© Reuters

LONDON – Copper and nickel prices have taken a step back as investor optimism about potential Federal Reserve rate cuts waned. Recent comments from Fed Chair Jerome Powell have led to a reassessment of the prospects for an early easing of monetary policy, causing industrial metals to face declines.

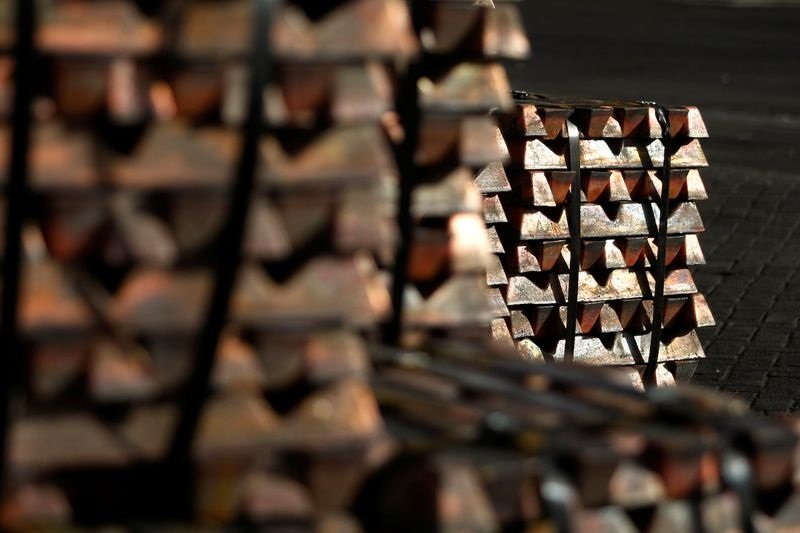

On Monday, on the London Metal Exchange (LME) dropped to $8,448 a ton, retreating from recent highs. This downturn reflects investors’ revised expectations following Powell’s remarks last week, which had initially sparked a surge in the LMEX Index. The index tracks the performance of six major industrial metals and had been under pressure due to high interest rates that affect commodity prices broadly.

Despite this setback for copper, demand from Chinese renewable energy sectors continues to provide some support for the metal. However, nickel prices fell as increased output from Indonesia and slowdowns in developed markets contrasted with the effects of Chinese policy stimulus.

The market is also digesting the implications of tightening supply conditions. Spot premiums and treatment charges are indicating these tighter conditions, which have been further exacerbated by the closure of the Cobre Panama mine. This comes at a time when global smelter capacity is expanding.

Investors are now closely monitoring economic strength outside China for 2024 and considering how potential drags from developed markets could influence commodity prices moving forward. The reassessment of global economic conditions has added a layer of uncertainty to risk assets, including industrial metals like copper and nickel.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.