During the US session on Sunday, Ethereum (ETH) is looking strong at $2,457, up 1.27% on the day. This is in line with the growing chatter that ETH could reach $10,000 in this cycle, as it has been stuck in a multi-year channel since 2017.

Crypto analyst Ted Pillows highlights the significance of Ethereum’s long-term rising trend. Historical touchpoints along the lower band of this channel have triggered massive rallies, with increases of up to 300x in 2017 and 50x in 2020. While such extreme multiples are less likely now due to ETH’s $292 billion market cap, Pillows believes a climb toward $10,000 remains plausible.

However, technical resistance must first be overcome. ETH was twice rejected near $2,600 in June. Analysts like Crypto Patel signal a clean break, and a close over $2,800 would confirm a bullish shift, potentially targeting $4,000 and beyond.

Whale Activity and Withdrawals Reflect Long-Term Belief

On-chain data supports the bullish thesis. Whale wallets and institutions are steadily accumulating ETH, even as price action remains range-bound. Lookonchain reports SharpLink Gaming acquired $4.82 million worth of ETH OTC, raising its total exposure to $478 million.

Additional signs of confidence:

- $4.56M deposited into Ethereum’s Beacon Chain, likely for staking

- $293M withdrawn from exchanges—suggesting a move to cold wallets

- Low volatility accompanied by high-value transfers

These patterns suggest whales are preparing for future appreciation rather than trading short-term moves.

Network Growth vs Market Price: Disconnect or Opportunity?

Ethereum’s network activity is surging. Daily transactions have topped 1.5 million, and active addresses exceed 356,000—the highest levels since early 2023. Gas fees have jumped 130% in a week, reaching $10.26M, indicating increased demand for DeFi and NFT platforms.

Despite this, ETH’s price lags. Key valuation indicators reflect caution:

- NVT Ratio spiked to 2044—implying price may be ahead of usage

- MVRV Z-score dipped into negative territory, suggesting holders are underwater

This disconnect between price and fundamentals could be a hidden buying opportunity—or a sign of excessive hype.

Bitcoin Final Take: Breakout Depends on Key Levels

Although the Ethereum price prediction remains bullish, is it really heading toward $10,000? Well, that depends on:

- Break above $2,800 to confirm the trend

- Whale interest and staking flows to stick

- Network usage to translate into price gains

If ETH maintains its support around $2,400 and Bitcoin’s dominance stabilizes, Ethereum may follow with a breakout. Analysts at XForceGlobal expect a Wyckoff-style move toward $9,400 if momentum builds.

For now, ETH’s bullish trajectory is intact—but upside depends on reclaiming key resistance levels and validating long-term investor conviction through sustained volume and accumulation.

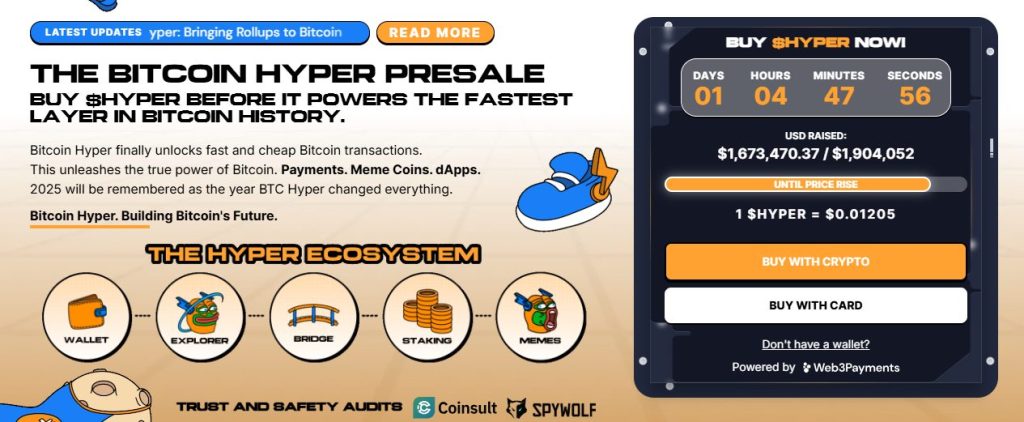

Bitcoin Hyper Presale Surges Past $1.74M as Price Rise Nears

Bitcoin Hyper ($HYPER), the first Bitcoin-native Layer 2 powered by the Solana Virtual Machine (SVM), has surpassed $1.74 million in its public presale, with $1,748,091.98 raised out of a $1,974,249 target. The token is priced at $0.012075, with the next price tier expected within hours.

Designed to merge Bitcoin’s security with Solana’s speed, Bitcoin Hyper enables fast, low-cost smart contracts, dApps, and meme coin creation, all with seamless BTC bridging. The project is audited by Consult and engineered for scalability, trust, and simplicity.

The golden cross of meme appeal and real utility has made Bitcoin Hyper a Layer 2 contender to watch in 2025. With staking, a streamlined presale, and full rollout expected by Q1, $HYPER is gaining serious traction.

The post Ethereum Price Prediction: $10,000 Target Returns Amid Multi-Cycle Ascending Channel – Is ETH Ready? appeared first on Cryptonews.