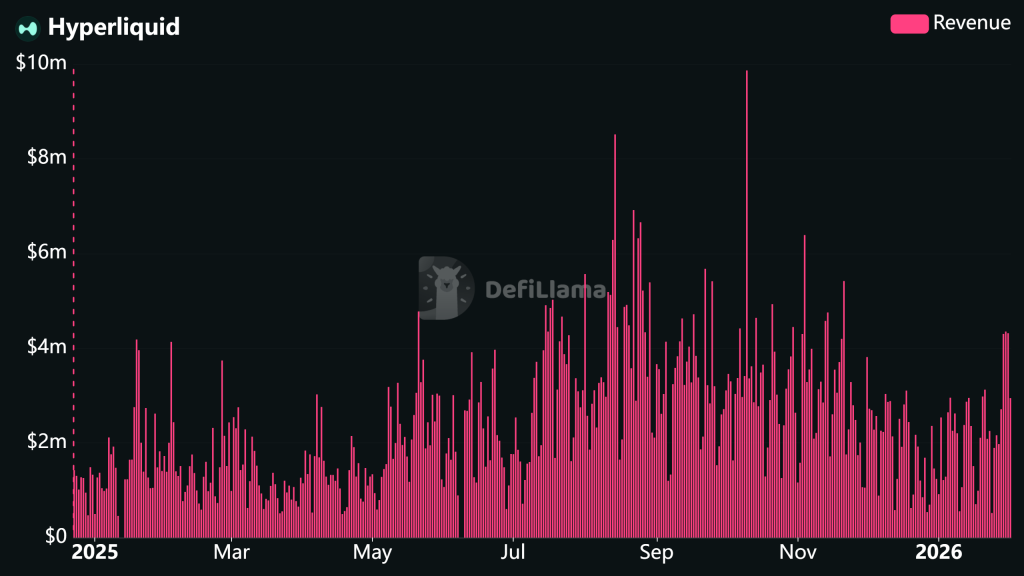

Momentum is building fast for HYPE, with Hyperliquid recording its highest daily revenue in over two months.

The past week marked a strong breakout from the late 2025 bear market slump, as HYPE rallied 40% alongside a major revival in derivatives activity.

Daily revenue has climbed to $4.3 million, a level not seen since November, with growing participation driven by incentive programs and deeper liquidity on the platform.

These trends are strengthening Hyperliquid price predictions, as the protocol regains momentum and positions itself for a bigger move.

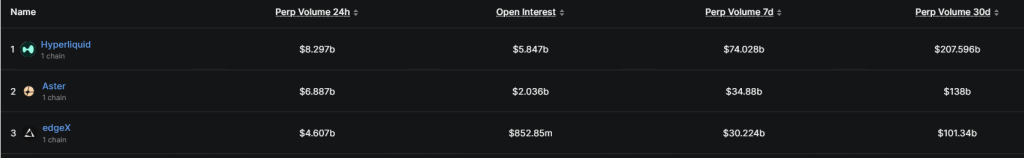

As traders regain their appetite for risk, Hyperliquid has emerged as the market’s derivatives platform of choice.

Last week alone saw over $74 billion in trading volume, pushing the monthly total past $207 billion, more than $71 billion ahead of its closest rival, Aster.

By every metric and timeframe, Hyperliquid is dominating the perpetual DEX market.

With this greater demand for expurse to assets and commodities, the platform noted that open interest in its HIP-3 structure has grown to an all-time high of around $790 million.

Hyperliquid is no longer just a trading venue. It is increasingly positioning itself as the infrastructure layer for perpetual markets, as builders adopt HIP-3 staking to permissionlessly launch new perpetual futures markets directly on the Hyperliquid blockchain.

The question is, can HYPE overtake Solana?

Hyperliquid Price Prediction: Is HYPE Ready to Overtake SOL?

