Alba Quintanilla/iStock via Getty Images

Tech regulation getting noisier and that may ramp up, according to BofA Securities.

In his weekly Flow Show note, strategist Michael Hartnett pointed to the DoJ vs Apple (AAPL) antitrust lawsuit, the FTC vs Amazon (AMZN) antitrust lawsuit, the FTC inquiry into AI deals of Amazon, Google (GOOG) (GOOGL) and Microsoft (MSFT), the EU investigation into Apple, Meta (META) and Google breach of Digital Markets Act, the EU $2B Apple antitrust fine and the Japan FTC Apple and Google antitrust complaint.

The Magnificent 7 is 30% of the S&P 500 (SP500) (NYSEARCA:SPY) (IVV) (VOO) and 60% of S&P gains over the past 12 months, Hartnett said.

Investors “love big tech ‘moats,’ (the) monopolistic ability to protect margins, market share, pricing power, finance & control (the) AI arms race,” he said. But $2T of Magnificent 7 revenues in the past 12 months is a “tempting target for regulators/governments struggling to pay bills.”

U.S. government spending is $2.7T in the past five months, up 9% year on year and on course for $6.7T for 2024, Hartnett said. The U.S. national debt is rising by $1T every 100 days and set to hit $35T in May 2024, which incidentally give the Federal Reserve more impetus to cut rates.

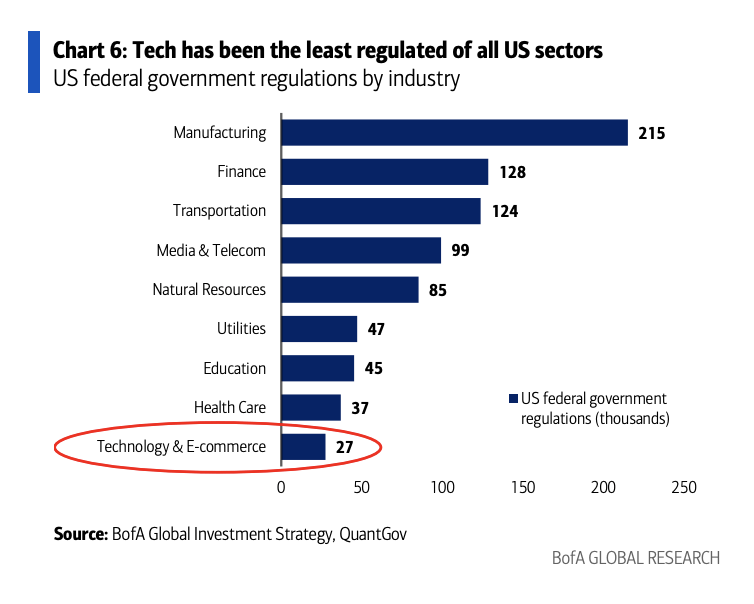

Hartnett says tech is “historically the least regulated of sectors” and in the past 12 months the “average tax rate of Magnificent 7 was 15% vs 21% for rest of S&P 500.”

Regulation and rates are “the historic way sector bulls & bubbles end,” he added.