Bank of Italy Governor Fabio Panetta told the country’s banking association on Wednesday that commercial banks must convert their money into digital tokens to remain competitive as stablecoins gain momentum, backed by what he described as strong support from the United States administration.

According to Reuters, the European Central Bank policymaker’s comments come as European officials debate how to preserve the continent’s monetary sovereignty while American policymakers accelerate efforts to establish dollar-backed digital assets as a global payment standard.

Addressing bankers in Milan, Panetta said traditional money would continue to anchor the financial system, but warned that both central bank and commercial bank money must become fully digital.

“I expect commercial bank money will also become mostly tokenised,” he stated, referring to the process of converting financial assets into digital tokens issued on distributed ledgers such as blockchain.

U.S. Push Drives Stablecoin Expansion

Panetta acknowledged that stablecoin use would grow substantially in line with Washington’s strategic priorities.

“They’ll definitely develop because there’s a big push by the U.S. administration,” he said, explaining that American officials view digital assets as tools to reinforce global dollar demand.

The governor emphasized uncertainty around stablecoins’ ultimate role but insisted they would not displace traditional money, which he called the financial system’s only stable anchor.

“It’s not clear what role they’ll have … but I expect the system will remain centred around central bank and commercial bank money, both of which will need to become digital,” Panetta added during his address to Italy’s banking leaders.

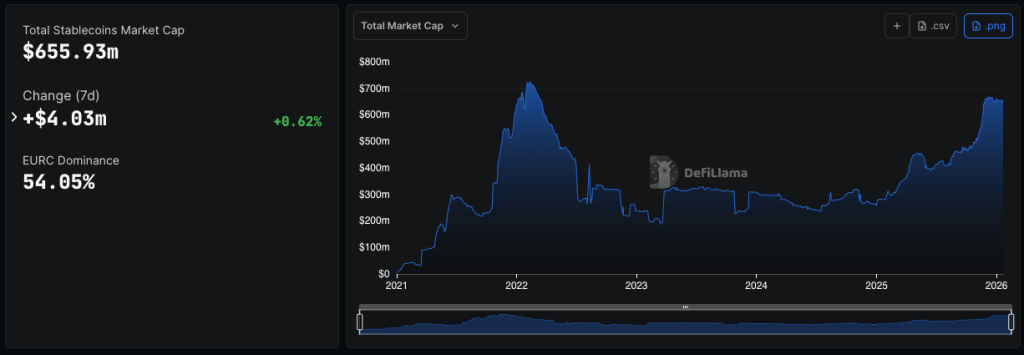

His warning arrives amid escalating European concerns about dollar-denominated stablecoins controlling 99.58% of the $300 billion global market while euro-backed alternatives remain marginal at just $680 million.

The ECB has repeatedly flagged systemic risks from rapid stablecoin growth, particularly as leading issuers now rank among the world’s largest U.S. Treasury holders, creating potential spillover effects into traditional markets during stress events.

The ECB seeks to launch a digital euro by 2029 to maintain the relevance of central bank money in an increasingly digital economy and to protect Europe’s monetary sovereignty.

Panetta noted recent geopolitical developments showed Europe’s risky dependence on American firms like Visa, Mastercard, and PayPal for over two-thirds of its payments.

Banks Resisted Digital Euro Over Competition Fears

The digital euro project has faced strong opposition from commercial banks, particularly in Germany, which fear competition from the ECB for deposits.

Panetta addressed this resistance directly, recounting discussions with banks in a large European country that opposed the project because they worried about losing 30% of the payments they handled digitally.

“When I discussed this with the banks of a large European country that opposed the digital euro because they worried they’d lose the 30% of payments they handled digitally, I told them: instead of worrying about the 30% think about who controls the 70% you’ve already lost,” Panetta said.

His remarks contrast sharply with a December open letter from 70 European economists who urged EU lawmakers to prioritize public digital currency over private stablecoins, warning that poor design choices could leave Europe dependent on foreign payment systems.

The academics, including Thomas Piketty and Paul De Grauwe, demanded that the digital euro serve as “the backbone of a sovereign, resilient European payment infrastructure,” with generous holding limits and broad accessibility.

Meanwhile, ten major European banks, including BNP Paribas, ING, and UniCredit, formed a consortium in December to launch a euro-backed stablecoin by mid-2026 through a Dutch entity called Qivalis.

The initiative directly addresses concerns about dollar dominance, with euro-denominated stablecoins accounting for less than 1% of the global market despite the eurozone’s economic scale.

Panetta’s tokenization call reflects growing recognition that traditional banks risk irrelevance if they do not adapt to blockchain-based payment systems.

The ECB confirmed last month it would begin allowing distributed ledger technology transactions to settle in central bank money in 2026, marking concrete progress toward integrating digital assets into Europe’s monetary infrastructure while political negotiations continue over the digital euro’s final regulatory framework.