Bitcoin is trading near $88,200, down more than 3% on the day, but the current pullback is unfolding alongside a deeper structural shift that long-term investors can’t ignore. Mastercard’s renewed push into crypto infrastructure highlights a growing reality: global payment networks are no longer experimenting with digital assets, they are embedding them into core financial systems.

That raises a serious question for investors: if Bitcoin continues to be integrated into global payment rails, does a seven-figure valuation by 2026 move from speculation to trajectory?

Mastercard Bets on Crypto Infrastructure, Not Tokens

Mastercard is reportedly considering a strategic investment in Zerohash, a regulated crypto infrastructure firm providing custody, settlement, and fiat on- and off-ramps. While earlier acquisition talks valued at up to $2 billion did not materialize, the shift toward a minority stake signals long-term alignment rather than control.

Zerohash already supports institutional clients including Interactive Brokers, Stripe, Franklin Templeton, and products linked to BlackRock, serving over 5 million users across 190 countries. For Mastercard, investing in infrastructure offers exposure to digital asset flows without balance-sheet risk tied to token prices.

This approach mirrors a broader Wall Street pattern. Capital is increasingly flowing into backend rails, where compliance, custody, and settlement create durable value. Adoption bottlenecks are being addressed quietly, long before price reflects them.

Why Payment Networks Matter for Bitcoin’s Valuation

Payment giants do not chase narratives. They respond to volume, regulation, and demand. Mastercard’s expanding crypto footprint already includes:

- A partnership with Kraken, enabling crypto spending at over 150 million merchants

- Ongoing work with stablecoins and tokenized assets

- Integration with institution-first, regulated providers

These moves don’t trigger short-term rallies. They reduce friction. Over time, that matters more. Bitcoin’s fixed supply of 21 million coins, combined with easier access through trusted intermediaries, gradually shifts demand dynamics from speculative to structural.

At today’s $1.76 trillion market cap, a move toward $1 million per Bitcoin implies roughly a 10x expansion. Aggressive, yes, but not unprecedented for early-stage monetary networks backed by global financial infrastructure.

Bitcoin Technical Outlook: Correction, Not Collapse

While the long-term narrative strengthens, the chart reflects near-term stress. On the 2-hour chart, Bitcoin price prediction is bearish as BTC broke below a multi-week ascending trendline and slipped under both the 50-EMA and 200-EMA, now acting as resistance between $92,300 and $93,300. The rejection from the $95,600–$96,000 supply zone was sharp, marked by strong bearish candles that point to distribution rather than consolidation.

Support is developing near $87,000–$85,900, aligning with prior consolidation and demand. The Relative Strength Index has dropped into oversold territory near 25, suggesting downside momentum is stretched, though no bullish divergence has formed yet.

A typical scenario would involve a short-term bounce toward $89,800–$90,000, followed by consolidation or another test lower if sellers continue to defend that zone.

Bitcoin Hyper: The Next Evolution of BTC on Solana?

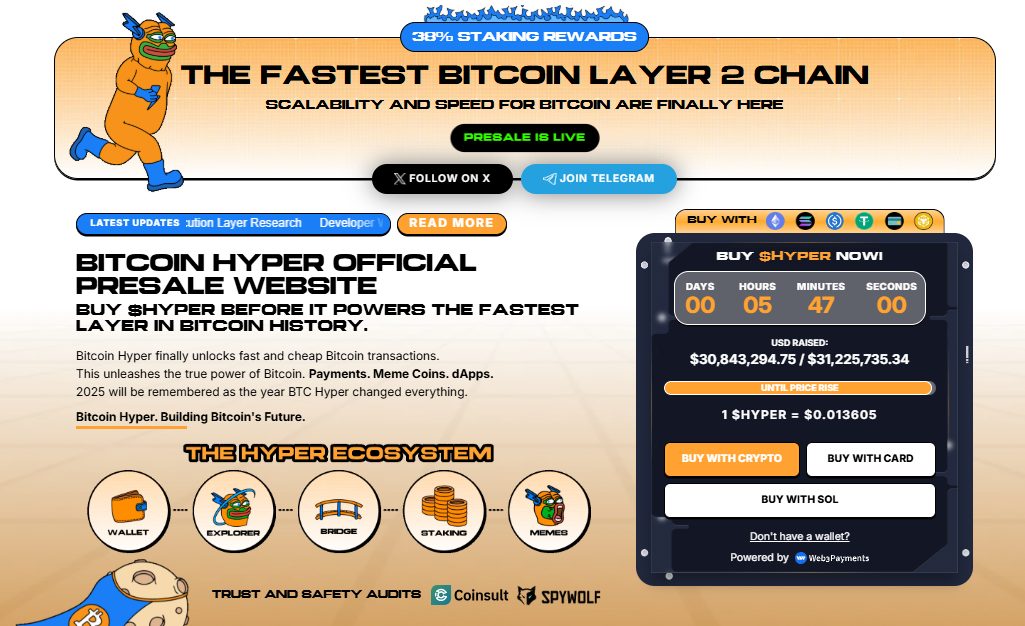

Bitcoin Hyper ($HYPER) is bringing a new phase to the Bitcoin ecosystem. While BTC remains the gold standard for security, Bitcoin Hyper adds what it always lacked: Solana-level speed. The result: lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation, all secured by Bitcoin.

Audited by Consult, the project emphasizes trust and scalability as adoption builds. And momentum is already strong. The presale has surpassed $30.8 million, with tokens priced at just $0.013605 before the next increase.

As Bitcoin activity climbs and demand for efficient BTC-based apps rises, Bitcoin Hyper stands out as the bridge uniting two of crypto’s biggest ecosystems. If Bitcoin built the foundation, Bitcoin Hyper could make it fast, flexible, and fun again.

Click Here to Participate in the Presale