Strategy has disclosed a new bitcoin buy covering the period of Aug. 11–17, 2025: 430 BTC acquired for $51.4 million, implying an average purchase price of $119,666 per Bitcoin.

The add-on continues the company’s program of tactically increasing its treasury position during windows of liquidity.

Following the transaction, total holdings stand at 629,376 BTC as of Aug. 17, 2025. Management also flagged a 25.1% BTC yield year-to-date for 2025, showing how balance-sheet exposure has contributed to performance during this year’s rally.

Cost Basis and Scale of the Bet

The update puts Strategy’s aggregate bitcoin cost at $46.15 billion, translating to an average purchase price of $73,320 per coin across the life of the program.

Against that historical cost basis, the latest tranche—bought near $120,000—shows the company continuing to accumulate at elevated market levels while maintaining a long-duration thesis.

The company’s approach remains simple: expand core holdings when capital is available and market conditions permit, with the expectation that bitcoin’s multi-cycle appreciation will outweigh near-term price volatility.

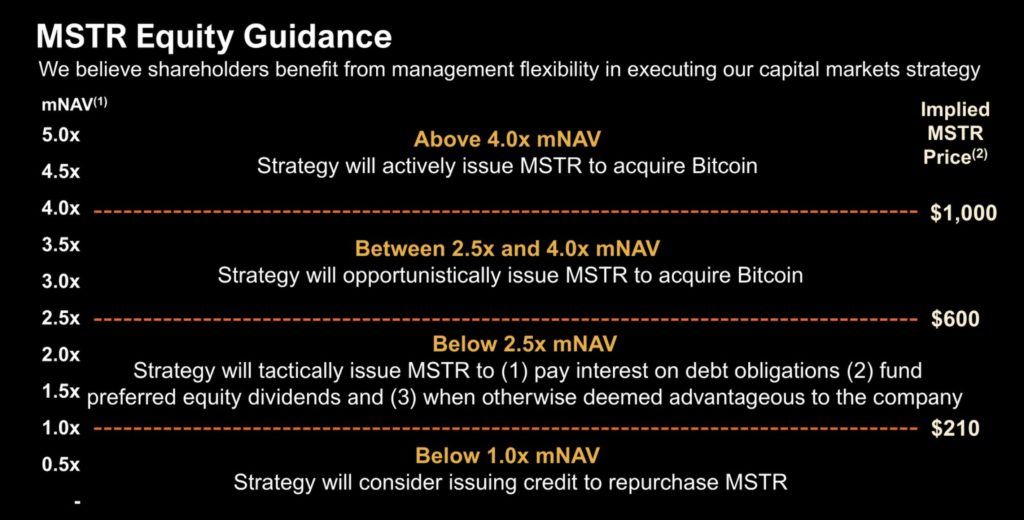

Alongside the treasury update, Strategy refined its guidance on how it may use its Common ATM equity program. When mNAV (as defined on Strategy.com) falls below 2.5×, the company may tactically issue MSTR shares to:

- pay interest on debt obligations

- fund preferred-equity dividends

- deploy capital “when otherwise deemed advantageous to the Company.”

This formalizes how equity issuance fits into the firm’s balance-sheet toolkit. In practice, it gives management a rules-based trigger to raise cash when market conditions pressure the multiple, preserving liquidity for debt service and opportunistic treasury actions.

Saylor Updates MSTR Equity Guidance to Boost Capital Flexibility

Strategy has rolled out updated MSTR Equity ATM guidance, which offers investors a clearer look at how management will approach capital allocation.

Strategy’s latest purchase is modest in size but consistent with its long-running thesis: use corporate finance levers—debt, equity, and cash flow—to compound a large, low-cost bitcoin position.

With a clarified ATM framework and a transparent disclosure cadence, the company is showing that it will keep adding selectively while managing obligations and market cycles.

Last week, Saylor took to X (formerly Twitter) to explain why shares of MSTR trade at a premium to Bitcoin’s net asset value (NAV).

In his post, Saylor attributed this advantage to four key factors: Credit Amplification, Options Advantage, Passive Flows, and Superior Institutional Access—benefits that equity and credit instruments offer over commodity assets like Bitcoin.

The post Michael Saylor’s Strategy Adds 430 BTC, Holdings Hit 629,376 – What’s the Catch? appeared first on Cryptonews.