity frameworks.

Therefore, “asset tokenization has decisively transitioned from experimental pilots to scaled institutional adoption in 2024-2025,” the report argues.

Meanwhile, in an email to Cryptonews, the team notes that the RWA tokenization market has shown “remarkable resilience” despite escalating military tensions between Israel and Iran starting mid-June, with the US joining several days later. The market grew $464 million over a 12-day period to reach this ATH as of 25 June.

“The sustained momentum in RWA capitalization suggests that institutional and retail investors continue to view tokenized real-world assets as a viable investment vehicle, even as traditional markets grapple with geopolitical instability,” the team says.

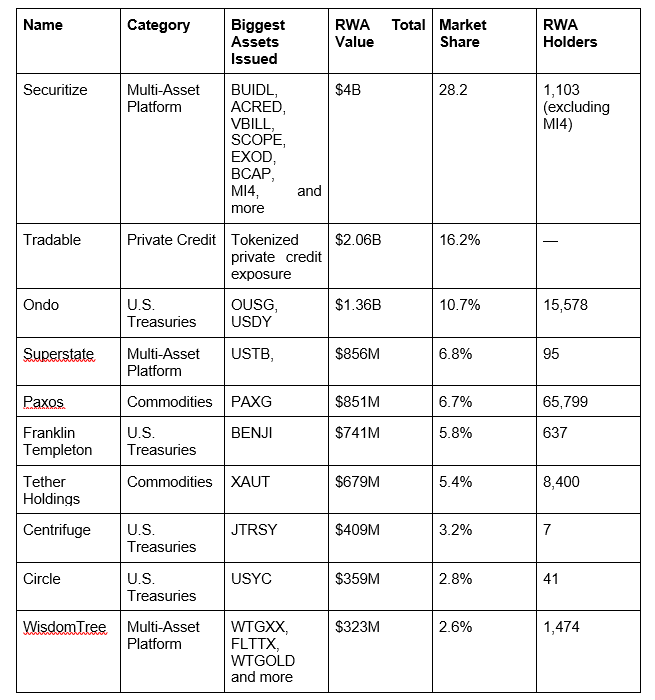

Notably, Securitize collaborates with major global financial institutions, including Apollo, BlackRock, Hamilton Lane, and KKR, to tokenize institutional-grade assets.

According to the press release, the partnership will enable RedStone to deliver price feeds for Securitize’s current and future tokenized products.

More precisely, RedStone…

Private Credit Fuels Tokenized RWA Space

Private credit is the largest RWA tokenization segment as of June 2025, the report has found. Over $14 billion of the current RWA market, or more than half, is currently composed of tokenized private credit. This shows “institutional appetite for blockchain-native credit markets.”

Tokenization lowers operational costs, enhances accessibility and distribution, and creates “potential for robust secondary liquidity markets.”

“Once confined to institutional desks and illiquid vehicles with seven to ten-year lock-ups, private credit has been transformed through tokenization,” it says.

Moreover, industry projections suggest that 10%-30% of global assets could be tokenized by 2030-2034. This is “positioning RWAs are bridging traditional finance’s $400+ trillion in assets to blockchain – over 130x larger than crypto’s current ~$3 trillion market cap.”

Notably, this massive growth is not a result of hype or headlines, the report says, but of “hard financial logic.” Institutions look for higher yields and faster access to capital. Blockchain and tokenization deliver that.

Also, the study concludes that tokenized assets could hit “critical mass” soon across institutional and consumer markets, “not as a new asset class, but as a fundamental upgrade to how existing capital markets operate.”

The institutional adoption we now see is the result of years of infrastructure development. Financial institutions like BlackRock, JPMorgan, Franklin Templeton, and Apollo have all moved “beyond experimentation.” Governments globally are also starting to recognize blockchain as “essential infrastructure for modernizing legacy financial systems and addressing fundamental macroeconomic challenges of the decade.”

Therefore, the report concludes that, “catalyzed by a friendlier regulatory environment towards tokenization, RWAs are positioned to proliferate. […] From BlackRock’s $2.9 billion BUIDL fund to Apollo’s ACRED pioneering private credit tokenization, we’re witnessing the early stages of what could be the largest capital migration in financial history.”

According to the South Korean news agency Yonhap, two bills that propose institutionalizing tokenized securities are pending before the National Assembly’s Political Affairs Committee.

Tokenized Securities: High on Political Agenda?

The bills were…

The post Private Credit Drives $24 Billion Tokenized RWA Boom – RedStone Report appeared first on Cryptonews.