Sean Anthony Eddy

During these difficult times in the market, my portfolio has held up quite well. Although I have seen some gyrations from month to month, I have, over almost any window of time, outperformed the market over the past year or so. But this doesn’t mean that every holding in my portfolio has done well. I have had some holdings that have certainly underperformed. And the one that has been the biggest problem is none other than Medical Properties Trust (NYSE:MPW). Because of the downside I have seen from the firm, I have made sure to keep a very close eye on all that transpires with it. In the event that the fundamental picture changes in a way that makes the company no longer appealing, I would most certainly sell my stock and move on. But the good news is that, recently, some rather important developments have come through the pipeline that, in my opinion, decrease the risk for investors moving forward. This gives me the confidence to keep the company rated a ‘strong buy’ like I have had it since first writing about it at the end of May of last year.

Completed at last

On May 23rd, the management team at Medical Properties Trust issued a press release to provide investors with an update on Prospect Medical Holdings and its exposure to the company. For those who don’t follow Medical Properties Trust closely, Prospect is one of the tenants utilizing Medical Properties Trust’s real estate. That relationship began in 2019 when the REIT invested in a portfolio of 14 acute care hospitals in three different states that were operated by and master leased to or mortgaged by Prospect. As time went on, the picture for Prospect worsened considerably. A lot of this pain was chalked up to the COVID-19 pandemic. But by the final quarter of 2022, the tenant was no longer able to meet its contractual rent payments, as well as the interest payments that it owed Medical Properties Trust in exchange for some earlier financing.

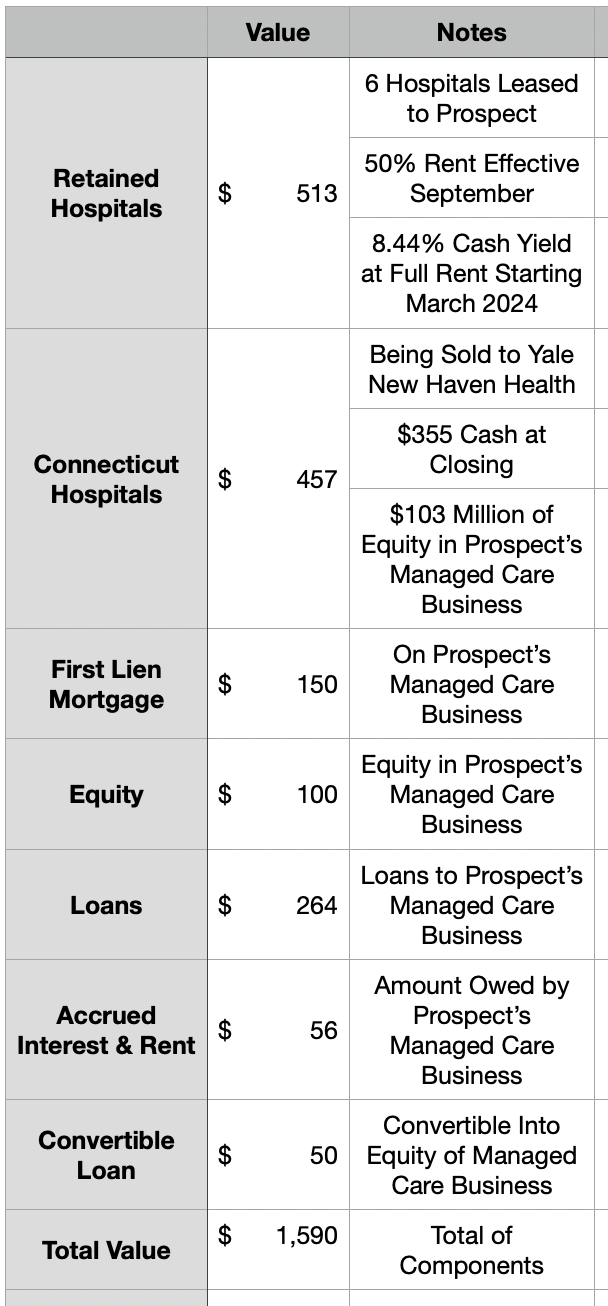

Because of the considerable financial pressure that it was facing, Prospect ended up entering into some restructuring activities. This brought into question roughly $1.6 billion worth of assets that Medical Properties Trust has. As part of its restructuring activities, Prospect received a $50 million loan from Medical Properties Trust that can be converted into equity of Prospect’s managed care business. But now, we have greater insight into what has just happened regarding the rest of the assets owned by Medical Properties Trust.