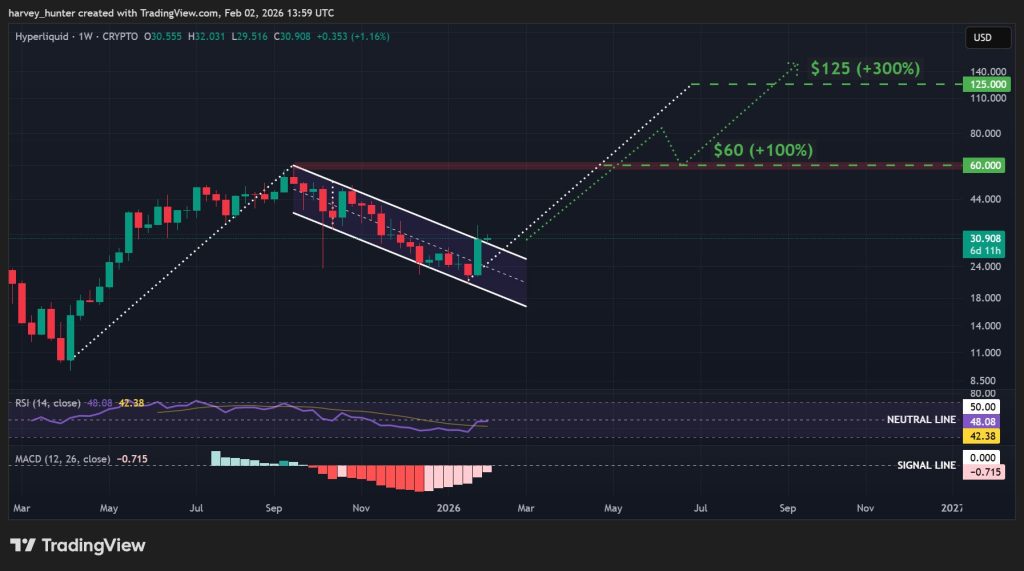

Hyperliquid’s strong fundamental foundation has given $HYPE the footing it needs for a bull run, breaking out of the channel that has been forming during the consolidation of a wider bull flag pattern.

The structure reframes the downtrend since November as a cooldown rather than a reversal.

Momentum indicators suggest this shift has been building quietly for weeks. The MACD is now closing in on a golden cross above the signal line after weeks of building momentum, a move that on the weekly timeframe often marks the transition into a sustained uptrend.

The sharp expansion over the past week has also pushed the RSI back toward the neutral 50 level, a critical inflection zone where buyers typically begin to assert control over the prevailing trend.

If the bull flag breakout is confirmed, an intial 100% push could see prior all-time highs reclaimed around $60. A full technical playout could extend that advance as much as 300%, targeting the $125 region.

Even then, Hyperliquid would remain some distance from the 535% upside required to rival Solana’s market capitalization.

Still, as the bull market matures and risk appetite continues to drive derivatives activity, Hyperliquid’s growing role as infrastructure, not just a platform, could gradually close that gap.

Maxi Doge: The Next Dogecoin?

Market sentiment may be cautious right now, but strategic positioning ahead of the next rally creates opportunity. And one trend proves consistent: Doge-themed meme coins.

The cycle repeats itself. Dogecoin started it all, Shiba Inu exploded in 2021, followed by Floki, Bonk, Dogwifhat, and Neiro. Each bull market eventually funnels capital toward a fresh Doge-inspired leader.

This time around, Maxi Doge ($MAXI) is channeling that original Dogecoin energy through a community centered on alpha sharing, trading strategies, and competitive participation.

Engagement drives everything. Through weekly Maxi Ripped and Maxi Pump challenges, top traders earn leaderboard status, rewards, and recognition that fuel ongoing activity.

The hype is already showing in the numbers. The ongoing $MAXI presale has raised more than $4.5 million, while early backers are earning up to 69% APY through staking rewards.

For anyone who sat out previous Doge cycles, Maxi Doge presents another entry point before mainstream adoption kicks in.

Visit the Official Maxi Doge Website Here