Author – Medical Properties Trust

According to the May 23rd press release issued by Medical Properties Trust, Prospect just received $375 million in funding from third-party lenders. The company took this, plus cash on hand, to completely pay off its $250 million asset-backed revolving credit facility, as well as other liabilities that it had. The proceeds will also allow Prospect to continue operating, including going so far as to capitalize on its managed care business so that it can be in a sound financial state. And some of the proceeds will also provide first lien security for a delayed draw term loan that Medical Properties Trust agreed to provide Prospect in the amount of up to $75 million.

Following the completion of this transaction, it’s expected that Prospect will be free of substantially all of its debt and lease obligations outside of what it will owe these third-party lenders and what it will owe Medical Properties Trust. This arrangement also involved what Medical Properties Trust calls a ‘reconstitution’ of the roughly $1.6 billion of assets that it owns that are related to Prospect. The largest chunk of this, about $513 million, is the value of its investment in six California hospitals that are going to remain leased to Prospect from this point on. By September, Prospect we’ll begin making partial rent payments, totaling 50% of the typical amount due, to Medical Properties Trust. And by March 2024, this will ratchet up to 100%, working out to an 8.44% cash yield on their value. This implies annual rent that the company should receive of $43.3 million.

Another $457 million of the investment is in the form of real estate that the company has in Connecticut. It was previously announced that these assets will be sold to Yale New Haven Health in a deal that should close in the third quarter of this year. Of the amount stated, $355 million will be paid to Medical Properties Trust in the form of cash, with the remaining amount coming in the form of an equity interest in Prospect’s managed care business. The REIT is also receiving a first lien mortgage worth $150 million, plus an equity interest in the managed care business that’s worth $100 million. On top of this, Medical Properties Trust will receive loans worth about $264 million, plus accrued rent and interest payments that aggregate to $56 million, along with the $50 million convertible loan that I mentioned earlier that the company made.

The structure of this arrangement is rather complicated. But for the most part, it exposes Medical Properties Trust to very little risk. Obviously, the asset sales will bring in mostly cash for the enterprise. Given the fact that Prospect would be more or less debt-free outside of the debt that it has associated with third-party lenders and Medical Properties Trust, the risk associated with said debts should also be quite low. The only real risk that is of a substantive nature would be the equity components of the deal that Medical Properties Trust is receiving.

For those who follow Medical Properties Trust closely, some of the terms of this arrangement were already known to the public leading up to this point. In the most recent 10-Q that the company filed, for instance, it mentioned the partial rent that it would receive from its California properties. The company also had made clear of the asset sale to Yale New Haven, plus it had revealed that, in late March of this year, Prospect received a binding commitment from lenders in order to cover operational matters. But the size of that commitment was not disclosed. Some of these other fine details are only now just coming to light.

This is not the only positive development announced by Medical Properties Trust at this time. On May 24th, for instance, management announced that they had completed the sale of seven of their hospitals in Australia in exchange for AUD$730 million. This is part of a AUD$1.2 billion deal that management previously announced, with the remaining AUD$470 million in property sales slated to be completed during this quarter. Although this was already planned, it’s great to see the deal completed, since the proceeds will go toward eliminating a term loan of the same amount. The 5.7% cap rate on the properties sold means that overall annual revenue for the company will drop by about $45.7 million. This is a greater change than the $19.7 million that the company is saving in interest expense. But the fact that the deal effectively reduces leverage is what’s most important. As part of this arrangement, but not previously discussed by management, was the fact that the company was able to settle the pro rata portion of its interest rate swap that kept the interest expense on the term loan effectively fixed at 2.45%. The gain on this came out to AUD$20 million, or about $13.1 million.

All of this comes only a couple of weeks after the company announced, in early May, that CommonSpirit Health had agreed to acquire Steward Health Care System’s Utah operations in a deal valued at $1.2 billion. In addition to reducing Medical Properties Trust’s exposure to its largest operator, this maneuver results in the revenue stream coming from its affected properties now coming from a new and healthier firm as opposed to Steward. The fact that this deal finally closed is a huge positive for shareholders who have been worried about the health of Steward, a company that has been known to be struggling financially on its own.

Takeaway

From what I can see, the picture regarding Medical Properties Trust continues to improve month after month. Almost all of the new data that has come out about the enterprise recently has been positive, and it shows that the overall risk to shareholders is decreasing. Unfortunately, the market has not seemed to care all that much. But in my mind, this works in favor of value-oriented investors since it opens the door for those who are bullish about the company to continue to load up on the stock.